- UK new car registrations ‘grow’ for first time since August – up 11.5% – but remain -36.9% adrift of 10-year March average.

- Showrooms ready for opening next week following Q1 shortfall of 58,032 fewer cars, at a cost of £1.8bn to industry.

- Around 8,300 registrations a day needed for a return to average pre-pandemic levels by the end of the year.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new car market recorded its first ‘growth’ since August 2020, with 29,280 more units registered during March compared to the same month last year, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). However, the month represents the anniversary of the first lockdown in March 2020, when the pandemic brought Britain to a standstill and registrations fell by -44.4%.

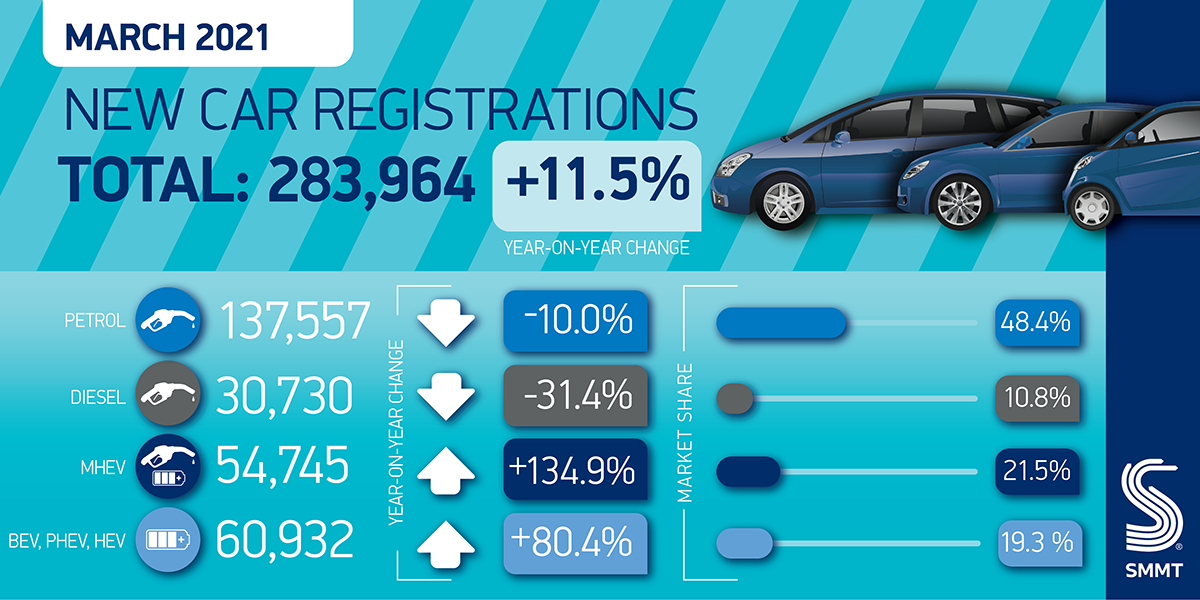

Compared with the 2010-2019 March average of 450,189, registrations were down -36.9%, with 283,964 units registered. So far, 2021 has seen 58,032 fewer cars registered compared to January to March last year, equivalent to a loss of £1.8 billion in turnover during the first quarter.1

For the sector to return to its pre-pandemic levels, around 8,300 new cars will need to be registered every single trading day for the rest of the year.2 By comparison, the industry has averaged around 7,400 a day during the past decade and current levels are closer to 5,600 a day.

Click and collect provided a lifeline for the sector – made possible by manufacturers and their networks successfully investing in digital channels. Click and collect does not, however, offer the consumer the same experience and excitement as a showroom environment. With dealerships reopening their doors next week, customers can look forward to choosing and configuring a new car, safely, in person from the wide choice available, as dealers attempt to recover some of the £22.2 billion lost in turnover since March 2020.

While overall registrations were slightly up compared to last year, growth came almost entirely from fleets, which saw a 28.7% increase in registrations. Retail consumer demand remained depressed, falling by -4.1% compared to March 2020 as showrooms remained closed for the duration of the month.

The shift to new technologies is continuing, however, with plug-in vehicle demand reaching its highest ever volume. Battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) took a combined market share of 13.9%, up from 7.3% last year as the number of models available to customers increased from 72 to 116. Registrations of BEVs increased by 88.2% to 22,003 units, while PHEVs rose by 152.2% to 17,330. Hybrid Electric Vehicles (HEVs) also rose 42.0% to reach 21,599 registrations.

Mike Hawes, SMMT Chief Executive, said:

The past year has been the toughest in modern history and the automotive sector has, like many others, been hit hard. However, with showrooms opening in less than a week, there is optimism that consumer confidence – and hence the market – will return. We know we will see record breaking growth next month given April 2020 was a washout, but a strong, sustainable market is possible if customers respond to the choice and competitive offers the industry provides within the safest of showroom environments.

New plug-in models are already helping drive a recovery but to convince more retail consumers to make the switch, they must be assured these new technologies will be convenient for their driving needs and that means, above all, that the charging infrastructure is there where they need it, and when they need it.

Notes to editors

1 Based on the JATO estimated average new car price of £30,729

2 Based on approx. 1.9m further registrations across remaining trading days in 2021