These two Buffett stocks look particularly tempting right now.

Warren Buffett owns more than 40 stocks through his holding company Berkshire Hathaway, and some of them have been a part of his portfolio for several years, even decades. Long-term investing is one of the biggest factors behind Buffett’s jaw-dropping success as an investor, which is also why he’s among the few you’d want to follow to find stocks to put your money on.

Right now, two stocks Buffett owns are screaming buys. While one is hovering near 52-week lows, the other is beating all others in the game in an industry with massive potential.

A Buffett stock with multibagger potential

Growth in the global electric-vehicles (EV) market has decelerated, and the slowdown has hit nearly every EV manufacturer. The only exception, perhaps, is BYD (BYDDY -0.17%).

The Chinese EV giant recorded four-straight months of record deliveries. BYD’s new energy vehicles (NEVs) sales, including passenger and commercial vehicles, surged 32% year over year to 419,426 units in September. NEVs include battery-electric vehicles, fuel-cell EVs, and plug-in hybrids.

BYD is the largest NEV player in China, commanding a 37% market share in August, according to industry data. In comparison, Tesla had a market share of only 6% in August, despite being a prominent EV player in China. Those numbers should give you an idea about BYD’s size, business scale, and unbeatable foothold in the world’s largest passenger EV market.

There’s a lot more to BYD, though. It also produces buses and is more than just an EV maker — it’s also the world’s second-largest producer of EV batteries, right behind Chinese battery manufacturer CATL. This vertical integration is one of the biggest reasons behind BYD’s success as it has helped the company avoid one of the biggest hurdles for EV manufacturers — battery costs.

BYD also has extensive operations outside of China, including North America, Europe, and Asia, and is expanding aggressively. Thailand is a key market, and 1 in every 3 EVs sold in the country is a BYD.

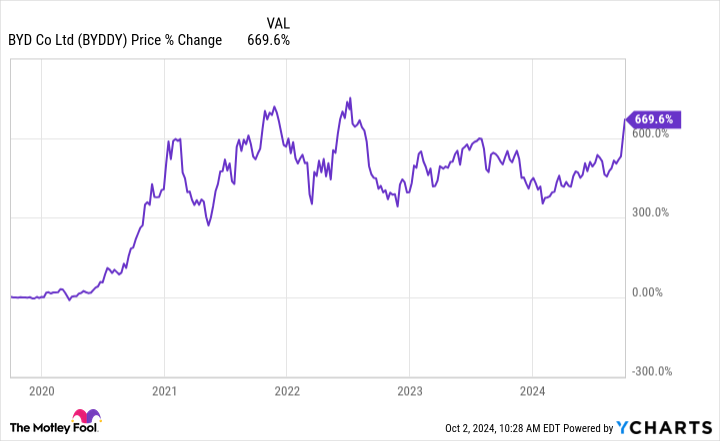

Buffett first bought shares in BYD in 2008, with Charlie Munger, the late vice chairman of Berkshire Hathaway, playing a key role in the decision to invest in the EV stock. Berkshire Hathaway still owned a 4.9% stake in the EV maker as of July 16.

Buffett may have significantly trimmed his BYD position in the past couple of years, but the EV stock has generated massive returns. EV is a high-potential industry, and BYD a potential multibagger — which is why you’d want to buy and hold this Buffett stock.

Rare opportunity: A Buffett stock near 52-week lows

When crude oil prices fall, shares of oil exploration and production companies bear the biggest brunt since their revenues are highly sensitive to commodity prices. That largely explains why Occidental Petroleum (OXY 1.02%) stock has tumbled this year and hit its 52-week lows in the last week of September. Occidental, however, remains one of Buffett’s favorite energy stocks, and I believe it’s a screaming buy now, thanks to its latest acquisition.

Occidental Petroleum acquired CrownRock in August in a cash-and-stock deal worth around $12 billion. The acquisition has extensively expanded Occidental’s footprint in the Permian and Midland Basins and will be immediately accretive to its free cash flow. Moreover, Occidental plans to divest assets worth $4 billion to $6.5 billion within 18 months of closing the acquisition and use the incremental cash flow plus proceeds from asset sales to cut debt.

High debt has been one of the biggest challenges for Occidental since it acquired Anadarko Petroleum in 2019, so any move to strengthen its balance sheet should work in investors’ favor. Read that as bigger dividends. Occidental prioritizes dividends and already raised its dividend per share by 22% earlier this year in anticipation of higher cash flow coming in from CrownRock.

Meanwhile, Occidental also has a large chemicals business called OxyChem and is investing heavily in carbon capture and storage technology, a market with multitrillion-dollar potential.

Buffett has been a consistent buyer of Occidental stock. In fact, Berkshire Hathaway owns a significant stake in Occidental stock now. It stood at 28.8% as of June 30.

The oil stock is also the sixth-largest holding in Berkshire Hathaway’s portfolio. There’s no better time than now to buy this Buffett stock while it’s near its 52-week lows.

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD Company, Berkshire Hathaway, and Tesla. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.