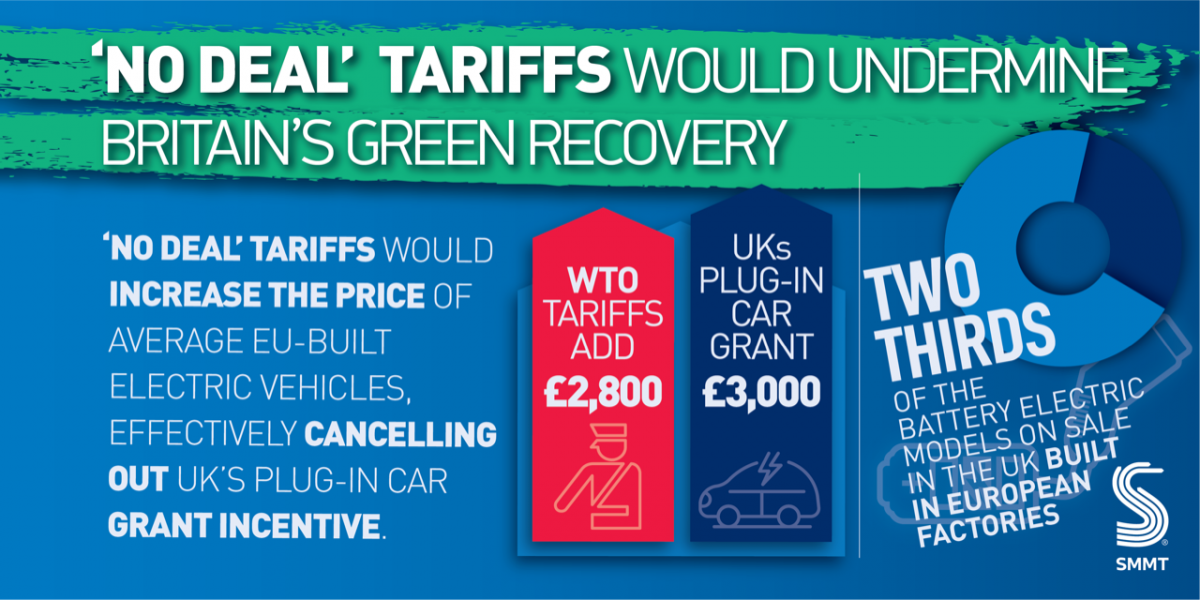

- New calculations reveal ‘no deal’ tariff threat to Britain’s green recovery, with £2,800 average price uplift on EU-built EV effectively cancelling out UK’s plug-in car grant.

- Shock of higher cost risks reducing increased BEV demand next year by at least 20%, hampering UK’s efforts to reach ambitious emissions reduction targets.

- Tariffs would also add £2,000 to cost of British-built battery electric cars sold in Europe, damaging international competitiveness as UK strives to become a global leader in electromobility.

- Automotive sector repeats call for swift conclusion of an ambitious UK-EU FTA to protect jobs and drive a sustainable recovery across every region.

The Society of Motor Manufacturers and Traders (SMMT) has again urged both sides to re-engage with vigour in the Brexit negotiation process, honouring the commitment to get a good deal done, as new calculations illustrate the high stakes of ‘no deal’, not only for the automotive sector but for hopes of a green recovery from the coronavirus crisis.

‘No deal’ would be the worst possible outcome for UK Automotive, for car buyers and for the country’s ambitions to become a world leader in transport decarbonisation. The immediate imposition of blanket tariffs under World Trade Organisation (WTO) rules would add billions to the cost of trade and, crucially, to the cost of building and buying electric vehicles.

The 10% ‘no deal’ WTO tariff would add at least £4.5 billion to the annual cost of fully assembled cars traded between the UK and the EU, with an average hike of £1,900 per EU-built vehicle sold in the UK.1 However, new analysis shows that for fully electric cars fitted with expensive battery technology, the cost increase is even higher, at £2,800, effectively making the £3,000 plug-in car grant for these vehicles null and void.2

Moreover, this tariff would also add some £2,000 on to the average cost of UK-built battery electric cars (BEV) exported to the EU, making our own products less competitive and the UK far less attractive as a manufacturing investment destination.3 This would further hamper the UK’s ambition to be a global leader in zero emission vehicle development, production and deployment, severely damaging industrial competitiveness.

The UK and EU automotive industries are deeply integrated, with around two thirds of all battery electric cars on sale in the UK built in European factories.4 New tariffs would hold back the evolution of the electric car from a niche technology to one with mass affordability. UK car buyers are currently on track to register some 78,000 BEVs this year, with further growth expected in 2021. However, SMMT estimates that the price shock caused by these tariff increases could reduce the increased demand for BEVs next year by at least 20%, even before the impact of potential, border delays, supply chain disruption and currency fluctuations are taken into account, hindering efforts to accelerate uptake and decarbonisation.5

Mike Hawes, SMMT Chief Executive, said,

Just as the automotive industry is accelerating the introduction of the latest electrified vehicles, it faces the double whammy of a coronavirus second wave and the possibility of leaving the EU without a deal. As these figures show, ‘no deal’ tariffs will put the brakes on the UK’s green recovery, hampering progress towards net zero and threatening the future of the UK industry.

To secure a truly sustainable future, we need our government to underpin industry’s investment in electric vehicle technology by pursuing an ambitious trade deal that is free from tariffs, recognises the importance of batteries in future vehicle production and ensures consumers have choice in accessing the latest zero emission models. We urge all parties to re-engage in talks and reach agreement without delay.

As the UK government prepares to announce its timeline for transition to a fully zero emission new car market, the situation throws into even sharper focus the need for a world-beating package of fiscal measures, alongside massive investment in charging infrastructure. The UK lags behind many of Europe’s major electric vehicle markets when it comes to market incentives. Car buyers in Germany, for example, enjoy a purchase incentive of up to £8,160 per battery electric vehicle whilst French consumers can obtain a £6,350 grant. UK EV customers get just £3,000.6

To deliver the ambitious environmental goals – to which electric vehicles will make a significant contribution – there must be a long-term commitment to competitive incentives, including full VAT exemption for all zero emission capable cars. This would potentially drive some 1.4 million BEV sales over the next five years, with an estimated 16% market share by 2025 compared with around 5% today.7

The sector’s latest annual sustainability performance report shows how manufacturers continue to make huge strides in reducing their environmental impact, introducing new, more efficient models to help fleet renewal. Furthermore, over the past two decades the sector has reduced its annual carbon footprint by more than 1.3 million tonnes, saving 1.2 billion litres of water a year and cutting waste to landfill by -97.4%.8

The new car market supports thousands of jobs nationwide, with the wider automotive sector employing some 864,000 people often in highly skilled, well paid roles with annual salaries in automotive manufacturing typically 21% higher than the UK average. All told, the sector contributes £15.3 billion annually to the public purse underlining its importance to the UK economy.9

Notes to editors

1 SMMT calculations based on the application of a 10% standard tariff on cars exported to and imported from the EU

2 SMMT calculation based on JATO average retail price data for 2020 H1 excluding any government incentives

3 SMMT calculations using September 2020 retail prices for UK made BEVs

4 SMMT calculations using data January – September 2020

5 SMMT calculations using SMMT July New Car Forecast fall of -7.7% from the current forecast of 131,000, BEVs registered in 2021 https://www.smmt.co.uk/wp-content/uploads/sites/2/WEBSUM-SMMT-CARLCV-MARKET-OUTLOOK-Q3-27072020.pdf

6 SMMT analysis based on ACEA data https://www.acea.be/uploads/publications/Electric_vehicles-Tax_benefits_purchase_incentives_European_Union_2020.pdf

7 Modelling and analysis by SMMT, June 2020

8 2020 UK Automotive Sustainability Report 21st edition – 2019 data – https://www.smmt.co.uk/reports/sustainability/

9 Figures all 2019 except wages based on 2018 data