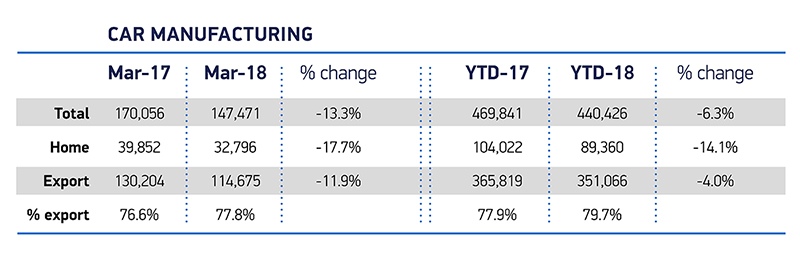

147,471 cars roll off UK production lines in March, down -13.3% on same month in 2017.

Output for home market falls for eighth consecutive month, by -17.7%, with exports also dropping -11.9%.

Q1 manufacturing down -6.3% year on year to 440,426 units, with eight in 10 shipped overseas.

SMMT restates need to maintain frictionless UK-EU trade, highlighting importance of automotive to Britain’s economy and jobs.

UK car production declined in March, with demand falling -13.3% year on year, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). 147,471 cars were built in British factories as the domestic market continued to slow, with demand falling -17.7%.

UK car production declined in March, with demand falling -13.3% year on year, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). 147,471 cars were built in British factories as the domestic market continued to slow, with demand falling -17.7%.

Exports also declined, down -11.9% due to fluctuations in demand in some global markets. In addition, some manufacturers were impacted by the adverse March weather conditions which negatively affected production operations.

Overall output in the first quarter of 2018 fell -6.3%, with 440,426 cars leaving production lines in total this year. Almost 80% of these were exported, and while demand from overseas customers fell -4.0% in Q1, this was dwarfed by the -14.1% decline in manufacturing for the UK market.

Britain’s vehicle and component manufacturers are important contributors to the UK economy and are responsible for 13.0% of all the country’s export in goods. For every one pound generated by the industry, three pounds are delivered to the economy via adjacent sectors such as logistics, retail and finance, with SMMT calculations putting the total economic impact at £219 billion – 10% of UK GDP.1

Mike Hawes, SMMT Chief Executive, said,

A double digit decline in car manufacturing for both home and overseas markets is of considerable concern. Following recent announcements on jobs cutbacks in the sector, it’s vitally important that the industry and consumers receive greater certainty, both about future policies towards diesel and other low emission technologies, and our post-Brexit trading relationships and customs arrangements.

Maintaining free and frictionless trade is an absolute priority – it has been fundamental to our past success and is key to our future growth.

Notes to editors

1 Calculation based on 2010 OECD ‘automotive’ output multiplier of up to 3 using 2017 projection using UK ONS official sources, estimates and projections to 2017. N.B Multiplier values will vary by country, position in economic cycle, activities within the value chain and between domestic and all traded linkages.