As global markets face challenges, the Hong Kong stock market remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership often signal strong confidence from those closest to the business, making them attractive candidates for investment.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

Laopu Gold (SEHK:6181) |

36.4% |

34.7% |

|

Akeso (SEHK:9926) |

20.5% |

54.9% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Fenbi (SEHK:2469) |

31.2% |

22.4% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

69.8% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

31.2% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.6% |

78.9% |

|

DPC Dash (SEHK:1405) |

38.2% |

104.2% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

109.2% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

93.4% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of HK$753.93 billion.

Operations: The company’s revenue segments are comprised of CN¥507.52 billion from Automobiles and Related Products and CN¥154.49 billion from Mobile Handset Components, Assembly Service, and Other Products.

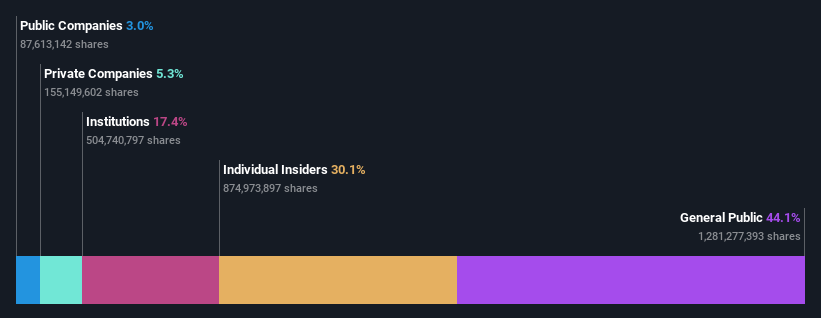

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD’s earnings are forecast to grow 15.2% annually, outperforming the Hong Kong market’s 11.7%. Recent half-year results show net income increased to CNY13.63 billion from CNY10.95 billion year-over-year, with sales reaching CNY294.77 billion. Production and sales volumes have also risen significantly, reflecting strong operational performance. Additionally, BYD’s strategic partnership with Uber aims to deploy 100,000 electric vehicles globally, enhancing growth prospects and reinforcing its position in the EV market.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited, with a market cap of HK$52.98 billion, is involved in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally.

Operations: The company’s revenue segments include Fund Management ($627.98 million) and New Economy Development ($113.33 million).

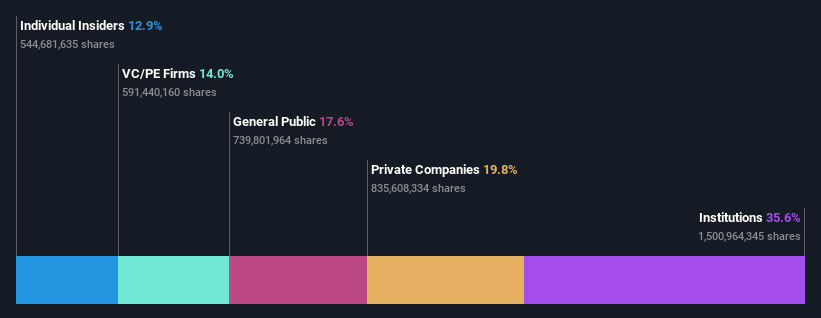

Insider Ownership: 13%

Earnings Growth Forecast: 78.9% p.a.

ESR Group’s revenue is forecast to grow at 16.4% per year, outpacing the Hong Kong market’s 7.4%. Despite an expected net loss of US$210 million for H1 2024 due to non-cash asset revaluations and a lack of promote fee income, earnings are projected to grow annually by 78.86%. Recent leadership changes include Jeffrey Perlman stepping down as chairman, with Brett Krause appointed interim chairman, bringing extensive experience in banking and investment management.

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company with a market cap of HK$48.23 billion, researches, develops, manufactures, and commercializes antibody drugs.

Operations: Akeso’s revenue primarily stems from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Insider Ownership: 20.5%

Earnings Growth Forecast: 54.9% p.a.

Akeso, a growth company with substantial insider ownership, is forecast to achieve high revenue growth of 32.8% per year and become profitable within three years. Despite recent earnings showing a net loss of CNY 238.59 million for H1 2024, the company continues to advance its innovative drug pipeline. Key developments include priority review for ivonescimab’s new indication and positive interim results from Phase III trials, underscoring significant clinical value in oncology treatments.

Key Takeaways

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1821 and SEHK:9926.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com