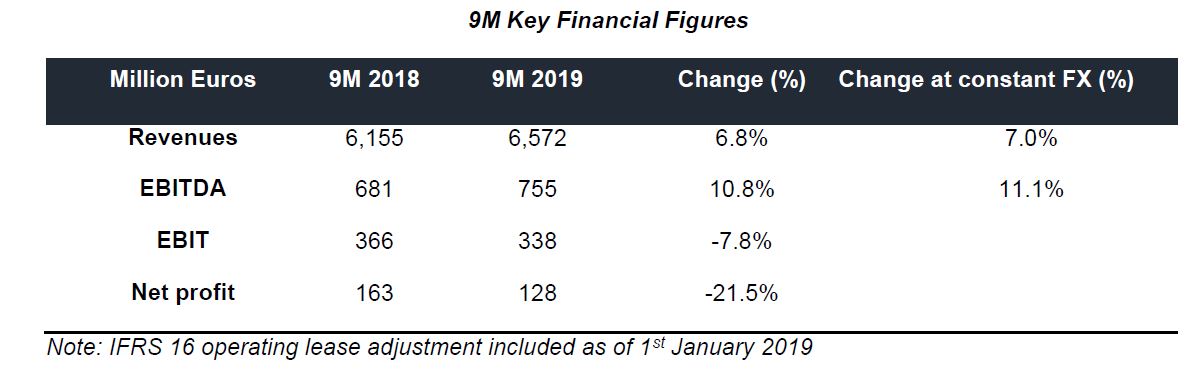

Gestamp, the multinational company specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented its results today for the first nine months of 2019 with revenues reaching €6,572m.

Gestamp outperformed the auto production market during 9M 2019 with a 6.8% growth rate in revenues (7.0% at constant FX) when compared with 9M 2018. Gestamp reported an EBITDA of €755m during 9M 2019 implying a growth rate of 11.1% at constant FX.

Outperforming the market across regions

Gestamp has outperformed the auto production market in all of its regions for the first nine months in terms of revenue. Growth at constant FX has been strong in Eastern Europe (21.1%), North America (20.2%) and Mercosur (18.7%). In Asia, Gestamp grew 9.6% in a challenging market that decreased -7.1%. The only geography in which Gestamp decreased its revenues was in Western Europe (-4.4%) but notably less than the market decrease (-6.2%).

During Q3 Gestamp recorded revenues of €2,059m, resulting in an 8.7% growth rate vs. Q3 2018 (6.3% at constant FX). EBITDA for Q3 increased by 19.4% to €234m. We have continued to grow both our revenues and EBITDA taking into consideration that the auto market environment remained challenging in which global auto production volumes declined by 3.2%.

During Q3 2019 Gestamp has started production in its new facility in Michigan (USA), which enhances Gestamp’s existing footprint and is expected to support future growth.

2019 Financial Outlook

Gestamp has updated its guidance for 2019. Revenue growth will be mid-single digit instead of high single digit. EBITDA will grow compared with 2018, but not at a rate higher than revenue growth. Capex decreases from around 9.5% of revenues to around 9.0% of revenues. Leverage moves from less than 2.2 times net debt/EBITDA ratio to around 2.4 times.

“In order to adapt to the current uncertain auto market environment, Gestamp has moderated its capital expenditures by being more selective in the opportunities pursued. However, we expect to continue to outperform the market growth rate but with a focus on free cash flow generation. The Company keeps focused on cost efficiencies, capex moderation, headcount reduction in certain geographies and optimization of our operations,” Gestamp CEO, Francisco López Peña, explained.