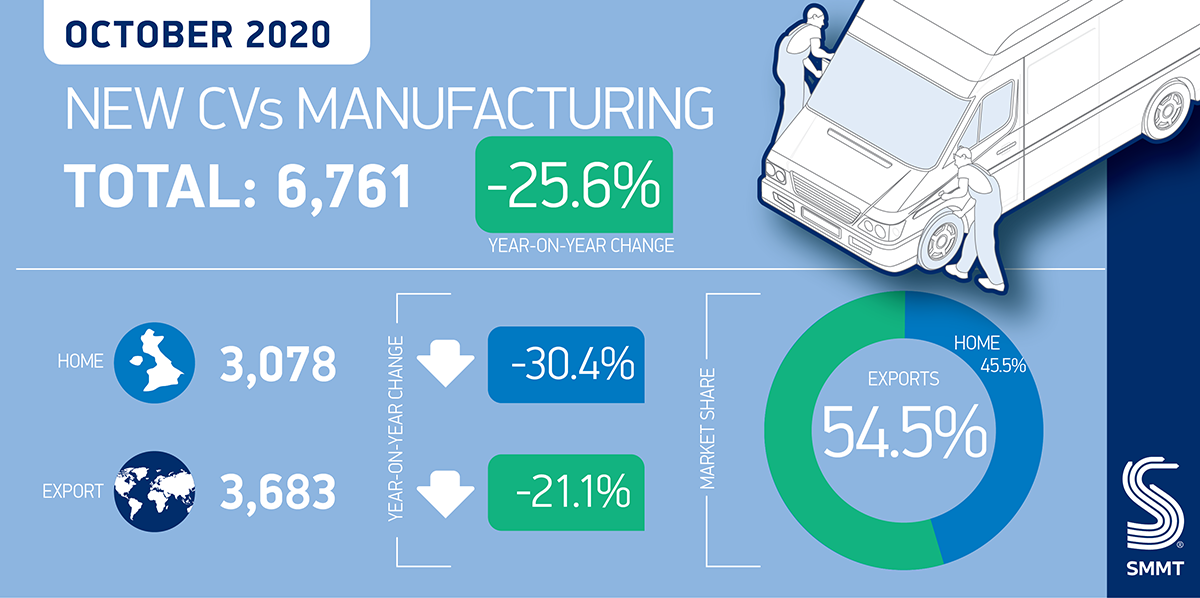

- UK commercial vehicle production falls by -25.6% as 6,761 units leave factory gates in October.

- Production both for overseas and domestic markets in double digit decline as dual impact of Covid-19 and risk of ‘no deal’ Brexit bring down operator confidence.

- Shortfall of 11,256 commercial vehicles in first 10 months pulls year-to-date performance down -18.1%.

UK commercial vehicle (CV) production decreased by -25.6% in October, with 6,761 units manufactured, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). Output for both overseas and domestic markets declined, by -21.1% and -30.4% respectively, as worries over recovery post-pandemic were compounded by the looming threat of a ‘no deal’ Brexit.

Factories turned out 2,326 fewer buses, coaches, vans, trucks and taxis than in the same month in 2019, as output for the domestic market fell for the first time since May, in spite of the wider CV and logistics sectors working double-time to keep the country moving throughout the pandemic. The number of units manufactured for export also decreased -21.1%, making up 54.5% of total production in the month.

Performance in the year to date remains down, falling by -18.1% overall, with a shortfall of 11,256 units in the first 10 months of the year. All told, just over 50,000 new commercial vehicles have been made in Britain this year.

Meanwhile October saw only 76 buses built in Britain, down -34.5%. The impact of social distancing continued to affect operator confidence, with bus production now down -52.9% in the year to date. This week’s government pledge to deliver the first 800 new zero emission buses by the end of this financial year, as part of the Prime Minister’s commitment in early 2020 to fund 4,000 of these vehicles, should offer some relief for the struggling bus manufacturing sector.

Mike Hawes, SMMT Chief Executive, said,

These figures demonstrate the immense pressure the commercial vehicle sector is under in these unprecedented times. During the pandemic the industry has stepped up, flexing to meet demand while, as always, putting safety first. CV output is decreasing, however, and orders at home and overseas are down as operators delay fleet renewal due to Covid pressures, exacerbated, in the UK at least, by Brexit uncertainty. Mass fleet electrification and economic recovery will only come if we can ensure the long-term competitiveness of UK Automotive. This starts with a favourable Brexit deal, with zero tariffs and rules of origin that encompass not just existing products but the next generation of zero emission capable technologies.

The news comes as the sector awaits the outcome of prolonged Brexit trade deal negotiations, with only 35 days left to agree a deal that minimises damage for UK Automotive.