- Demand for new buses and coaches drops -32.0% in 2020, with 3,996 vehicles joining UK roads.

- Single-deck registrations, down -58.7% to 755 units, drive overall decline.

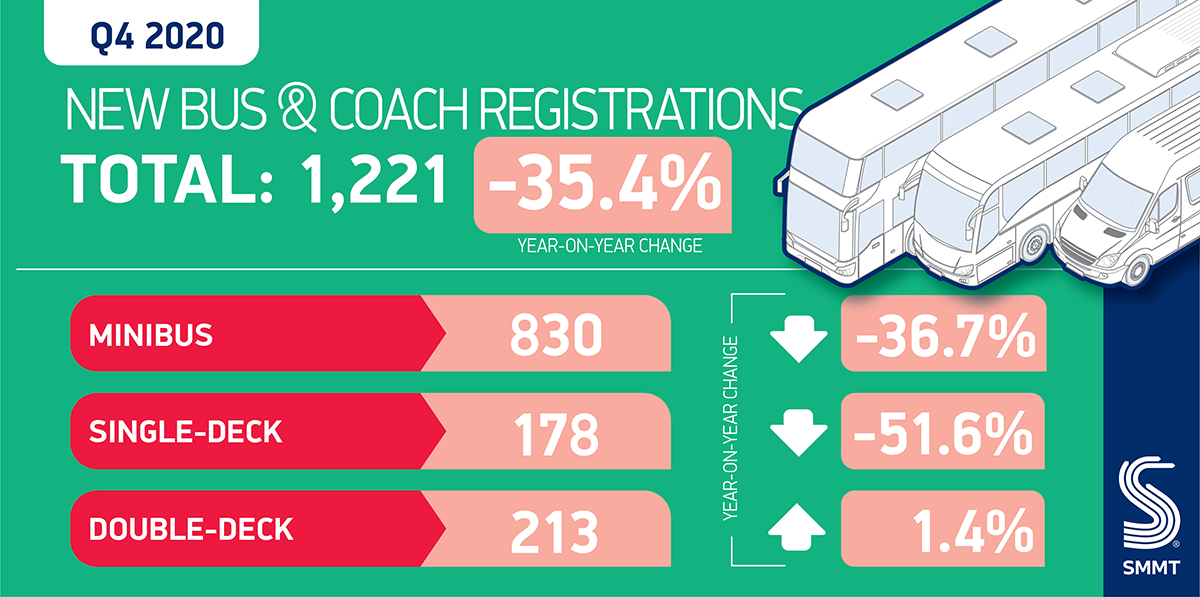

- Year started with growth in Q1 but ends with Q4 down -35.4% to 1,221 units as pandemic hits market.

- Sector calls for promised funding and bus strategy to be released urgently to support jobs, livelihoods and green ambition.

The UK new bus and coach market fell by -32.0% in 2020, with registrations falling to 3,996 vehicles, the worst total since records began, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). Quarter 4, down -35.4% to 1,221 registrations, rounded off what had started as a promising year for the sector, with the market having risen 15.8% in the first quarter despite being curtailed midway through March as the pandemic struck the UK.

The impact of coronavirus lockdowns ultimately dealt a hammer blow to demand for new vehicles, with all body styles experiencing double-digit declines. Single-deck vehicle registrations, however, were the worst affected, their number tumbling -58.7% to 755 representing a loss of 1,072 units. Minibus and double-deck registrations fell -15.7% and -33.9% respectively, with the former accounting for more than six in 10 (65.6%) of all new bus and coaches hitting UK roads in 2020.

Measures introduced to stem the tide of coronavirus in the UK affected demand for road passenger transport throughout much of 2020, with bus use outside of London down by an average of -65%1 since restrictions were originally introduced almost a year ago. Operators, however, continued to provide transport for essential workers and passengers throughout the pandemic, with some using their fleets as makeshift ambulances to support hospitals and many now being used as mobile coronavirus vaccination centres.

Mike Hawes, SMMT Chief Executive, said,

The bus and coach sector has been hit extremely hard by the pandemic, with passenger numbers plummeting last year and with it, demand for new vehicles. The sector has demonstrated its adaptability over the past year but, with the start of 2021 looking similarly challenging, it’s now critical that the sector funding and National Bus Strategy promised by government is released. Operators need the confidence to invest in their fleets, fleets which are becoming increasingly electrified to reduce carbon emissions and improve air quality, and which are fundamental to the economy and the need to keep people moving.

Notes to Editors

1 DfT: Transport use by mode: Great Britain, since 1 March 2020 – average bus use at 35% of equivalent week, from 24 March to 31 December