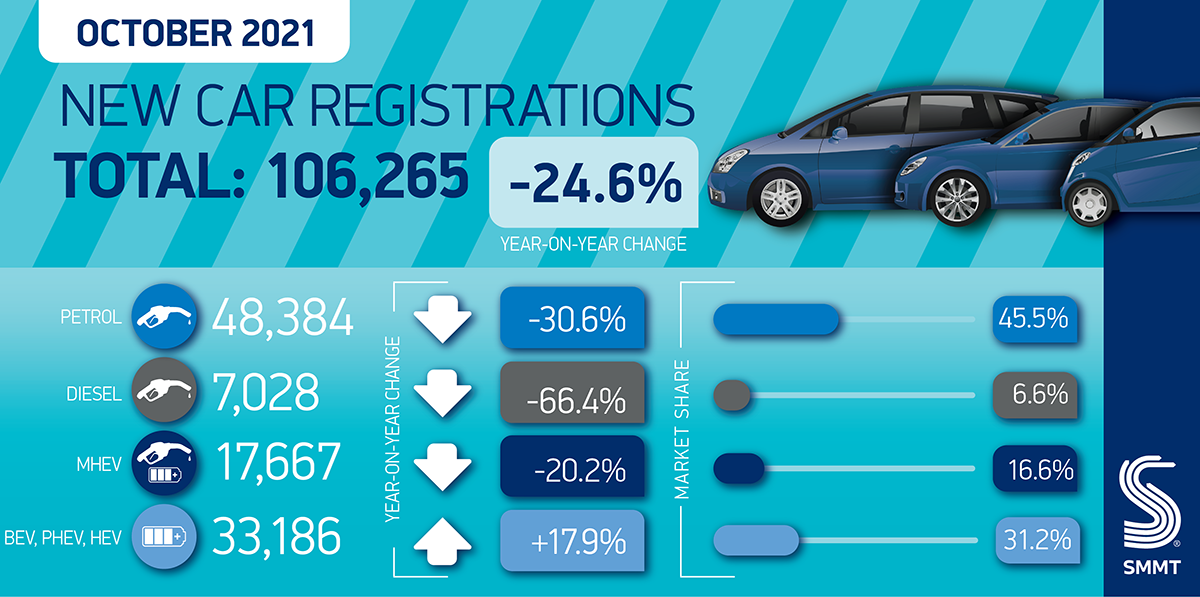

- 106,265 new cars registered in October, a -24.6% fall on last year and the weakest October since 1991.

- Plug-in vehicles now account for 16.6% of all cars registered so far in 2021.

- Chip shortages and tax rises mean industry expects to finish year on 1.66m units, or only 1.9% ahead of Covid-hit 2020.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

New car registrations have fallen for the fourth consecutive month, with a decline of -24.6% to 106,265 units compared to October last year, according to new figures released today from the Society of Motor Manufacturers and Traders (SMMT).

Plug-in vehicle uptake remained positive in the month before COP26, with battery electric vehicles (BEVs) equalling their September market share of 15.2% with 16,155 units, while plug-in hybrid vehicles (PHEVs) grew to 7.9% or 8,382 units.

Plug-in vehicles now account for 16.6% of all new car registrations in 2021, which, when joined by a further 9.1% from hybrid electric vehicles means that 25.7%, or more than a quarter of the new car market, has been electrified year-to-date.

In fact, plug-in vehicle uptake rates have accelerated so rapidly that SMMT forecasts that more will join Britain’s roads in 2021 than during the whole of 2010 to 2019 combined. Businesses and consumers are expected to take up around 287,000 of the latest zero-emission capable cars by the end of the year.

Despite this strong performance in electrified vehicle registrations, the overall market’s monthly performance was the weakest seen since October 1991.1 Demand from large fleets fell by a substantial -40.4%, driving most of the decline. Private demand fell by a more modest -3.3%, although this apparent small decline is compared against weak consumer uptake during the pandemic-affected October 2020.

Falls were recorded in all vehicle classes except the Mini category, although this is typically a low volume segment and so subject to volatility. The most popular categories were lower medium (30.7%), supermini (30.0%) and dual purpose (26.6%). All three saw an increase in year-on-year market share.

Looking ahead, the latest SMMT forecast has been revised downward by -8.8% to 1.66 million units, in light of the on-going supply issues and deteriorating economic outlook. This would see 2021 finish 1.9% or some 30,000 units up on 2020, but some 650,000 units down on 2019’s pre-pandemic 2.3 million performance.

A partial recovery, however, is forecast for 2022, with industry anticipating some 1.96 million new car registrations next year. This will be driven by continued demand for plug-in vehicles, which is expected to continue at pace with new BEVs anticipated to be more popular than new conventional and mild-hybrid diesels by the end of 2022.2 Plug-in cars are also expected to account for more than a fifth (21.5%) of all new car registrations next year.

Mike Hawes, SMMT Chief Executive, said:

The current performance reflects the challenging supply constraints, with the industry battling against semiconductor shortages and increasingly strong economic headwinds as inflation rises, taxes increase and consumer confidence has weakened. Electrified vehicles, however, continue to buck the trend, with almost one in six new cars registered this year capable of zero-emission motoring, growth that is fundamental to the UK’s ability to hit its net zero targets. With next year looking brighter, and even more new models expected, the continuation of this transition will depend on the preservation of incentives that overcome the affordability barrier, and the ability of the public and private sectors to increase public on street charging to allay EV driver concerns.

Notes to editors

1. October 1991 registrations – 101,107

2. 2022 forecast – 260,000 BEVs, 221,000 diesel and MHEV diesel