- Number of new buses, coaches and minibuses joining UK roads up a third in Q3, marking six consecutive quarters of market growth.

- Demand rises in every segment with strongest growth in new minibus and single decker markets.

- Sector continues to lead road transport decarbonisation with ZEVs representing a fifth of registrations YTD.

SEE BUS & COACH REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

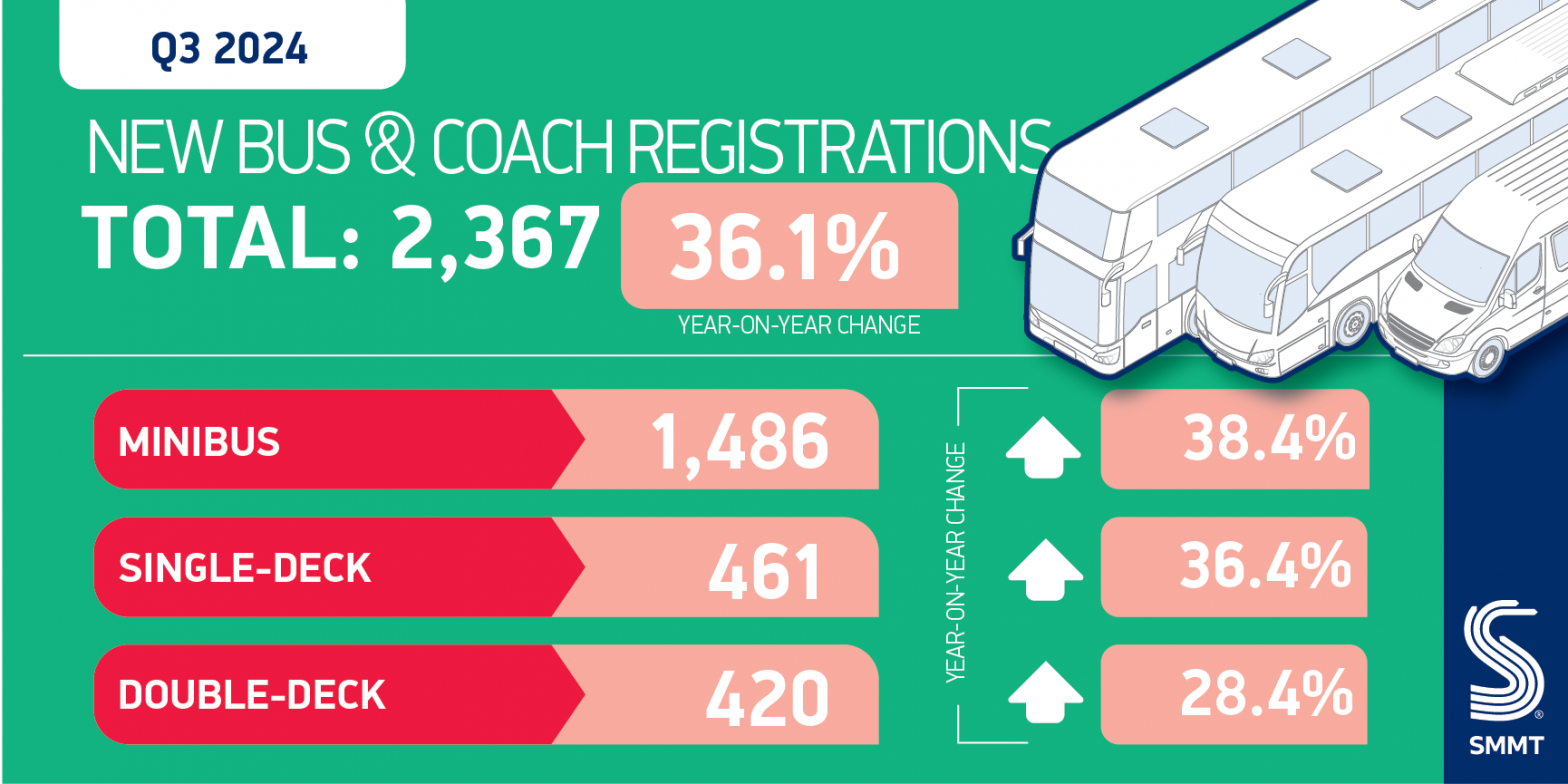

The number of new buses, coaches and minibuses joining UK roads grew by a third (36.1%) between July and September, according to new figures published today by the Society of Motor Manufacturers and Traders (SMMT). 2,367 new registrations were made during quarter three, completing six consecutive quarters of market growth. It reflects a gradual rise in passenger levels following historic lows during the pandemic, with ridership supported by the Bus Fare Cap Grant.

The third quarter growth was driven by all segments but the strongest demand was for new minibuses and single deckers, up 38.4% and 36.4% to 1,486 and 461 units respectively. Deliveries of new double deckers also rose, by 28.4% to 420 units.

Registrations in England, Wales and Northern Ireland were all up, by 37.3%, 103.7% and 162.5% respectively, while rollout in Scotland fell -21.8% compared with a bumper 2023 when demand more than doubled.1 England continued to take the lion’s share of the overall UK market, representing almost nine in 10 (87.9%) new registrations.

More operators are continuing the switch to zero emission buses (ZEBs), with new registrations rising by almost half (48.0%) to 484 units in the quarter. In the first nine months of the year, ZEBs accounted for a fifth (20.9%) of all new bus, coach and minibus registrations, with 1,230 of the very greenest models joining the road. The success is being driven by manufacturer investment in cutting-edge technology, with operators now able to choose from 15 electric and hydrogen models. Government support remains crucial, however, given operators – many already facing tight margins – are challenged to find the upfront cost of investing in new ZEBs and depot infrastructure.

Schemes such as Zero Emission Bus Regional Area (ZEBRA) and Scottish Zero Emission Bus Challenge funding have underpinned bus decarbonisation so far but, due to onerous requirements and short-term windows for grant bidding, larger and urban operators – those with the most resources – are better placed to succeed. As a result, smaller and rural operators – which tend to have tighter margins, lower ridership and longer routes – risk being left behind. As SMMT’s latest position paper Next Stop, Net Zero: The Route To A Decarbonised UK Bus Market sets out, the sector would benefit from a long-term timetable to reach net zero – one that includes suitably ambitious, accessible support for UK operators of every size to make the switch.

Mike Hawes, SMMT Chief Executive, said,

A year and a half of growth in the number of new buses, coaches and minibuses joining UK roads is good news for a sector still recovering from the pandemic. The latest zero emission bus technologies provide many benefits, from innovative safety and passenger features to better local air quality and carbon savings, so the next step is long-term support – particularly for smaller and rural operators – to deliver such benefits to communities across all parts of the country.

Notes to editors

1 New bus, coach and minibus registrations in Scotland, Q3 2023: 124 units, up 148.0% on Q3 2022.