Nio might be one of the first young automakers to truly turn the corner, and its margins are leading the charge.

For brave and risk-tolerant investors looking into the young electric vehicle (EV) industry, Nio (NIO +7.55%) is an intriguing opportunity. Nio is a premium EV maker, one of a handful of Chinese automakers quickly expanding thanks to their advanced EV technology and ability to undercut much of the world on prices.

Nio is fresh off setting monthly and quarterly delivery records, with momentum poised to continue, and that’s not even the best part. Let’s pop the hood, take a look at Nio’s margins, and learn why there is good news for investors.

Image source: Nio.

What delivery records?

Roughly a month ago, Nio announced strong results for deliveries, but if you have forgotten, here’s a brief recap. Nio set a new monthly high for deliveries with 48,135 vehicles in December 2025. It wasn’t a one-hit wonder, either, with fourth-quarter deliveries spiking over 71% to a new quarterly record.

Nio’s surge in deliveries was largely expected, thanks to its two newer brands Onvo and Firefly gaining more traction in the markets. However, some investors were nervous about Nio’s margins in the near term because not only is the company dealing with a brutal price war in China’s automotive market, its Onvo and Firefly vehicles may not be as profitable as Nio’s namesake premium EV brand.

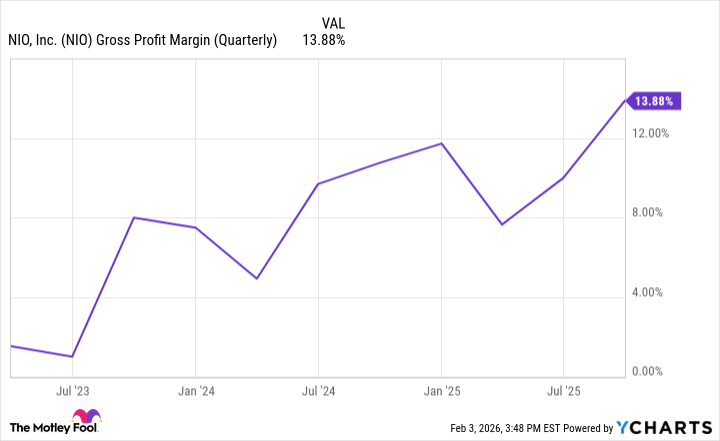

Fortunately, for investors, Nio’s margins have consistently increased over time and were strong in the third quarter. In fact, you can see the clear progress Nio has made in recent years.

NIO Gross Profit Margin (Quarterly) data by YCharts

Further, with third-quarter vehicle and gross margin moving higher, Nio’s gross profit was up a robust 50.7% higher from the prior year’s third quarter — a clear example of why margin matters. Nio also has reinforcements on the way, which should position the company’s margins to continue driving higher.

New launches coming

Those reinforcements will come in the form of three new large SUV models launching later this year between Nio’s three brands. Nio’s management believes deliveries can reach a compound annual growth rate (CAGR) of 40-50% over the next two years.

Today’s Change

(7.55%) $0.35

Current Price

$5.05

Key Data Points

Market Cap

$11B

Day’s Range

$4.93 – $5.21

52wk Range

$3.02 – $8.02

Volume

5M

Avg Vol

49M

Gross Margin

11.25%

In fact, Nio plans to launch its flagship ES9 on April 10, which seems destined to become the automaker’s largest and most expensive SUV. The ES9 is expected to sell with a price nearing $72,000 and will be key to Nio driving margins higher in the near term.

This is all great news for investors because Nio is at a major potential turning point. Remember, Nio is aiming to achieve its first adjusted earnings during the fourth quarter, and is targeting 2026 to be break even for the full year. Nio deliveries have set records recently, but its margin growth is what should really have investors excited going forward.