Amsterdam, the Netherlands, 4 February 2022, 7:00 AM CEST

Significant Automotive contract wins power future growth

TOMTOM’S CHIEF EXECUTIVE OFFICER, HAROLD GODDIJN

“We recorded our best Automotive order intake in years, including a partnership with Volkswagen Group to deliver an EV-centric navigation service. The Automotive backlog increased to €1.9 billion. Our Enterprise business improved year on year.

In Automotive, we expect ongoing supply chain constraints during 2022, which will ease in 2023. We expect that our investments during 2022 will result in operational efficiencies. These, combined with revenue growth, are expected to lead to positive free cash flows in 2023 and onwards.

We will give an update on our strategy at our Capital Markets Day in the second half of this year.”

OPERATIONAL SUMMARY

- TomTom and CARIAD will partner to deliver a navigation solution for all Volkswagen Group brands worldwide, excluding China

- We launched TomTom IndiGO and secured an inaugural customer for the world’s first open digital cockpit software platform for carmakers

- Our ADAS Maps with advanced features for automated driving now power over 5 million vehicles sold in Europe and North America, outpacing industry volumes

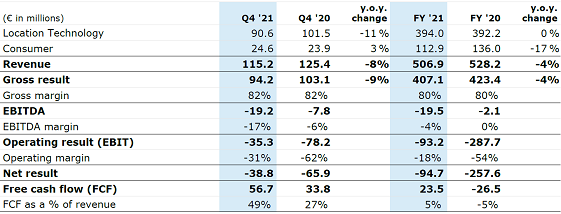

FINANCIAL SUMMARY FOURTH QUARTER 2021

- Group revenue decreased by 8% to €115 million (Q4 ’20: €125 million)

- Location Technology revenue decreased by 11% (Q4 ’20: €101 million)

- Automotive operational revenue decreased by 17% to €71 million (Q4 ’20: €85 million)

- Free cash flow is an inflow of €57 million (Q4 ’20: inflow of €34 million)

FINANCIAL SUMMARY FULL YEAR 2021

- Group revenue of €507 million (FY ’20: €528 million)

- Location Technology revenue increased slightly to €394 million (FY ’20 €392 million)

- Automotive operational revenue decreased by 3% to €266 million (FY ’20: €274 million)

- Free cash flow is an inflow of €24 million (FY ’20: outflow of €26 million)

- Net cash of €356 million (FY ’20: €372 million)

KEY FIGURES

TOMTOM’S CHIEF FINANCIAL OFFICER, TACO TITULAER

“Our Automotive operational revenue was in line with expectations, however, reported revenue was negatively impacted by total contract value adjustments. Consequently, our Location Technology revenue ended just below our guidance for 2021. As the before-mentioned adjustments are non-cash based, full year free cash flow was strong at 5% of group revenue, which is partly explained by faster-than-anticipated cash collection and prudent cost management.

Last year, we were confronted with lower car production volumes resulting from supply chain shortages affecting our Automotive revenue. For this year, 2022, we have assumed that these supply chain shortages will persist throughout the year. Nevertheless, we expect a significant increase in our Automotive operational revenue. The effect on our reported revenue will be partly moderated, as our Automotive products increasingly shift towards a software-as-a-service model.

Therefore, the recognition of corresponding reported revenue is phased over a longer period of time. In the Enterprise business, we renewed various customer contracts. Some of these renewals reflect lower usage, translating into a reduced contract value. This will affect our Enterprise revenue as of the fourth quarter of 2022 and beyond.”

View the full TomTom fourth quarter 2021 results press release on our quarterly results website.