Since Toyota AI Ventures was founded in July 2017, I’ve received a flurry of questions from startup founders, institutional venture capital investors, other corporate venture capital investors, and the press. They want to know how the fund is structured, how (and how fast) we make decisions, the role of our corporate business units, whether we are truly founder-friendly, and, to address Paul Graham’s point below, what being “strategic” really means for our startup portfolio companies and our big corporate limited partner.

“All other things being equal, [startups should] avoid ‘strategic’ investors. What that word ‘strategic’ means is that they have ulterior motives that are unlikely to be aligned with yours.” — Paul Graham, November 29, 2019

The answer to these questions begins with our mission, and ends with the structure and operation of the fund. To borrow from mountain climbing, our firm’s mission defines the summit we’re seeking, the fund structure is our climbing equipment, and the fund’s operational execution is the actual day-to-day climbing.

In this first post, I will help explain our mission and why we’re on it — a subject I’ve explored in some of my previous talks and pieces. Future posts will detail how we’re structured and how we operate to attract and align with the best startup teams and co-investors. Venture capital has its place in the corporate development toolkit, especially for early-stage investments to discover over-the-horizon opportunities.

Let’s start with the Toyota AI Ventures mission:

We are explorers. Our mission is to discover what’s next for Toyota by helping early-stage startups bring disruptive technologies and business models to market quickly.

Note that we are explorers first. And, like our early-stage startups, we invest to help discover “what’s next” for our business, specifically where artificial intelligence is driving innovations in autonomy, mobility, robotics, cloud, data, and even smart, connected cities. We’re exploring these potential new territories, even when there isn’t an obvious alignment with our current or planned businesses, because we know prediction is difficult, especially about the future. Richard Danzig has written well about the folly of such predictions.

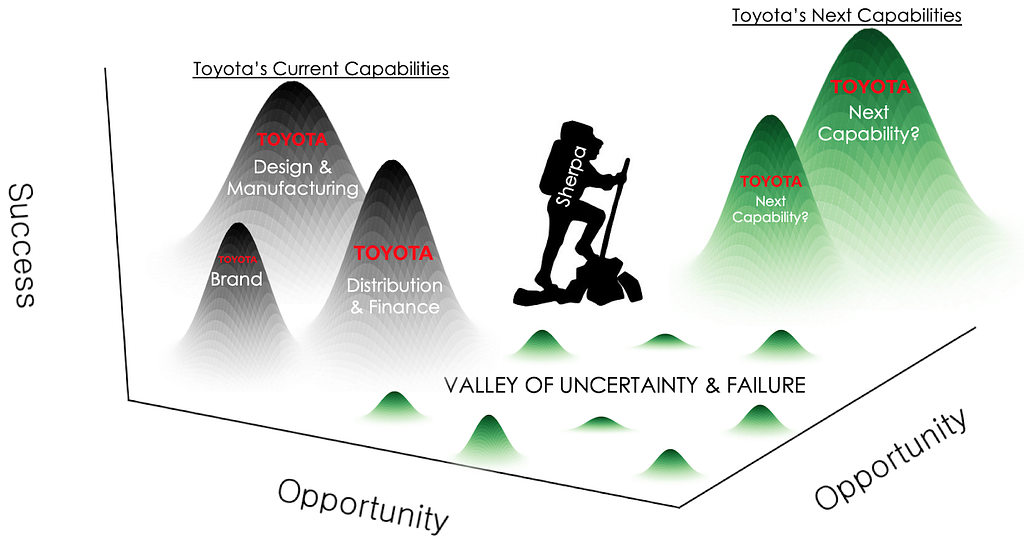

Mountains of opportunities … among valleys of uncertainty and failure

Today, Toyota is valued at roughly $210 billion driven by deep capabilities in, principally, five areas — design, manufacturing, distribution, finance, and one of the world’s most valuable consumer brands. Where will the next set of capabilities come from to power Toyota’s next era of success? The opportunities are many, but the potential successes are few. Clay Christensen taught us that large incumbent companies often wait too long to identify new opportunities — only to be disrupted by new insurgents. They hesitate to wade into the “valley of uncertainty and failure.”

Often, the only superpower a startup has is speed. Without hesitation, startups are incented to quickly traverse the landscape of molehills in search of where the true mountains of opportunity might lie. Startups can serve as sherpas for Toyota to unveil the next mountain of opportunity and the capabilities needed to reach it.

This journey of discovery can’t be centrally planned. The world is too complex and moves too fast. Startups are experiments in this marketplace landscape and, for the last 60 years, venture-backed startups have proven they often stumble upon what’s next. Well, we want to be on those exploratory journeys — and not just read about them.

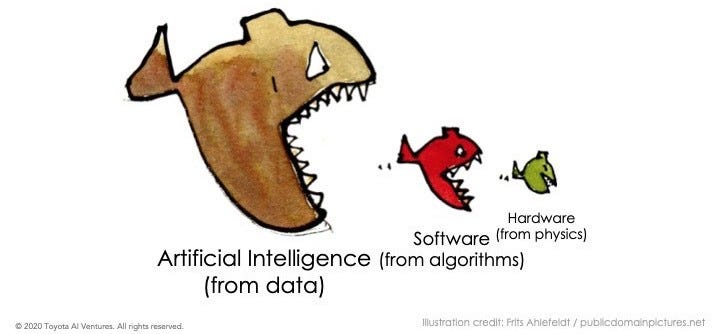

Software is eating the world … and cars are on the menu

Marc Andressen was right that software is eating the world, and now cars are on the menu. Artificial intelligence, autonomy, centralized software stacks, and service platforms are disrupting the auto industry. And, because of their capabilities and experience, large, high-technology companies are better positioned as insurgents to muscle their way into the vehicle itself and disrupt the auto market incumbents.

With apologies to Netflix’s Ted Sarandos, automotive has to become high tech before high tech becomes automotive. The good news for the auto industry is that cars are safety-critical and difficult to manufacture at-scale with high quality. The moat around the industry is wide and deep — but not infinite. Like Toyota’s transition from industrial looms to automobiles in the 1930s, the path to what’s next and new for Toyota will be paved by the curiosity, creativity, tenacity, and bravery of startup entrepreneurs.

Earning and learning with our startups

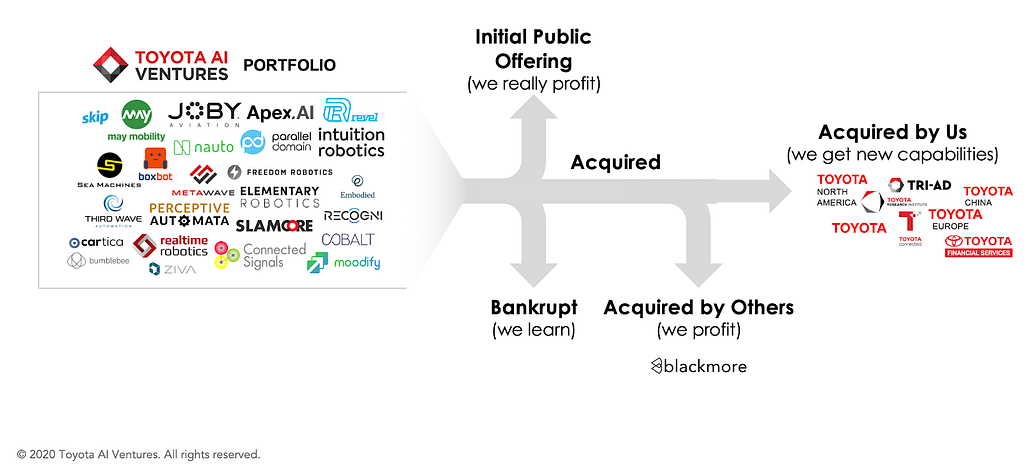

In some cases, these startup innovations may be truly disruptive, leading to huge productivity improvements and market opportunities. Our venture fund will profit from the successful startups as shareholders in an exit or through the startup going public. Or, we might acquire the startup and incorporate their technology and business into ours. The key is that our financial return must precede any strategic return. That keeps us aligned with the startup founding team and our co-investors.

In other cases, the startups may struggle and, ultimately, fail. We’ll learn from these negative examples, too. As Bill Gates said, “It is fine to celebrate success, but it is more important to heed the lessons of failure.” We derive some strategic benefit from every startup — because we naturally expect that some part of exploration will involve getting lost — before ultimately finding the right path toward what’s next. Venture investing helps to institutionalize our learning process.

Additionally, startup investing can lead to a higher likelihood of a successful post-acquisition integration. Getting to intimately know a startup through a long-term, minority investment is a great way to minimize acquisition risk. In my experience, post-acquisition integrations most often run into trouble because of incompatible corporate cultures and/or misaligned team incentives. By living with a startup through the ups and downs of their journey, an investor can really get to know the team and, should an acquisition occur, have a better chance of realizing the value for the price paid. If corporations actually get the expected value from their startup acquisitions, they might do more of them — a welcome outcome for the whole startup ecosystem.

For us, the point of corporate venture, at least for early-stage investing, is to explore new markets and learn from the disruption that startups are bringing to them. This helps identify, prepare, and position Toyota for the next emergent opportunities. In future posts, I’ll discuss more about the form of our fund, and how we’re structured and run to best align with the best startup sherpas on this journey of discovery.

Finding New Mountains: Our Venture Mission of Discovery was originally published in Toyota AI Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.