Grab has released its 2021 Food Delivery Industry Overview report in partnership with Euromonitor International. The report was based on research completed in Q2 2021 and seeks to provide an in-depth view into the food delivery industry over the next five years, including Southeast Asian consumers’ appetite for food delivery services post-COVID-19.

- Food delivery transactions to reach US$28B in 2025, with fastest growth coming from emerging markets

- Strong preference for convenience and positive macroeconomic trends expected to spur food and grocery delivery growth

- GrabFood is the top of mind brand among surveyed consumers [1] and the category leader by GMV in Southeast Asia [2]

SINGAPORE, 3 September 2021 – Southeast Asia’s online food delivery spend is expected to grow more than two times faster than the total foodservice spend in the region over the next five years at a compound annual growth rate (CAGR) of 24.4% versus 12.1%. Growth is expected to be fastest in emerging markets such as Myanmar, Vietnam and the Philippines, with the total regional online food delivery Gross Merchandise Value (GMV) to more than triple from US$9 billion in 2020 to US$28 billion in 2025.

Grab, the leading online food delivery player in Southeast Asia, released its 2021 Food Delivery Industry Overview report in partnership with Euromonitor International today. The report was based on research completed in Q2 2021 and seeks to provide an in-depth view into the food delivery industry over the next five years, including Southeast Asian consumers’ appetite for food delivery services post-COVID-19.

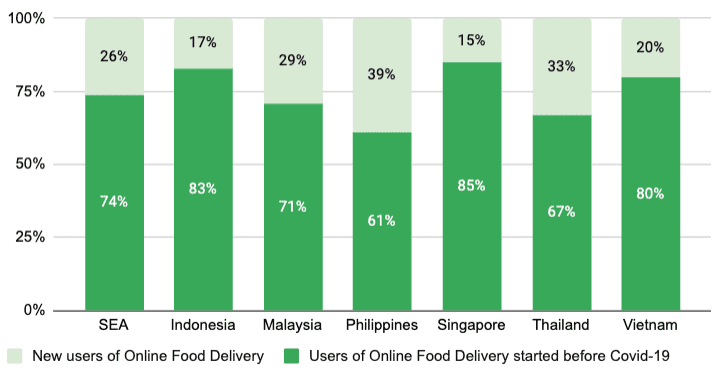

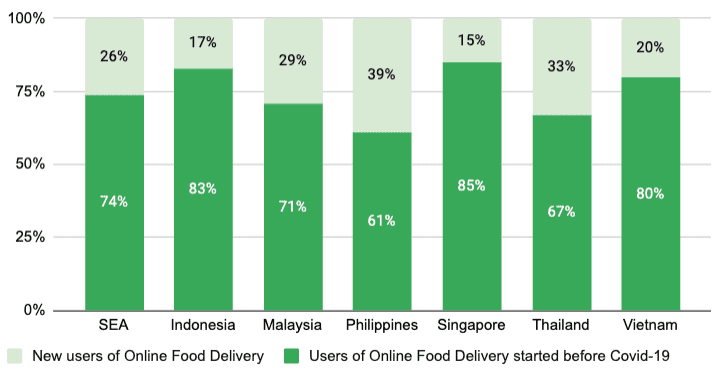

The report revealed that about one in four (26%) surveyed consumers in the region were new users of online food delivery services during the pandemic. The main motivations for trying the service were to avoid dining out and to minimise contact with others, to order food for family and friends, and to enjoy exclusive promotions only available for online delivery.

Chart 1: Percentage of new online food delivery users in Southeast Asia

Source: Euromonitor International Survey 2021, Base: All respondents, N=1800

Note 1: Southeast Asia refers to Indonesia, Malaysia, Singapore, Thailand, the Philippines, Vietnam only

Note 2: New user is defined as consumers who started using online food delivery services during COVID-19 period (in 2020 or 2021)

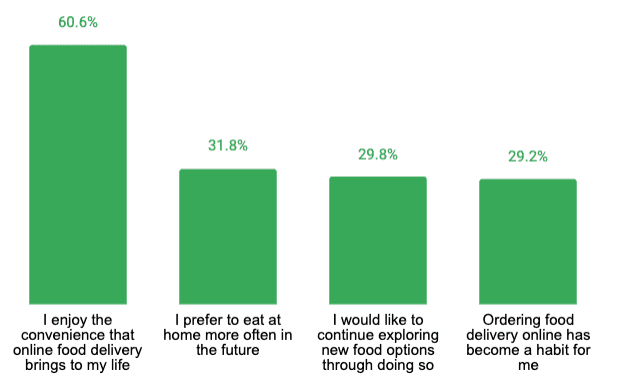

While the COVID-19 pandemic has accelerated food delivery adoption in Southeast Asia, a rising appreciation for food delivery services will contribute to its sustained growth. Between October 2020 and March 2021, 78% of consumers in the region used the service once a week or more. Close to 9 in 10 consumers (87%) expect their usage to remain the same or increase even as COVID-19 restrictions ease. The convenience of food delivery was the number one reason for continued and increased usage post-pandemic.

Chart 2: Top reasons for using online food delivery services as frequently or more frequently in Southeast Asia

Source: Euromonitor International Survey 2021. Base: Respondents who are likely to be using online food delivery services at least the same way as they do currently, N=1,567

Note: Southeast Asia refers to Indonesia, Malaysia, Singapore, Thailand, the Philippines, Vietnam only

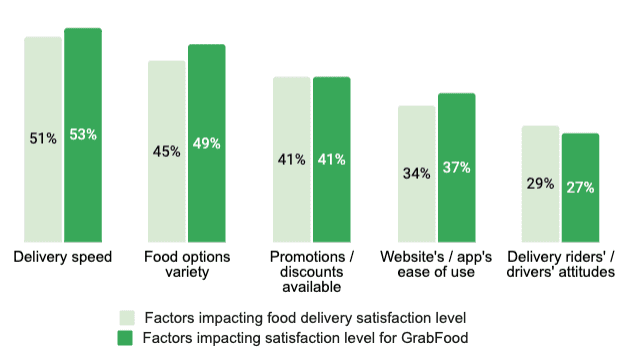

Food delivery users value speed and variety above promotions

Consumers in Southeast Asia value service quality and experience above promotions, suggesting a shift in consumer expectations on food delivery services. The survey found that the top factors impacting satisfaction level for food delivery services are speed of delivery (51%), food options variety (45%), and promotions availability (41%).

When measured against these factors, GrabFood outperformed in delivery speed and variety of food options. GrabFood was voted the top-of-mind brand across six Southeast Asian countries [3]. In 2020, GrabFood recorded a regional online food delivery category share of about 50%.

Chart 3: Top factors impacting satisfaction level for most used food delivery app / website in Southeast Asia

Source: Euromonitor International Survey, 2021. Base for ‘factors impacting food delivery satisfaction level’: All respondents who have used online food delivery services in the past 6 months, N=1,800; Base for ‘factors impacting satisfaction level for GrabFood’: Respondents selected GrabFood as most frequently used website/app, N=646

Note: Southeast Asia includes Singapore, Malaysia, Indonesia, Thailand, the Philippines, Vietnam only

Strong growth potential through 2025

By 2025, the region’s overall prepared meal sales is projected to reach US$170.5 billion, with online food delivery penetration increasing to 16.4%. This will be driven in part by a rising middle class and increasing smartphone adoption in Tier 2 cities.

Commenting on this trend, Russell Cohen, Group Managing Director for Operations at Grab said: “The majority of online food delivery transactions today are from the largest Southeast Asian cities. With infrastructure and connectivity improvements, we believe that the next wave of growth will come from smaller cities. Our leading position across mobility, food delivery and digital wallet payments gives Grab an edge to capture the immense opportunity ahead of us. We will continue to invest in tech to bring down the overall cost of delivery and cost to serve consumers, so as to make on-demand delivery more affordable and accessible to more people.”

In Grab’s recent earnings announcement, the company reported that GrabMart’s GMV for Q1 2021 increased by 21% quarter on quarter compared to Q4 2020, and was 36x higher compared to Q1 2020.

“The pandemic has accelerated the shift in consumer behaviour towards buying food and groceries online. However, online grocery delivery penetration is extremely low in the region, at just over 1% here compared to 8% in China and 9% in the US. Our strategy for GrabMart is to serve the mass market, and this has been a key differentiator for us. Through different delivery models, we are able to offer grocery delivery services at different price points to meet different price expectations in Southeast Asia,” added Cohen.

Footnotes

[1] Euromonitor International Survey 2021, Base: All respondents, N=1800

[2] Includes Singapore, Malaysia, Indonesia, Thailand, the Philippines, Vietnam only

[3] Euromonitor International Survey 2021, Base: All respondents, N=1800; Six Southeast Asian countries include Singapore, Malaysia, Indonesia, Thailand, the Philippines, Vietnam only