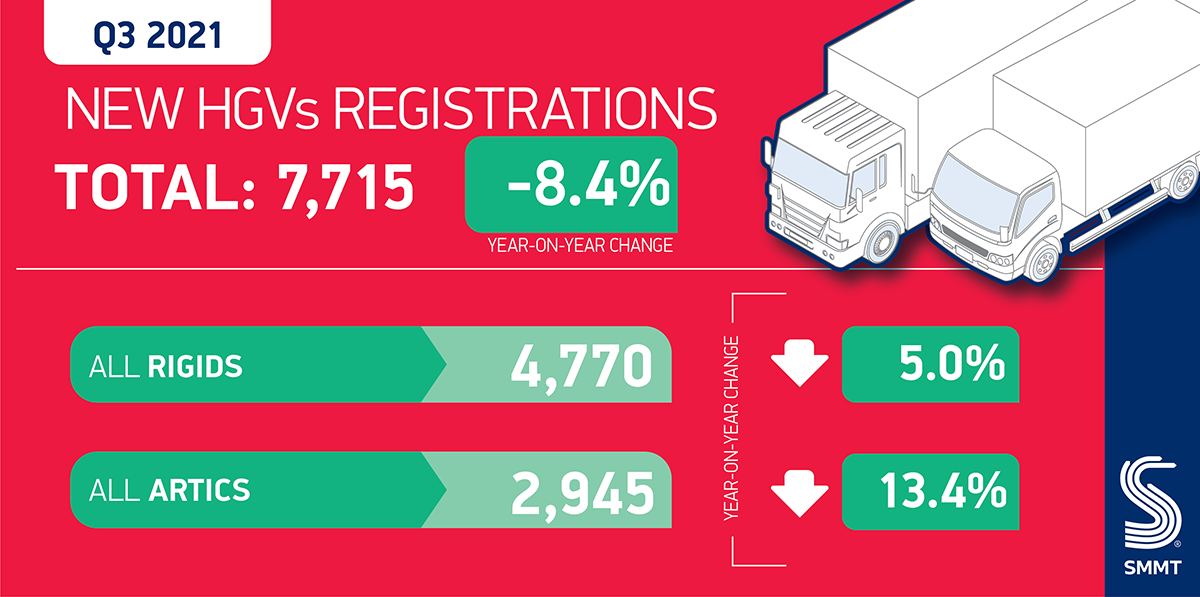

- UK HGV market declines -8.4% in the third quarter, with 7,715 vehicles registered.

- New truck registrations down on subdued Q3 2020 and -9.8% on a particularly weak Q3 pre-pandemic 2019.

- 27,272 trucks registered in the first three quarters of the year, down -24.3% on pre-pandemic 2019.

SEE HGV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

New heavy goods vehicle (HGV) registrations declined by -8.4% in the third quarter of 2021, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). The decrease saw 7,715 trucks registered, some 704 fewer than the Q3 2020 total, which itself was volatile due to the effects of the pandemic. It was also -9.8% on a particularly weak pre-pandemic total in 2019, which saw orders pulled forward into Q2 ahead of the introduction of new smart tachograph regulations.

Despite the decline in Q3, performance for the year to date was still 25.3% higher than the pandemic-impacted 2020, with 27,272 vehicles registered in 2021. However, for context, this still falls short of the 2019 total by -24.3%, or 8,749 trucks.1

As would be expected given the overall performance, most segments saw their volumes decrease in Q3 compared to the same period in 2020, with articulated trucks falling by -13.4% and rigids by a more modest -5.0%. Tractors, which remain the most popular vehicle body type with 37.3% of the market, declined by -11.8%. On more positive note, dropside lorries and tippers segments saw growth, up by 20.4% and 11.0% respectively.

Mike Hawes, SMMT Chief Executive, said,

With operators still struggling with acute driver shortages, and global shortages of semi-conductors restricting production, it is disappointing, yet unsurprising, to see the number of registrations fall in the third quarter. The sector is also facing significant long-term challenges, with government confirming its ambition to end the sale of all non-zero emission HGVs by 2040. Manufacturers are investing billions into the latest, green technologies, but there is no single technological solution that can meet every HGV use case. Indeed, there may be some specific and limited instances in which electrified technologies are not yet feasible, so flexibility for the future is important. Above all else, however, the industry needs dedicated HGV infrastructure, a plan for which we still await.

Notes to Editors

1: 2019 year to date – 36,021