Government policy, consumer consciousness and pandemic-induced circumstances have combined to make 2020 a tipping point for Germany’s electric vehicles (EV) market. This is according to a new Horváth & Partners report.

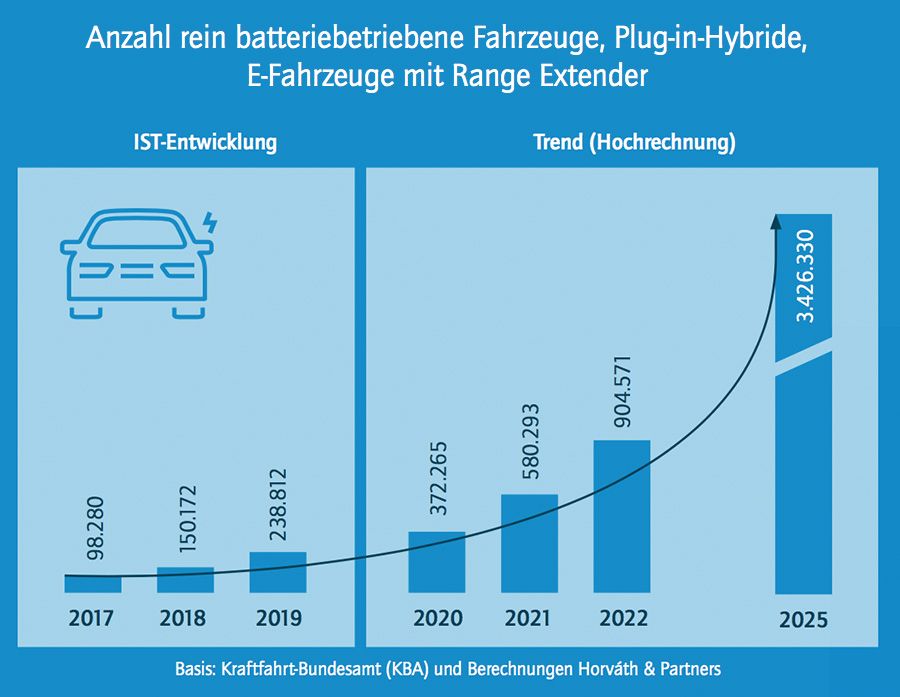

The numbers suggest a market on the charge. By the end of 2020, Horváth & Partners expects more than 370,000 EVs to be on German roads – a staggering jump of nearly 60% since last year. As of September, EVs accounted for a record 50% of new registrations in the German car market.

“2020 will be a key year for electromobility in Germany. The spread of e-cars is now finally happening with the necessary dynamism, driven among other things by the Corona crisis,” noted Partner & Head of Studies at Horváth & Partners Oliver Greiner. No doubt, the EV paradigm was already a growing reality in Germany and across Europe before this year.

That being said, Covid-19 has had a particularly catalyzing effect, with widespread infection risks putting public transport largely out of contention for many. Environmentally conscious consumers who would previously opt for low-emission public transport are having to take the private vehicle route as a result, and are naturally opting for EVs.

Fuelling this trend, the German government’s economic stimulus package introduced earlier this year includes an environmental bonus – up to 9,000 euros – for consumers who choose EVs. Previously, costs were among the biggest barriers to EV consumption in the country, pushing all too many buyers towards the more cost-effective internal combustion engines.

For Greiner, the new bonus is “an important contribution to further reducing the average price premium for an electric car compared to a combustion engine.” In September, more than 27,000 buyers applied for the environmental bonus – a solid indicator of the policy’s success.

In the backdrop, the European Union’s (EU) CO2 fleet limits on passenger vehicles have taken effect this year – restricting emissions to 95 grams per kilometer. Cars currently contribute more than 10% of the total CO2 emissions across the EU, and the new limit aims to curb this unsustainable trend.

Combined, all these factors are pushing German consumers towards EVs. Promisingly, the report presents this as more than just a temporary blip induced by the Covid-19 crisis. Indeed, EV numbers in Germany are expected to go from strength to strength over the next half a decade or so.

By the end of next year, nearly 600,000 EVs will be driving on German roads – a figure that will jump past the 900,000 mark by 2022 and make a remarkable leap to nearly 3.5 million by 2025. Such is the pace of EV growth in Germany that the country has overtaken other key markets such as Japan and Norway when it comes to new registrations.

Currently, Germany places third globally in the new registration rankings, behind only China and the United States. Since 2017, new EV registrations have doubled in the country, signaling tremendous momentum in tandem with broader EV growth on the continent. Yet, the Horváth & Partners researchers point out the long road that remains ahead for EV adoption.

Long road ahead

While 370,000 is an impressive number, it pales in comparison to the total number of vehicles on German roads – 45 million. Even with tremendous growth in the future, EVs will amount to only 2% of all vehicles by 2022, and a maximum of 20% by 2030 if current rates of growth persist.

As mentioned, costs are one central barrier to further EV penetration. According the report, charging infrastructure is another equally crucial enabler of growth. For now, there is not enough infrastructure to make medium or long distance EV travel hassle-free for drivers. On the plus side, two key developments are underway that will help this along.

One, charging points are proliferating at unprecedented rates. Between 2018 and 2019, the number of public and semi-public charging points in Germany grew by nearly 50% to reach 24,000 – topping off a previous jump of almost 50% between 2017 and 2018. The estimate for the end of 2020 is nearly 36,000 charging points, followed by a staggering jump to more than 250,000 by 2025.

At those levels, charging infrastructure will be more than sufficient to enable a thriving EV market. Also in the plus column is the rapid growth of EV range. In 2018, an average EV could run less than 270 kms without charging. By 2019, this had jumped to 325 kms. “Reaches beyond the tight urban environment are still an important factor for customers,” noted Greiner.

With higher range and more charging points, many consumers will feel more confident choosing an EV. The monetary incentives will help this process along, as will the high infection risks on public transport. As summed up by Greiner, “The question of range takes a back seat when the electric car is to be used in everyday life instead of public transport.”