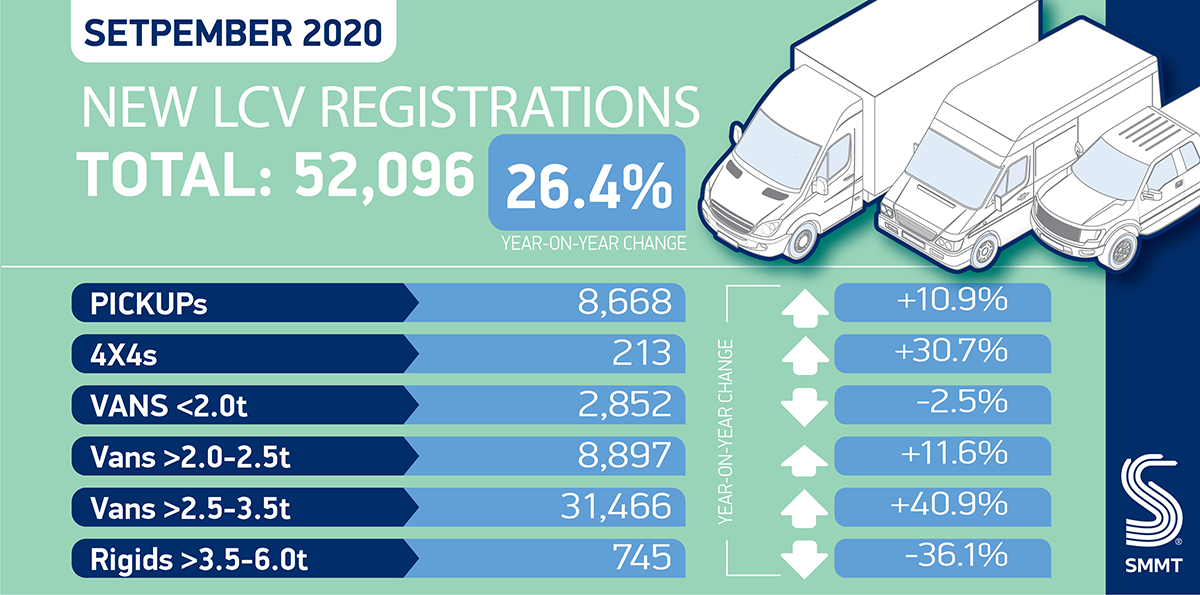

- UK new van market grows by 26.4%, following a weaker than usual month last year due to emissions regulation changes.

- Registrations of most segments show double-digit growth against last year’s low volumes.

- Market still below ‘normal’ levels, down -6.6% on previous five-year September average.

- Performance year-to-date remains down -27.4%, a shortfall of almost 80,000 units.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new light commercial vehicle (LCV) market grew by more than a quarter (+26.4%) in September, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). In total, 52,096 vans, pickups and 4x4s were registered in the month, up some 10,880 units on a weak September 2019, when regulatory changes distorted the market.1

When put into context, new van registrations were still down -3.3% on 2018’s September market and declined by -6.6% on the September average between 2014-2018.

Nearly all segments saw double digit increases against previous low volumes, with the only exception being small vans weighing less than or equal to 2.0 tonnes decreasing -2.5%, 74 vans fewer than last year. Registrations of medium vans weighing more than 2.0 tonnes to up to 2.5 tonnes grew 11.6%, while the biggest segment, larger vans weighing more than 2.5 and up to 3.5 tonnes saw the sharpest increase, up by 9,000 units, or 40.9% on September last year.

Meanwhile performance in the year to date remains low, down -27.4% or almost 80,000 units below 2019 levels.

Mike Hawes, SMMT Chief Executive, said,

The sector has shown incredible resilience throughout the ongoing crisis and September’s numbers indicate some confidence is returning as operators seek flexibility and lower operating costs. However, the context of these figures is important as the headline growth belies a very weak September 2019 and is still short of the rolling average. From new social distancing restrictions, to job losses as the furlough scheme comes to an end next month, and the ticking clock that is the end of the Brexit transition period, the next quarter holds myriad challenges for the industry.

Notes to editors

1. September 2019 – 41,216, 2018 – 53,878, 2014-2018 – average 55,788.