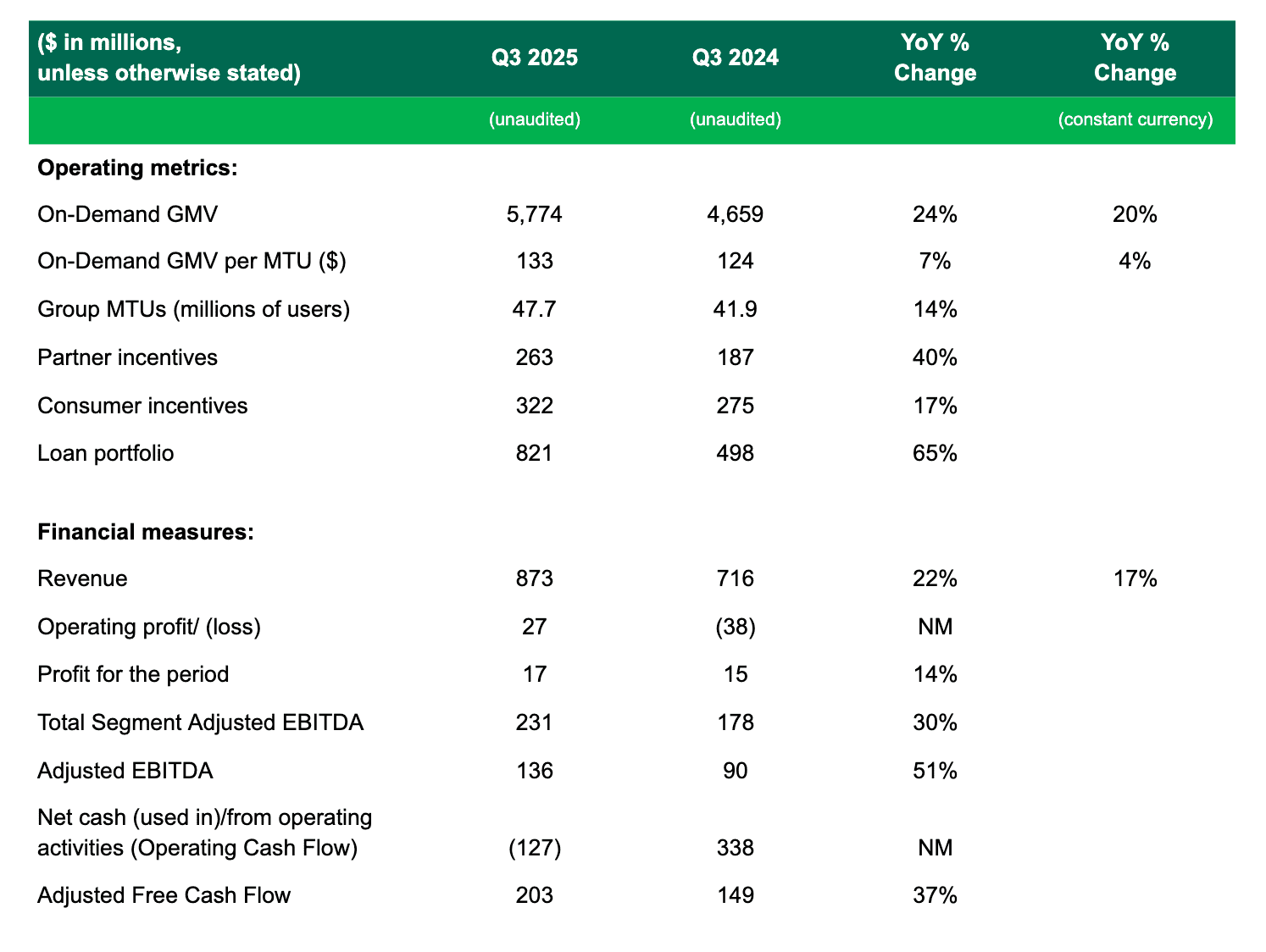

- Revenue grew 22% year-over-year, or 17% on a constant currency basis to $873 million

- On-Demand GMV grew 24% year-over-year, or 20% on a constant currency basis to $5.8 billion

- Profit for the quarter of $17 million; Adjusted EBITDA of $136 million, up 51% year-over-year

- Adjusted Free Cash Flow of $283 million on a trailing twelve months basis

SINGAPORE, November 4, 2025 – Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the third quarter ended September 30, 2025.

“This quarter marks another vital step forward in our journey, not just in financial performance, but in how we are building a more resilient, technology-driven platform for the long term. Grab’s growth engine continues to gain momentum, with On-Demand GMV accelerating to 24% year-over-year (“YoY”), or 20% YoY on a constant currency basis1, while achieving our fifteenth consecutive quarter of Adjusted EBITDA growth,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab. “Looking ahead, we will continue to prioritize innovation to fuel profitable growth in our core On-Demand business, while making disciplined investments to accelerate growth in Financial Services and explore Autonomous Vehicle (“AV”) and Remote Driving opportunities.”

“We continued to accelerate growth while delivering sequential Adjusted EBITDA margin improvements and Adjusted Free Cash Flow generation,” said Peter Oey, Chief Financial Officer of Grab. “This quarter’s results underscore the resilience of our counter-cyclical business model and is a testament to the strong execution of our ecosystem partners and our employees. We now expect full-year Group revenue to come in at $3.38 to $3.40 billion from our prior range of $3.33 to $3.40 billion, and are also upgrading our full-year Adjusted EBITDA guidance to $490 million to $500 million from $460 million to $480 million.”

Group Third Quarter 2025 Key Operational and Financial Highlights

- Revenue grew 22% YoY, or 17% on a constant currency basis to $873 million in the third quarter of 2025, driven by growth across our On-Demand and Financial Services segments.

- On-Demand GMV grew 24% YoY, or 20% YoY on a constant currency basis to $5.8 billion, underpinned by strong YoY growth in On-Demand MTUs and total number of On-Demand transactions at 16% and 27% respectively, and a YoY increase in On-Demand GMV per MTU on a constant currency basis.

- Total incentives were $585 million during the quarter. On-Demand incentives as a proportion of On-Demand GMV increased by 21bps YoY but remained flat QoQ at 10.1% as we continue to drive adoption of our product offerings across Mobility and Deliveries.

- Operating profit in the third quarter was $27 million, an improvement of $65 million YoY, primarily driven by increases in revenue, improvements in Adjusted EBITDA margins and disciplined cost management.

- Profit for the period was $17 million, an improvement of $2 million YoY, primarily due to positive operating profit and lower income tax expenses incurred, partially offset by lower net finance income for the period.

- Adjusted EBITDA was $136 million for the quarter, an improvement of $46 million YoY from $90 million in the prior year period, as we grew On-Demand GMV and revenue, while improving profitability on a Segment Adjusted EBITDA basis.

- Regional corporate costs2 for the quarter were $95 million, an increase compared to $88 million in the prior year period and $92 million in the second quarter of 2025 but improved YoY and QoQ as a percentage of revenue as we increased operating leverage of the business.

- Gross cash liquidity3 totaled $7.4 billion at the end of the third quarter, compared to $7.6 billion at the end of the prior quarter and $6.1 billion in the prior year period. Net cash liquidity4 was $5.3 billion at the end of the third quarter, compared to $5.7 billion at the end of the prior quarter.

- Net cash used in operating activities was $127 million in the third quarter of 2025, an increased outflow of $464 million YoY, with higher cash outflows from deposits from customers in the banking business and higher cash outflows related to our lending businesses, which were partially offset by better operating performance. Adjusted Free Cash Flow was $203 million during the quarter, improving by $54 million YoY, and $283 million on a trailing 12-month basis, improving by $185 million YoY. Improvements in Adjusted Free Cash Flow were driven by increasing profitability and stronger focus on working capital management.

Business Outlook

The above guidance and expected year-over-year growth is primarily attributable to the organic expansion of our business, and represents our expectations as of the date of this press release and may be subject to change.

Segment Financial and Operational Highlights

Deliveries

- Deliveries revenue grew strongly by 23% YoY, or 17% YoY on a constant currency basis, to $465 million in the third quarter of 2025. The strong growth was primarily driven by growth in Deliveries GMV and Advertising business revenue.

- Deliveries GMV grew strongly by 26% YoY, or 22% YoY on a constant currency basis, to $3,733 million during the quarter, driven by increases in the total number of Deliveries transactions, Deliveries MTUs and GMV per MTU.

- Deliveries segment adjusted EBITDA as a percentage of GMV was 2.1% during the quarter, improving by 23 basis points from 1.8% in the prior year period. This was primarily driven by increased contributions from Advertising business and improvements in operating leverage.

- During the quarter, the total number of quarterly active advertisers who joined our self-serve platform increased 15% YoY to 228,000 while average spend by quarterly active advertisers on our self-serve platform increased 41% YoY, as we continued to deepen Advertising penetration among our merchant-partners. Average earnings for our Deliveries merchant-partners also increased by 12% YoY.

Mobility

- Mobility revenue grew 17% YoY, or 13% YoY on a constant currency basis, in the third quarter of 2025. Growth was underpinned by strong growth in Mobility MTUs and total number of Mobility transactions. The growth in the number of Mobility transactions continued to outpace GMV growth at 30% YoY.

- Mobility GMV growth accelerated to 20% YoY, or 17% YoY on a constant currency basis, to $2,041 million during the quarter.

- Mobility segment adjusted EBITDA as a percentage of Mobility GMV was 8.9% in the third quarter of 2025, compared to 8.8% in the same period last year due to operating leverage.

- We increased active driver supply while optimizing our existing driver supply to meet growing demand for our services. During the quarter, we reached new all-time highs in monthly active drivers and transactions per active driver, while driver-partner retention rates remained stable. Notably, average Mobility fares declined 7% YoY while average driver earnings increased 4% YoY in the third quarter, as we improved the affordability of our Mobility offerings for our users while improving driver efficiency.

Financial Services

- Revenue for Financial Services grew 39% YoY, or 35% YoY on a constant currency basis, to $90 million in the third quarter of 2025. The YoY growth was primarily driven by increased contributions from lending across GrabFin and our Digibanks.

- Lending to our ecosystem partners through GrabFin and our Digibanks continued to gain traction, with total loans disbursed growing by 56% YoY to $886 million during the third quarter. Our total loan portfolio at the end of the third quarter grew 65% YoY to $821 million from $498 million in the prior year period, and remains on track to exit the full year above $1 billion.

- As we scaled our lending businesses across GrabFin and our Digibanks during the quarter, we increased provisions for expected credit losses in line with disbursals growth, resulting in Segment Adjusted EBITDA losses increasing by 8% YoY to negative $28 million. Our credit risk management framework remains robust, with 90-days non-performing loans well within our risk appetite and the loan portfolio generating healthy risk-adjusted returns.

- Customer deposits in GXS Bank (Singapore) and GX Bank (Malaysia) grew 20% YoY to $1,311 million in the third quarter, but declined 15% QoQ from $1,543 million in the prior quarter. The sequential decline reflects our move to proactively manage funding costs across our Digibanks and align our deposit rates with the prevailing interest rate environment. While total deposits declined sequentially, our total deposit customers across GXS Bank (Singapore) and GX Bank (Malaysia) grew to another all-time high at the end of the third quarter, signalling the continued traction of our Digital Banks.

- In September 2025, GX Bank (Malaysia) launched GX Business Banking alongside its flagship Jaguh Niaga Programme, initially rolled out for sole proprietors, to support Micro, Small and Medium Enterprises (“MSMEs”) in Malaysia.

- In Indonesia, Superbank5 continued to drive strong growth, with deposit customers growing over 20% QoQ to reach another all-time high at the end of September 2025. This growth is driven by innovative products such as OVO Nabung, which enables users to benefit from the seamless payments experience using the OVO wallet, while enjoying the yield of a Superbank savings account.

Others

- Revenue for Others was $1 million in the third quarter of 2025.

Other Events

- During the quarter, we announced plans to launch Autonomously Intelligent Ride (“Ai.R”), our first AV service for consumers in Singapore, in partnership with WeRide. By early 2026, Ai.R is expected to start taking its first batch of passengers, improving access to key amenities including supermarkets, schools and major transport nodes.

- In October, we announced our multi-year partnership with May Mobility to integrate their autonomous driving technology, including fleet management, vehicle matching and routing systems, into our core ecosystem. The partnership will combine May Mobility’s operational best practices and Grab’s local expertise to facilitate the safe and reliable implementation of AVs into Southeast Asia, tailored to the unique needs of local infrastructure.

1 We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

2 Regional corporate costs are costs that are not attributed to any of the business segments, including certain cost of revenue, research and development expenses, general and administrative expenses and marketing expenses. These regional costs of revenue include cloud computing costs. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses and capitalized software costs.

3 Gross cash liquidity includes cash on hand, short-term and long-term time deposits, marketable securities and restricted cash.

4 Net cash liquidity includes gross cash liquidity less loans and borrowings.

5 Grab holds a 37.88% effective equity interest in its associate company PT Super Bank Indonesia.

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast,” “annualized,” “annualized run-rate,” “on track” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of currency exchange fluctuations and inflation; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described under “Item 3. Key Information – D. Risk Factors” and in other sections of Grab’s annual report on Form 20-F for the year ended December 31, 2024, as well as in other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information

Grab’s unaudited selected financial data for the three months and nine months ended September 30, 2025 and 2024 included in this document and the investor webcast is based on financial data derived from Grab’s management accounts that have not been reviewed or audited.

Certain amounts and percentages that appear in this document may not sum due to rounding.

Non-IFRS Financial Measures

This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Total Segment Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Free Cash Flow, gross cash liquidity and net cash liquidity. Grab uses Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Total Segment Adjusted EBITDA, and Adjusted EBITDA margin for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs. Adjusted Free Cash Flow excludes the effects of the movement in working capital for our lending and digital banking deposit activities. Grab uses Adjusted Free Cash Flow to monitor business performance and assess its cash flow activity other than its lending and digital banking deposit activities, and Grab’s management believes that the additional disclosure serves as a useful indicator for comparison with the cash flow reporting of certain of its peers. Grab uses gross cash liquidity and net cash liquidity to assess our ability to meet short-term obligations and invest in growth opportunities.

However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is calculated as profit (loss) for the period adjusted to exclude: (i) net finance income (costs), including interest income (expenses), foreign exchange gain (loss) and changes in fair value of financial assets and liabilities, (ii) net other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) impairment losses on goodwill and non-financial assets, (viii) restructuring costs, (ix) legal, tax and regulatory settlement provisions, and (x) other items not indicative of our ongoing operating performance.

- Segment Adjusted EBITDA represents the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Segment Adjusted EBITDA margin is calculated as Segment Adjusted EBITDA divided by Gross Merchandise Value. For Financial Services and Others, Segment Adjusted EBITDA margin is calculated as Segment Adjusted EBITDA divided by Revenue.

- Total Segment Adjusted EBITDA represents the sum of Adjusted EBITDA of our four business segments.

- Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Revenue.

- Adjusted Free Cash Flow is defined as net cash flows from operating activities less capital expenditures (including assets acquired under lease arrangements), plus proceeds from disposal of property, plant and equipment, and excluding changes in working capital related to loans and advances to customers, and deposits from the digital banking business.

- Gross cash liquidity includes cash on hand, short-term and long-term time deposits, marketable securities and restricted cash.

- Net cash liquidity includes gross cash liquidity less loans and borrowings.

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement. GMV includes (i) sales made through offline stores reported under the deliveries segment; and (ii) revenues made from products and services provided to driver-partners, merchant-partners and other customers to support their businesses, such as GrabAds and GrabRentals, reported under the deliveries and/or mobility segment, as applicable. Mobility GMV is an operating metric representing the GMV of our Mobility segment. Deliveries GMV is an operating metric representing the GMV of our Deliveries segment. On-Demand GMV is an operating metric defined as the sum of Mobility GMV and Deliveries GMV. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of customer spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare Grab’s aggregate operating results, which captures significant trends in its business over time.

Monthly Transacting User (MTUs) is defined as the monthly number of unique users who transact via Grab’s apps, where transact means to have successfully paid for or utilized any of Grab’s products or services (including lending and offline Jaya Grocer transactions where users record their Jaya Grocer loyalty points on the Grab app). MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners, the effect of which is to reduce revenue. For certain delivery offerings where Grab is contractually responsible for delivery services provided to end-users, incentives granted to driver-partners are recognized in cost of revenue.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers, the effect of which is to reduce revenue. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Loan portfolio is an operating metric representing the total of current and non-current loan receivables in the financial services segment, net of expected credit loss allowances.

Industry and Market Data

This document may contain information, estimates and other statistical data derived from third party sources, including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources can guarantee the accuracy of such information. You are cautioned not to give undue weight to such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Impact of $1.5 Billion Convertible Notes Offering on Reported Financial Results

The conversion feature within the convertible notes is accounted for as a derivative liability under IFRS, with its fair value re-measured each reporting period. While this generates volatility in profit/loss, it does not impact Grab’s underlying cash flows or adjusted EBITDA.

Unaudited Summary of Financial Results

The number of outstanding Class A and Class B ordinary shares was 3,965 million and 122 million as of September 30, 2025, and 3,909 million and 118 million, respectively, as of September 30, 2024. Additionally, 415 million and 269 million potentially dilutive securities have been considered for the computation of diluted earnings per ordinary share for the three months ended September 30, 2025 and 2024, respectively.