The Zacks Automotive – Foreign industry is grappling with mixed signals from key markets. In China, despite a rise in vehicle sales and a surge in new energy vehicle (NEV) demand, concerns over economic headwinds and international tariffs loom large. Europe’s BEV market faces a downturn, marked by declining sales and economic uncertainty, with major players like Volkswagen VWAGY considering plant closures. Meanwhile, Japan’s market is also struggling with sluggish auto sales. While near-term prospects of the industry don’t seem rosy, investors may still find opportunities in leading companies like BYD Co Ltd BYDDY and Honda HMC.

Industry Overview

Companies in the Zacks Automotive – Foreign industry are involved in designing, manufacturing and selling vehicles, components as well as production systems. The foreign automotive industry is highly dependent on business cycles and economic conditions. China, Japan, Germany and India are some of the key foreign automotive manufacturing countries. The widespread usage of technology is resulting in the fundamental restructuring of the market. Stricter emission and fuel-economy targets and ramp-up of charging infrastructure, as well as supportive government policies, are boosting sales of green vehicles. With almost all firms intensifying their electrification game, competition is getting tougher with each passing day. Foreign automakers are now actively engaged in the R&D of electric and autonomous vehicles, fuel efficiency, and low-emission technologies.

Key Forces Shaping the Foreign Auto Industry

China Auto Sales Growth Amid Economic Worries & Tariff Woes: In the first half of 2024, vehicle sales in China reached 14.05 million units, up 6.1% from the prior year, while exports surged 30.5% to 2.79 million units, according to the China Association of Automobile Manufacturers. While retail passenger sales last month declined 1% year over year, the same grew 11% month over month. Notably, sales of new energy vehicles (NEVs) jumped 42% year on year in August, totaling 1.015 million units, up 16% from July. Having said that, the economic slowdown in China and the imposition of new tariffs on China EVs by the United States, European Union (EU) and Canada remain concerns. Per AlixPartners, China auto sales will grow at a relatively modest rate of 4.7% in 2024 to 26.7 million vehicles. The S&P Global forecasts 2024 light vehicle sales in China to rise a mere 2-4% in 2024.

Europe’s BEV Market in Trouble: Despite a 3.9% increase in new car registrations in the EU during the first seven months of 2024, BEV sales declined 0.4%. The downturn was particularly evident in July when BEV sales dropped 10.8% to 102,705 units due to a steep 37% fall in Germany. Factors causing the decline included reduced government incentives, a shortage of affordable models and limited charging infrastructure. EV-Volumes.com has revised its 2024 projections for Europe’s BEV market, citing sluggish growth, with Germany’s stalled recovery being a major factor. In response to the growing competition from Chinese automakers and the economic pressure in Europe, Volkswagen is now considering shutting down two of its plants in Germany for the first time in its 87-year history—a move that reflects the challenges faced by Europe’s BEV industry.

Japan’s Auto Market Dynamics: Japan’s vehicle market continues to face challenges, with new car sales declining 3.5% last month to 328,470 units and sales for the first eight months of 2024 down 9.7% to 2.86 million units, according to Japan’s Automotive Dealers Association. The decline began late last year after Daihatsu was ordered to halt production due to decades of falsified safety test results. While Japan’s economy struggled in early 2024, a modest recovery may be on the horizon, supported by stronger wage growth and increased consumer spending. Although these factors should help improve economic conditions, growth is expected to be modest. Given the cyclical nature of the auto industry, vehicle sales in Japan might start to pick up.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Automotive – Foreign industry within the broader Zacks Auto-Tires-Trucks sector currently carries a Zacks Industry Rank #148, which places it in the bottom 41% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence about this group’s earnings growth potential. Over the past year, the industry’s earnings estimates for 2024 have moved 6.5% south.

Before we present a couple of stocks that are still worth considering, let’s look at the industry’s recent stock market performance and current valuation.

Industry Tops Sector, Lags S&P 500

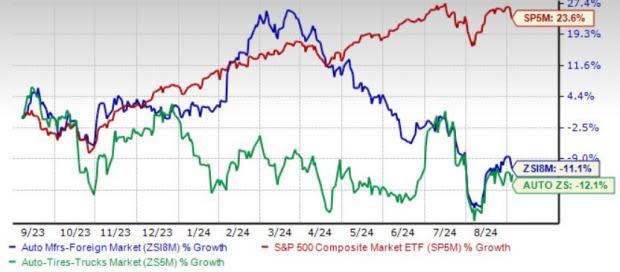

The Zacks Automotive – Foreign industry has outperformed the Auto, Tires and Truck sector but lagged the Zacks S&P 500 composite over the past year. The industry has lost 11.1% compared with the S&P 500’s growth of roughly 23.6%. Meanwhile, the sector has contracted 12.1% over the same timeframe.

One-Year Price Performance

Industry’s Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

Based on trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 10.03X compared with the S&P 500’s 18.52X and the sector’s 15.55X.

Over the past five years, the industry has traded as high as 12.55X, as low as 5.64X and at a median of 9.09X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

2 Stocks to Keep an Eye On

BYD: China-based BYD is a prominent player in automobile research, manufacturing and distribution. It also produces secondary rechargeable batteries and mobile phone components. With a vertically integrated structure encompassing mines, battery production and chip manufacturing, BYD holds a competitive edge. The company has a robust international presence across Asia, Europe and Latin America, making significant inroads in markets such as Japan, India, Malaysia, Australia, Singapore, Israel and Europe.

BYD’s diverse electric vehicle lineup, including models like Seagull, Denza, and Yangwang, has garnered global acclaim. The company is leveraging new technology to produce more affordable and efficient models. In May, it launched its DM 5.0 hybrid system, which is already featured in several new vehicles and significantly reduces costs while improving fuel efficiency. Earlier this year, BYD also introduced its e-Platform 3.0 for EVS, enhancing both efficiency and charging capabilities. Notably, BYD company saw a remarkable 36% year-over-year increase in deliveries in August, totaling 373,083 units. It sold 222,384 passenger plug-in hybrid electric vehicles in the month, marking the sixth consecutive record high since March. BYD rolled out a plug-in hybrid compact crossover in Mexico last month.

BYD currently has a Zacks Rank #2 (Buy) and a Value Score of B. The consensus mark for 2024 and 2025 revenues implies year-over-year growth of 22% and 21%, respectively. The Zacks Consensus Estimate for 2024 and 2025 earnings per share has been upwardly revised by 20 cents and 26 cents over the past 60 days to $3.41 and $4.23, implying year-over-year growth of 17% and 24%, respectively. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price: BYDDY

Honda: Based in Japan, it is one of the prominent manufacturers of automobiles and the largest producer of motorcycles in the world. Honda’s hybrid-focused strategy is thriving. The company aims to sell 1 million hybrids this year and double production to 2 million by 2030. In fiscal 2025, Honda projects to sell 13.06 million motorcycles and 2.97 million automobiles, indicating year-over-year growth of 7% and 4%, respectively.

HMC’s electrification push is also praiseworthy. Honda 0 Series — the flagship series of Honda EVs — will be launched in North America in 2026 and then globally, with seven models by 2030. The company aims to produce 2 million EVs annually by 2030 and is making efforts to lower overall production costs by 35%. Honda’s strategy focuses on building partnerships for lithium-ion battery production, including a joint venture with LG Energy to achieve 40 GWh annually. Collaborating with GS Yuasa, Honda will also source materials from POSCO Future M and Kasei. By 2030, the company aims for a 5% return on EV sales to ensure self-sustainability.

HMC currently has a Zacks Rank #3 and a VGM Score of B. The consensus mark for fiscal 2025 revenues implies year-over-year growth of 3%. The Zacks Consensus Estimate for fiscal 2025 earnings per share has been upwardly revised by 3 cents to $4.53 over the past 60 days. The company surpassed earnings estimates in the trailing four quarters, the average surprise being 59%.

Price & Consensus: HMC

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report