As global markets navigate a period of mixed economic signals, with the S&P 500 showing strength in utilities and real estate while energy stocks retreat, investors are keenly observing opportunities that might be undervalued amidst these fluctuations. With consumer spending strengthening yet industrial output weakening, identifying stocks that offer potential value becomes crucial for those looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Lindab International (OM:LIAB) |

SEK264.00 |

SEK524.69 |

49.7% |

|

Associated Banc-Corp (NYSE:ASB) |

US$22.06 |

US$43.80 |

49.6% |

|

On the Beach Group (LSE:OTB) |

£1.53 |

£3.06 |

50% |

|

IDP Education (ASX:IEL) |

A$13.71 |

A$27.40 |

50% |

|

Lectra (ENXTPA:LSS) |

€26.50 |

€52.79 |

49.8% |

|

Redcentric (AIM:RCN) |

£1.20 |

£2.39 |

49.8% |

|

Securitas (OM:SECU B) |

SEK131.05 |

SEK260.34 |

49.7% |

|

EVERTEC (NYSE:EVTC) |

US$33.02 |

US$65.71 |

49.7% |

|

Exel Composites Oyj (HLSE:EXL1V) |

€0.375 |

€0.75 |

49.8% |

|

Solutions 30 (ENXTPA:S30) |

€1.155 |

€2.30 |

49.8% |

Let’s review some notable picks from our screened stocks.

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$920.39 billion.

Operations: The company’s revenue segments include CN¥507.52 billion from automobiles and related products, and CN¥154.49 billion from mobile handset components, assembly service, and other products.

Estimated Discount To Fair Value: 21.6%

BYD is trading at HK$284.6, below its estimated fair value of HK$363.23, indicating potential undervaluation based on cash flows. The company’s earnings grew by 36.2% last year and are forecast to grow 15.71% annually, outpacing the Hong Kong market’s growth rate of 12.1%. Recent sales reports show significant volume increases year-over-year, supporting strong revenue growth projections above the market average of 7.4%.

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in the People’s Republic of China and internationally, with a market cap of approximately HK$3.87 trillion.

Operations: The company’s revenue segments include Value-Added Services (CN¥302.28 billion), Fintech and Business Services (CN¥209.17 billion), and Online Advertising (CN¥111.89 billion).

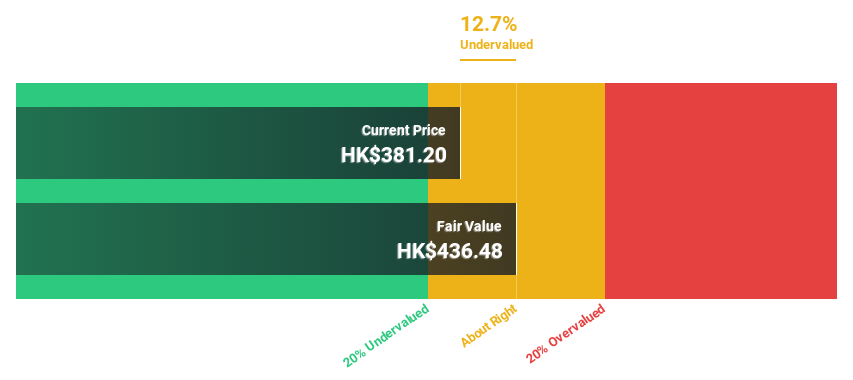

Estimated Discount To Fair Value: 17.4%

Tencent Holdings is trading at HK$421.6, which is 17.4% below its estimated fair value of HK$510.38, suggesting potential undervaluation based on cash flows. Recent earnings reports reveal a significant increase in net income to CNY 47.63 billion for Q2 2024 from CNY 26.17 billion the previous year, with revenue growth outpacing the Hong Kong market at an annual rate of 8.2%. However, substantial insider selling occurred over the past quarter, warranting caution.

Overview: Jiangsu Zhongtian Technology Co., Ltd. engages in the production and sale of electrical machinery and equipment for various sectors including communications, electric power, marine, new energy, and marine engineering construction both in China and internationally, with a market cap of CN¥51.62 billion.

Operations: The company generates revenue from its operations in the communications, electric power, marine, new energy, and marine engineering construction sectors both domestically and internationally.

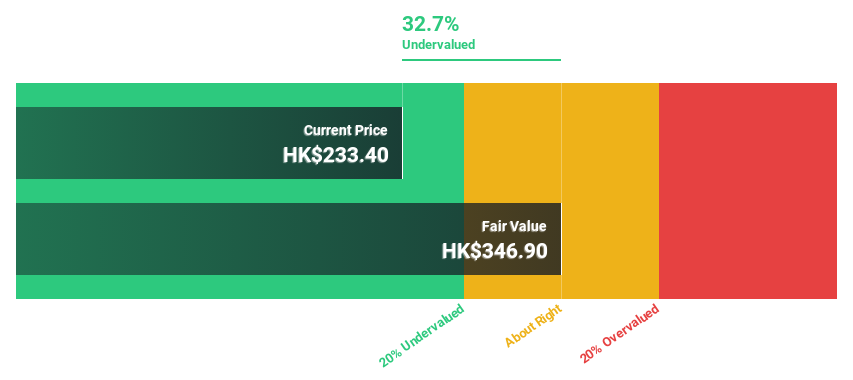

Estimated Discount To Fair Value: 33.7%

Jiangsu Zhongtian Technology is trading at CNY 16.29, significantly below the estimated fair value of CNY 24.57, highlighting potential undervaluation based on cash flows. Despite a decline in net income to CNY 1.46 billion for H1 2024 from CNY 1.95 billion a year earlier, earnings are forecasted to grow annually by over 26%, outpacing the broader CN market growth rate of approximately 23.8%. The company completed a share buyback worth CNY 114.71 million recently, reflecting ongoing capital management efforts.

Where To Now?

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1211 SEHK:700 and SHSE:600522.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com