- March UK car output grows 46.6% against Covid hit 2020 when pandemic forced factories to close.

- Monthly performance down -22.8% on five-year March average and Q1 down -4.0% year-on-year.

- Companies continue to wrestle with global supply chain issues, impact of new EU trading arrangements and Covid recovery at home and abroad.

- New SMMT member survey reveals nine-in-ten companies expending additional resource managing UK/EU trade requirements with six-in-ten large firms expecting Covid recovery to take at least six months.

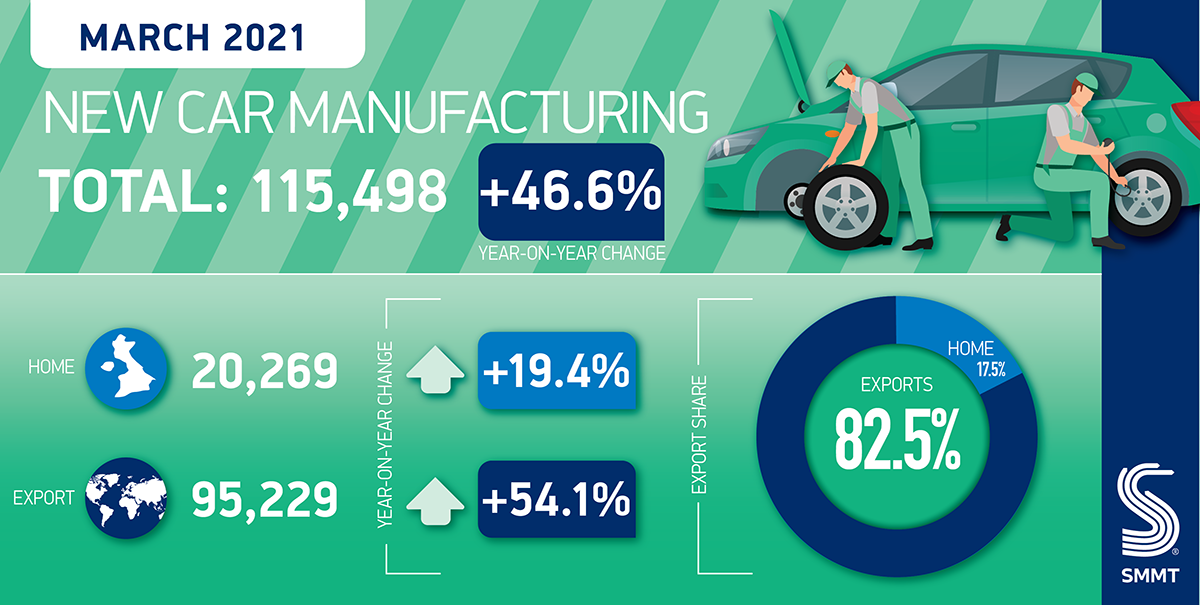

UK car production rose 46.6% in March, the first increase after 18 months of decline, with 115,498 cars manufactured, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT).1 The performance marks one year since the coronavirus crisis caused all UK automotive plants to be shuttered in mid-March 2020, after only 78,767 cars had left factory gates that month.

Compared with the five-year March average, production was down -22.8%, equivalent to a loss of 34,047 units, and some -32.1% lower than the 2017 record for the month.2 It rounds off a -4.0% decline in the first quarter of 2021 with 306,558 units produced, 12,694 less than a year before.

March output for the domestic market rose 19.4% to 20,269 units with exports also increasing, up 54.1% to 95,229 units. More than eight-in-ten (82.5%) cars were sent overseas in March, with shipments to major destinations rising dramatically compared with 2020 when many markets were already shut before the UK itself entered lockdown.

Exports to the EU, US and Asia were all up in March, by 33.5%, 36.4% and 54.1% respectively. The EU remained by far the number one market for UK made cars, with more than half (51.9%) of all exported cars heading across the channel. Meanwhile, combined output of battery electric (BEV), plug-in hybrid (PHEV) and hybrid vehicles (HEV) amounted to a 21.5% share of all cars produced, up from 13.7% a year before, meaning one-in-five-cars produced in the UK is now alternatively fuelled.

Mike Hawes, SMMT Chief Executive, said,

The first rise for UK car production since summer 2019 is a major step in the right direction but belies the underlying situation. With factories shut for much of March 2020, output was always going to be up but it remains below average, with some £11bn worth of production lost over the past year. Whilst the Covid situation is improving in the UK and in some major export markets, manufacturers are still struggling to manage residual issues, most notably the global semiconductor shortage.

The shift towards electrified vehicle production is fundamental to the future of this vital sector. Securing investment for this transformation will depend on the global competitiveness of our industry. Companies are already having to absorb additional costs arising from our new trading arrangements with the EU, but must also invest in new technologies, new processes and upskilling the workforce. A competitive business environment that helps reduce operating costs and policies that support manufacturing will be essential if the transition to zero is to be Made in the UK.

The news comes as SMMT releases details of its latest member survey gauging the impact of both the pandemic and the new trading relationships arising from the UK’s withdrawal from the EU.3 Automotive businesses are working incredibly hard to maintain output, with some nine-in-ten (91%) firms spending more time and resource managing UK/EU trade than in 2020 and more than a third (36%) already devoting more resource to rest of the world trade. UK automotive is export-led, so maintaining free and fair trade with all nations is crucial to our future prosperity.

These challenges come at the same time as the sector navigates a path out of the coronavirus pandemic, with six-in-ten (60%) large firms expecting Covid recovery to take at least six months, and a third of these at least two years. Instigating a successful recovery of UK automotive manufacturing will be critical to sustaining the 864,000 jobs that keep the broader industry going, jobs that are highly skilled and based in every region of the UK.

The turnaround is projected to begin in 2021 as, the sector is forecast to produce more than one million units this year, some 130,000 additional cars than in 2020 when the pandemic saw production fall to its lowest level since 1984.4

Notes to editors

1: August 2019 UK car production rose 3.3% to 92,158 units.

2: Five-year average calculated over 2015-2019. March 2017 170,056 cars made.

3: SMMT member survey carried out in March 2021 – responses from 107 companies across the sector representing £29.9bn turnover.

4: 920,928 units.