The outlook for the Zacks Automotive – Original Equipment industry appears optimistic, driven by anticipated vehicle sales growth in the final quarter of 2024. The recent rate cut by the Federal Reserve are expected to lower vehicle financing costs, which bodes well for auto equipment suppliers. Adapting to the shift toward electric and self-driving cars requires industry players to invest in research and development. The rise of new technologies and increased demand for electrified and autonomous vehicles reflect encouraging prospects. Effective cost management in mass production and advanced technology will be crucial for the industry’s success. Companies such as Allison Transmission Holdings ALSN, BorgWarner BWA and Autoliv ALV are well-positioned to seize emerging opportunities.

Industry Overview

The Zacks Automotive – Original Equipment industry includes companies that engage in the designing, manufacture and distribution of automotive equipment components used for manufacturing vehicles. A few of the components manufactured by the participants include the drive axle, engine, gearbox parts, steering, and suspension, as well as brakes. Demand for original equipment depends directly on the sale of vehicles, which, in turn, is heavily reliant on economic growth and consumer confidence. Importantly, rapid globalization is opening up newer avenues for auto-equipment manufacturers who need to adapt to the changing dynamics through systematic research and development. From a future competitive standpoint, the industry players need to focus on technologies that offer the best value in a short span of time to the market.

Key Themes Defining the Industry’s Fate

Vehicle Sales Likely to Rebound in Q4: Cox Automotive and Edmunds.com project a 2% decline in U.S. vehicle sales for the third quarter of 2024, citing economic and political uncertainties, along with high interest rates and prices. With the election season underway, further volatility is expected through the end of the year. However, the recent interest rate cut should alleviate pressure on household finances, with automakers offering more aggressive discounts. As a result, Cox Automotive anticipates a slight improvement in new-vehicle sales during the final quarter of 2024. This is encouraging for industry participants, whose performance is closely tied to vehicle sales.

Technological Progress Unlocking New Opportunities: The transition to electric and autonomous vehicles is transforming the automotive industry, pushing suppliers to innovate and develop cutting-edge components. This shift presents significant growth opportunities for original equipment manufacturers (OEMs). As demand for electrification and self-driving technologies intensifies, OEMs are ramping up efforts to design more advanced and sophisticated components. Rising demand for fuel-efficient vehicles, driven by stricter emission regulations, is fueling the need for high-quality, cost-effective auto parts and equipment.

Optimizing Production Costs for Success: As the automotive industry undergoes this technological transformation, effective cost management has become critical. OEMs must continuously upgrade and innovate their products to remain competitive in this fast-evolving market. However, introducing new features and designs requires substantial investments in research and development, thus incurring higher financial, labor and time costs. Streamlining production processes is essential to reducing pressure on profit margins. The success of industry players depends on their ability to manage manufacturing and expansion costs while positioning themselves to seize profitable growth opportunities.

Zacks Industry Rank is Promising

The Zacks Automotive – Original Equipment industry is placed within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #95, which places it in the top 38% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates sunny near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence about this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry Lags Sector and S&P 500

Over the past year, the Zacks Original Equipment industry has underperformed the broader Auto sector and the Zacks S&P 500 composite. The industry has lost 26.8% against the S&P 500’s growth of 32.6%. The sector has declined 4.2% over the same timeframe.

One-Year Price Performance

Industry’s Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 12.2X compared with the S&P 500’s 19.21X and the sector’s 16.97X.

Over the past five years, the industry has traded as high as 19.97X, as low as 3.96X and at a median of 12.31X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

3 Stocks to Keep an Eye On

BorgWarner: The company is a global leader in clean and efficient technology solutions required for combustion, hybrid and electric vehicles.The acquisition of the charging business of SSE in China — completed in March 2023 — expanded BorgWarner’s footprint beyond Europe and North America. The buyout of Eldor Corporation’s Electric Hybrid System business in December 2023 further enhanced BorgWarner’s electric product portfolio. BWA’s Charging Forward project to accelerate its electrification strategy bodes well. The firm expects its 2024 eProduct sales to be in the range of $2.5-$2.8 billion, implying year-over-year growth of 25-40%, with high demand for battery systems being the main driver. BorgWarner’s high liquidity, manageable debt and investor-friendly moves bode well.

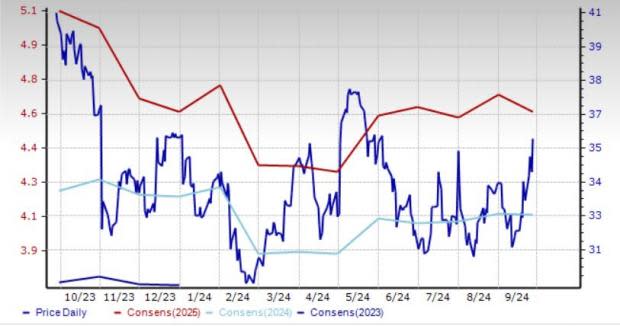

BorgWarner currently carries a Zacks Rank #2 (Buy) and has a Value Score of A. The Zacks Consensus Estimate for 2024 and 2025 bottom line implies year-over-year growth of 9.3% and 13.4%, respectively. The consensus mark for BWA’s 2024 and 2025 EPS has moved up 9 cents and 7 cents, respectively, over the past 60 days.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: BWA

Allison: It is a manufacturer of fully automatic transmissions for medium and heavy-duty commercial and heavy-tactical U.S. defense vehicles. Allison’s focus on advanced technology and continued innovation in product development augur well. In particular, the eGen Flex portfolio and the eGen Force portfolio are driving the firm’s prospects.

ALSN is well poised to capitalize on rising global defense budgets. The firm’s investor-friendly moves also instill confidence. It has increased its annual dividend each year since 2020. Allison has raised its full-year guidance. It now expects total sales of $3.09-$3.17 billion (previously $3.05-$3.15 billion), net income of $650-$700 million (up from $635-$685 million) and adjusted free cash flow of $590-$640 million (previously $575-$625 million).

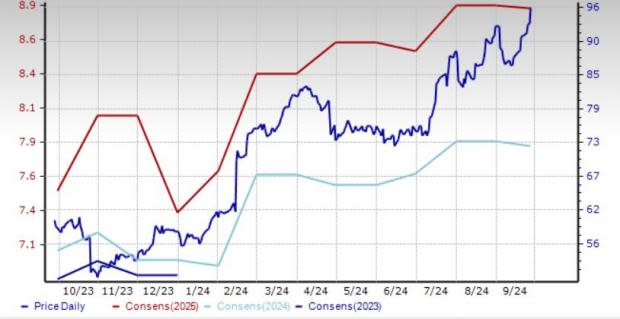

Allison currently carries a Zacks Rank #3 (Hold) and has a Value Score of B. The Zacks Consensus Estimate for 2024 and 2025 bottom line implies year-over-year growth of 6% and 13%, respectively. The consensus mark for ALSN’s 2024 and 2025 EPS has moved up 11 cents and 31 cents, respectively, over the past 90 days.

Price & Consensus: ALSN

Autoliv: It is one of the leading manufacturers and suppliers of a wide range of product offerings, which majorly include passive safety systems. With content per vehicle on the rise, Autoliv is set to gain from the growing demand for front-center airbags, rear-side airbags and pedestrian protection products.Strategic structural initiatives, stringent cost control measures, and effective customer compensation strategies are likely to boost ALV’s adjusted operating margins in 2024.Autoliv has a strong investment-grade company credit rating. The firm remains committed to increasing shareholder returns, thanks to its strong financials. Since initiating the current stock buyback program in 2022, ALV has reduced the number of outstanding shares by roughly 9%.

Autoliv currently carries a Zacks Rank #3 and has a Value Score of A. The Zacks Consensus Estimate for 2024 and 2025 bottom line implies year-over-year growth of 5.2% and 22%, respectively. The consensus mark for 2024 and 2025 sales implies year-over-year growth of 1.1% and 5.3%, respectively.

Price & Consensus: ALV

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report