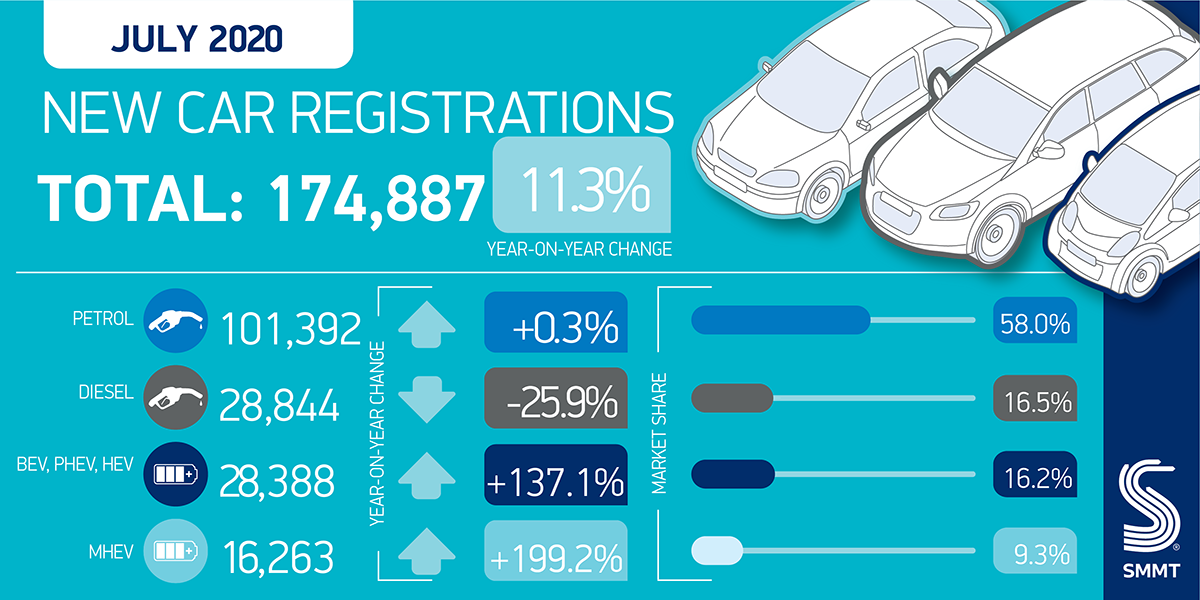

- Pent-up demand sees UK new car registrations rally in July with 11.3% increase to 174,887 vehicles, as dealerships across the nation fully re-open.

- Overall registrations currently down -41.9% YTD and expected to be -30.0% down by end of 2020, totalling £20bn in lost sales.1

- Manufacturer offers help encourage demand but economic uncertainty could put the brakes on recovery.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD THE PRESS RELEASE AND DATA

UK new car registrations rose for the first time this year, by 11.3% in July, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). Some 174,887 cars were registered in July 2020 as dealerships across the UK opened for their first full month of trading since February.2 This represents a significant improvement on the same month last year, when declining business and consumer confidence undermined the market.

Pent-up demand and special offers led to a reprieve for the sector, but overall registrations are still down by -41.9% or 598,054 units year-to-date. Despite the increase in July, SMMT’s full year outlook is for a -30% decline in registrations, representing more than £20 billion of lost sales.

Private demand saw the most significant growth with a 20.4% increase in registrations, primarily a result of consumers finally being able to renew their cars after lockdown had forced them to delay. In addition, manufacturer incentives have helped attract customers to showrooms. Eight of the 10 major manufacturers provided attractive finance offers and flexible payment terms in a bid to head off consumer uncertainty3 – vital as the Coronavirus Job Retention Scheme phases out, potentially sparking redundancies across the economy and impacting confidence to invest in big ticket purchases.4

Public appetite for zero and ultra low emission cars remains stable, with plug-in hybrids and battery electric vehicles taking a 9.0% share of registrations for July, compared with 9.5% last month and up from 3.1% for 2019 overall. Meanwhile, ‘supermini’ and lower medium sized (or small family) cars were once again the most popular segments, accounting for 59.1% of registrations. Dual Purpose cars comprised 25.9% of vehicles registered.

Business car registrations showed modest growth, with fleet purchases increasing by 5.2%. Even so, more than 13,000 jobs have now been lost by UK Automotive across retail and manufacturing as a result of the pandemic, with more likely to follow given the scale of the challenges facing the sector, including shifts in technology, Brexit uncertainty and a depressed market.

Mike Hawes, SMMT Chief Executive, said,

July’s figures are positive, with a boost from demand pent up from earlier in the year and some attractive offers meaning there are some very good deals to be had. We must be cautious, however, as showrooms have only just fully reopened nationwide and there is still much uncertainty about the future.

By the end of September we should have a clearer picture of whether or not this is a long-term trend. Although this month’s figures provide hope, the market remains fragile in the face of possible future spikes and localised lockdowns as well as, sadly, probable job losses across the economy. The next few weeks will be crucial in showing whether or not we are on the road to recovery.

Notes to editors

1 Based on an expected shortfall of c708,000 units at an average cost from JATO of c£28,000 per vehicle

2 Showrooms in England were allowed to re-open on 1 June, in Wales on 22 June, and in Scotland on 29 June

3 Offers from eight of the top 10 best-selling brands available on brand websites

4 Source: OBR Fiscal Responsibility Report June 2020