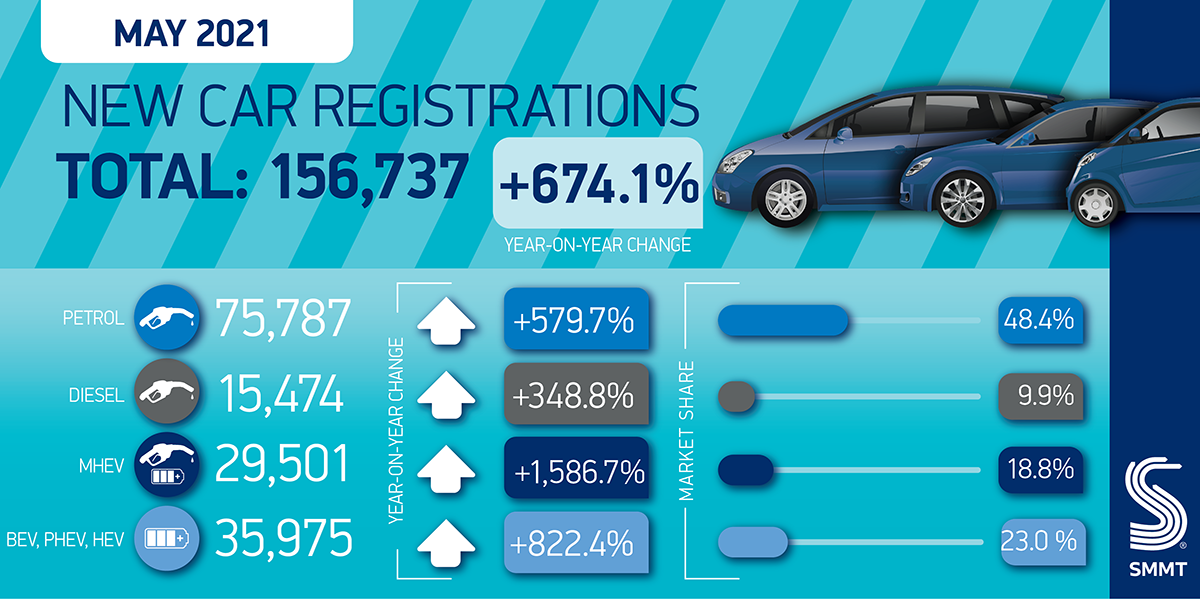

- 156,737 new cars registered in May – significantly up from last year when retailer doors were shut during the pandemic.

- Plug-in vehicle market continues to rise, accounting for 13.8% of registrations in 2021 so far

- Despite more positive economic outlook, total registrations over the year to date remain down –29.1% on 10-year average.1

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

With the year’s first full month of showroom openings, new car registrations in May reached 156,737 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The total represents an almost eightfold increase on the same month last year, but is down -14.7% on pre-pandemic May 2019, and -13.2% on the 10-year May average.2

Uptake was in line with the most recent industry outlook, published in April, which sees the sector anticipating around 1.86 million registrations by the end of the year – with 723,845 achieved so far.

Against a more positive economic backdrop – including OECD forecasting a 7.2% increase in UK GDP during 2021 – fleet registrations grew more than twice as fast as private purchases in May.3 Large fleets accounted for 50.7% of all new vehicles hitting the road, demonstrating improving business confidence compared to the same month last year.

In terms of segments, dual purpose vehicles saw a small decline in market share in the month, down to 26.7%, leapfrogged by lower medium cars which rose to 27.8%. Superminis remained Britain’s most popular car choice, with a 31.1% share.

Battery electric vehicle (BEV) market share declined from 12.0% a year ago to 8.4% in the past month, although the May 2020 performance was distorted by lockdowns when new cars could only be purchased through click and collect or delivery, giving rise to variable purchasing patterns.

Looking more broadly across 2021, plug-in vehicles now comprise 13.8% of new car registrations, up from 7.2% a year earlier, with the most rapid growth seen in plug-in hybrid (PHEV) derivatives. Pure petrol and mild hybrid petrol cars so far account for 60.4% of registrations, while pure diesel and mild hybrid diesels took a 18.0% share year to date, compared to 64.6% and 22.4% last year.

Meanwhile, total registrations for 2021 sit at 296,448 fewer units, or -29.1% less, than the average recorded across January to May during the last decade, evidence of the scale of the recovery still needed given the impact of Covid on the market.

Mike Hawes, SMMT Chief Executive, said:

With dealerships back open and a brighter, sunnier, economic outlook, May’s registrations are as good as could reasonably be expected. Increased business confidence is driving the recovery, something that needs to be maintained and translated in private consumer demand as the economy emerges from pandemic support measures. Demand for electrified vehicles is helping encourage people into showrooms, but for these technologies to surpass their fossil-fuelled equivalents, a long term strategy for market transition and infrastructure investment is required.

Notes to editors

1 Average Jan-May 2010-2019 registrations: 1,020,293

2 May 2019 registrations: 183,724; Average May 2010-2019 registrations: 180,489

3 OECD Economic Forecast summary, May 2021 (https://www.oecd.org/economy/united-kingdom-economic-snapshot/)