Lawsuit abuse reforms in Florida

In March 2023, Florida passed sweeping tort reform measures to address legal abuse in the sunshine state that was causing instability in insurance markets and large rate increases for consumers and businesses.

2023 Florida House Bill 837 (HB 837) introduced much-needed reforms that changed the statutes, standards, and dynamics of civil litigation in Florida. It included updated negligence standards to deter lawsuit abuse, caps on exorbitant attorney’s fees, limits preventing over-inflated medical expenses, and new rules to prevent gamesmanship by lawyers.

Before HB 837, Florida had some of the highest insurance rates in the country due to rampant lawsuit abuse. This created a cycle of rising premiums, excessive litigation, and instability for consumers, small businesses, and insurers.

While insurance claims can take years to resolve, we are now starting to see the benefits of Florida’s lawsuit abuse reforms take shape.

HB 837’s impact on affordability

The positive impacts of reform for Florida businesses and consumers are striking: insurance markets stabilized, with large insurance carriers entering, expanding, and investing in Florida. Consumers are seeing their auto insurance rates decrease by 20% or more as a result of multiple rate cuts that will save Floridians billions of dollars in annual premiums.

And it doesn’t stop there. Coupled with state TNC vicarious liability reforms passed in 2020, HB 837 is impacting the cost of rideshare in Florida. As of September 2025, on average, 19% of a rider’s fare on Uber went towards government-mandated insurance — roughly a two percentage-point improvement compared to the prior year.

Since March 2025, Florida riders have saved tens of millions of dollars.¹ Lower insurance costs mean lower prices for riders, plain and simple.

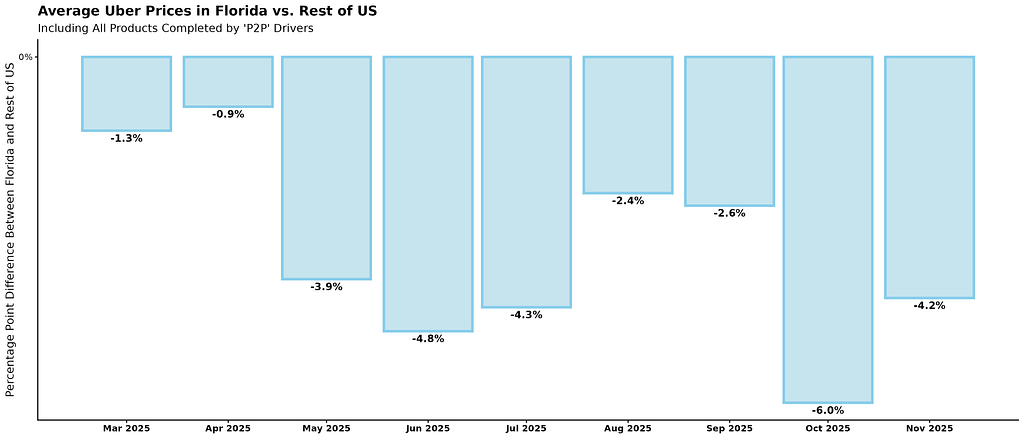

What’s more, the impacts of Florida’s reforms are even clearer when compared to the rest of the country. Since March 2025, the year-over-year change in average fares in Florida has been as much as six percentage points lower than in other states.² While Uber riders in many parts of the country have seen fares rise due to factors like excessive insurance mandates, rigid pay standards, and/or extra fees, riders in Florida are paying less.

The benefits for ridesharing drivers

Not only are many Florida ridesharing drivers paying hundreds of dollars less in annual premiums for personal insurance under HB 837, they’re also completing more trips than ever in Florida. Lower prices have grown demand and increased the number of earning opportunities for drivers across the state.

At the same time, Uber has continued to raise the bar on safety through driver education and innovations like seat-belt alerts, left-turn reductions, and Driving Insights, as well as input from safety advocates that helps inform our safety approach.

Keep Florida moving affordably

Florida’s reforms are working: Riders are seeing lower trip fares and drivers are completing more trips. Let’s protect these wins. Sign up here to stay informed on legislation that could threaten your savings.

—

[1] “P2P” drivers only, based on UberX data from April through November 2025, compared to the same monthly data in 2024.

[2] Average fares per trip mile are calculated after promotions. We divide by trip miles and exclude taxes and airport fees from fares to isolate the impacts of Florida’s insurance reforms compared to the rest of the country from other changes.

The Impacts of Legal Abuse Reform on Rideshare Prices in Florida was originally published in Uber Under the Hood on Medium, where people are continuing the conversation by highlighting and responding to this story.