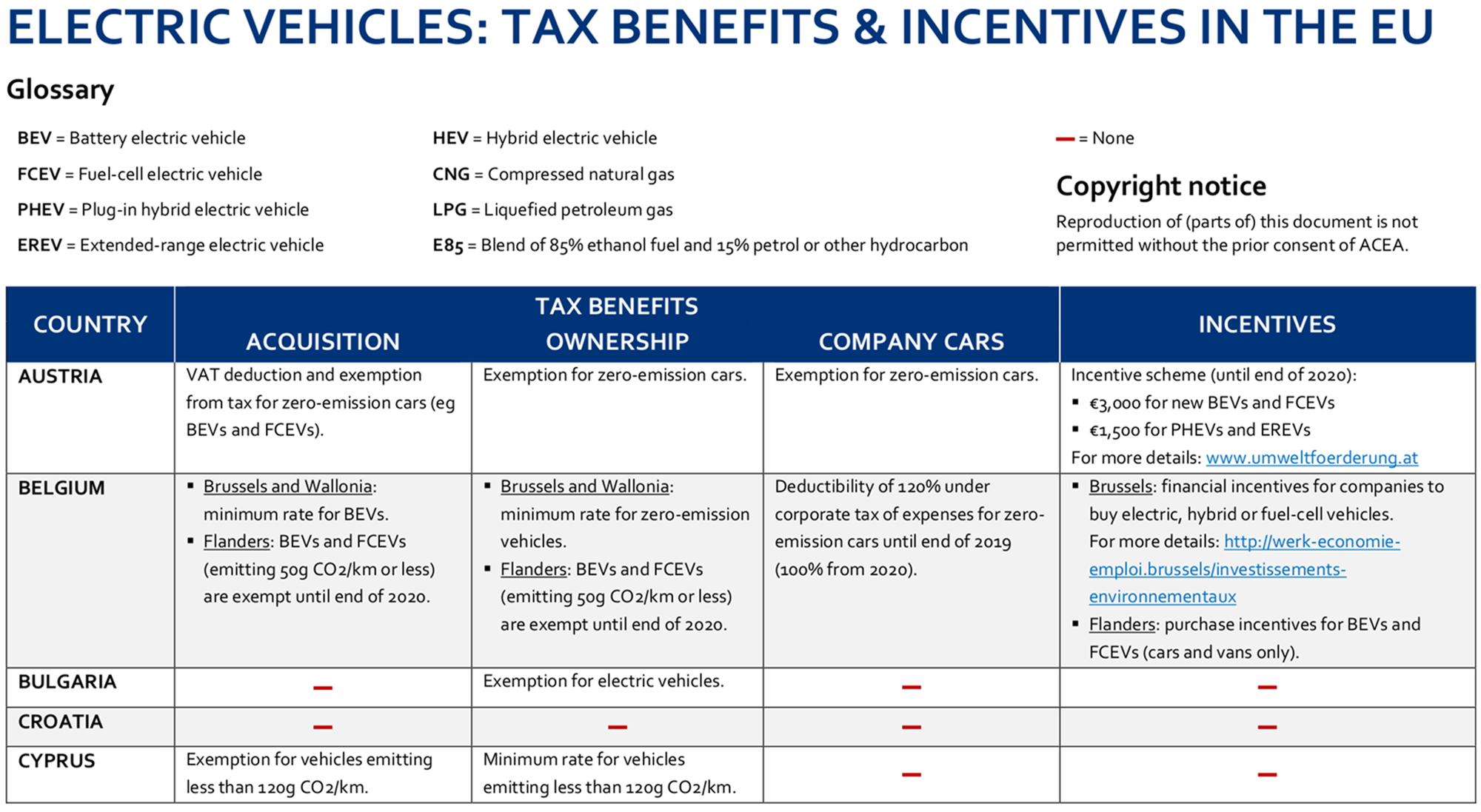

Although fiscal measures to stimulate electric vehicle sales are available in nearly all EU member states now, this overview shows that the nature and (especially) the monetary value of these benefits and incentives still varies widely.

(Click on the thumbnail above to open the complete overview in a new window)

This comprehensive document provides an overview of fiscal measures for buying electric vehicles in the 28 member states of the European Union, consisting of tax benefits (ie reductions and exemptions) and bonus payments or premiums for buyers.

Key observations

- Today, stimuli for electrically-chargeable cars are available in 24 out of the 28 EU states.

- However, just 12 EU member states offer bonus payments or premiums to buyers.

- Most countries only grant tax reductions or exemptions for electric cars.