EnerSys ENS stands to benefit from strength across its businesses, strategic acquisitions and a focus on improving the product line and operational excellence. The company remains focused on investing in growth opportunities and strengthening its long-term market position.

ENS, which has a market capitalization of $4 billion, currently carries a Zacks Rank #2 (Buy). Let’s delve into the factors that have been aiding the firm for a while now.

Business Strength: EnerSys has been witnessing strength in its Motive power segment, driven by increased orders for its products in the electric industrial forklift trucks market. The segment’s revenues increased 4% year over year in the first quarter of fiscal 2025 (ended June 30, 2024). Management expects the Motive Power segment to benefit from strength in automation and electrification markets.

Driven by strength across its businesses, ENS currently anticipates its revenues to be in the band of $3.735-$3.885 billion in fiscal 2025 (ending March 2025), higher than its previous projection of $3.7-$3.8 billion. The figure also indicates growth from revenues of $3.6 billion generated in fiscal 2024.

Acquisition Benefits: ENS remains focused on acquiring businesses to gain access to new customers and product lines. In July 2024, EnerSys acquired Bren-Tronics, Inc. in an all-cash deal of $208 million. The acquisition will strengthen the company’s position as a critical enabler of the energy transition and support its growth in the growing military and defense end market. The buyout will likely add $60 million of revenues and 25 cents of earnings per share to its fiscal 2025 results.

Also, in April 2023, it acquired the U.K.-based battery service and maintenance provider Industrial Battery and Charger Services Limited. The buyout boosted the company’s motive power service offerings and strengthened its presence in the U.K. market. It also augmented ENS’ comprehensive range of battery-related services, including installation and maintenance.

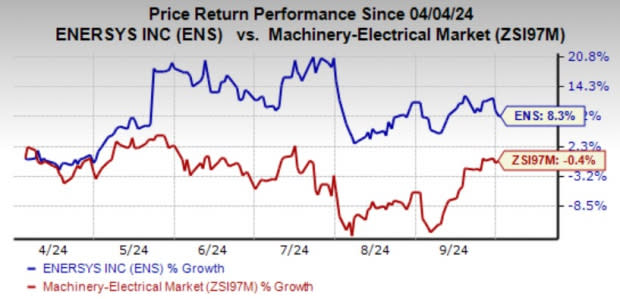

Price Performance of ENS

Image Source: Zacks Investment Research

In the past six months, shares of the company have gained 8.3% against the industry’s 0.4% decline.

Balanced Capital Allocation Strategy: EnerSys utilizes its cash flow to improve organic growth capabilities, execute acquisitions, pay out dividends and repurchase shares. The company paid out dividends of $34.5 million in fiscal 2024 (ended March 2024) and $9 million in the first three months of fiscal 2025.

EnerSys bought back its shares worth $95.7 million in fiscal 2024 and $11.6 million in the first three months of fiscal 2025. Also, it hiked its quarterly dividend by 7% to 24 cents per share in August 2024. Exiting the fiscal first quarter, it was left to repurchase shares worth $87.3 million in aggregate.

Northbound Estimate Revision: The Zacks Consensus Estimate for ENS’ fiscal 2025 earnings has been revised 2.3% upward to $8.94 per share in the past 60 days. The consensus estimate for its second-quarter fiscal 2025 (ended September 2024) earnings has increased by a penny to $2.08 per share over the same time frame.

Other Key Picks

Some other top-ranked companies from the same space are discussed below.

Eaton Corporation plc ETN currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eaton delivered a trailing four-quarter average earnings surprise of 4.7%. In the past 60 days, the consensus estimate for ETN’s 2024 earnings has increased 1.5%.

Zurn Elkay Water Solutions ZWS presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 8.7%.

In the past 60 days, the Zacks Consensus Estimate for ZWS’ 2024 earnings has remained stable.

ESCO Technologies Inc. ESE currently has a Zacks Rank of 2. In the past 60 days, the Zacks Consensus Estimate for ESE’s fiscal 2025 earnings has increased 2.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

ESCO Technologies Inc. (ESE) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Zurn Elkay Water Solutions Cor (ZWS) : Free Stock Analysis Report