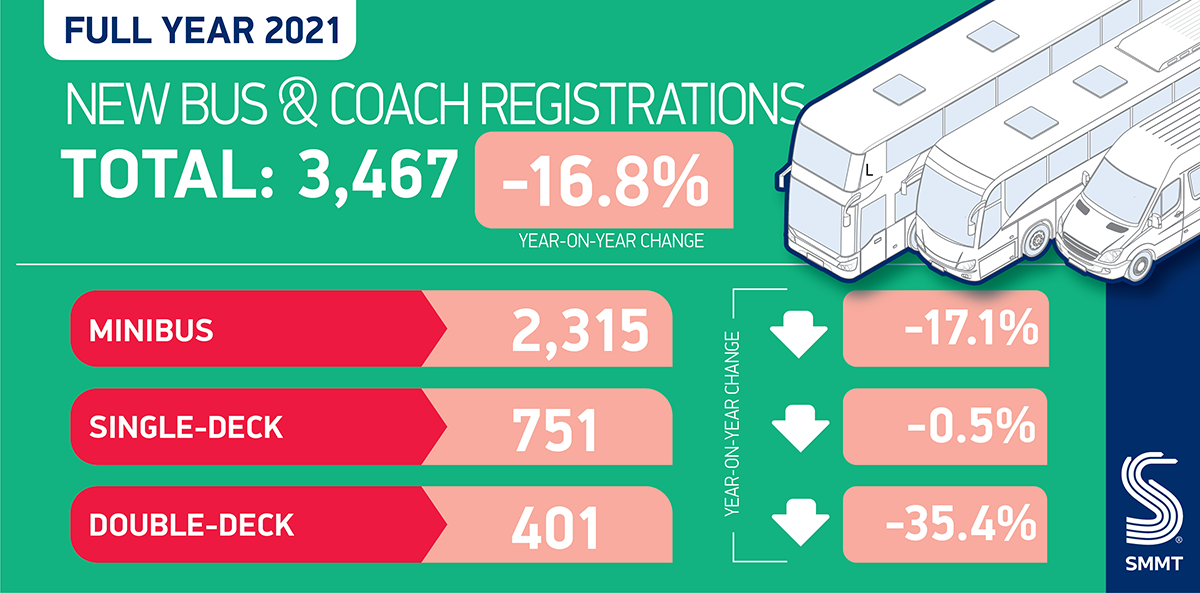

- Demand for new buses and coaches drops -16.8% in 2021, with only 3,467 vehicles joining UK roads.

- Double-deck bus registrations fall -35.4%, driving overall decline.

- Q4 down -31.6% rounding off the weakest year since records began in 1996.

- • Sector looks to government’s Bus Back Better Fund and Levelling Up ambitions to boost ridership and recovery.

SEE BUS & COACH REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new bus and coach market declined by -16.8% in 2021, with registrations falling to just 3,467 vehicles, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). Quarter four, down -31.6% to just 883 registrations, rounded off the worst year since records began1 as ridership levels failed to recover to pre-pandemic levels.

Ongoing Covid restrictions and a subsequent -17.0% decline in ridership levels continued to dent demand for new buses and coaches, with all body types experiencing declines in 2021.2 Single-deck bus registrations fell by -0.5% to 751 units, against a weak 2020 performance.3 Double-deck and Minibus registrations saw much more significant declines of -35.4% and -17.1%, respectively. Minibuses continued to dominate the market, accounting for more than two thirds (66.8%) of all new bus and coaches joining UK roads in 2021.

The long-term effect of the global pandemic on bus ridership, with levels still around a quarter down on 2019, is the biggest reason behind the drop in demand. Operators are facing significant financial constraints and, with the emergency Government funding to support routes during the pandemic scheduled to end in April, the short-term challenges for operators are significant.4 Indeed, the Local Government Association recently suggested that up to a third of existing routes could be cut. Given the sector also faces the challenge of decarbonising its entire fleet as part of the plan to achieve net zero, the need for Government incentives to invest in new, greener vehicles is paramount.

The challenge is a national one, and government recently set out its ambition within it’s Levelling Up White Paper to bridge the gap between the user experience of public transport in London compared with other parts of the UK.5 Achieving this ambition will require significant action – including the release of necessary funds from the Bus Back Better Fund – but could ensure the conditions are right for operators to invest in new vehicles, safeguarding the sector, the jobs, and livelihoods it sustains as well as providing the mobility society needs whilst meeting its green ambitions.

Mike Hawes, SMMT Chief Executive, said,

The pandemic has continued to undermine the bus and coach market, with the latest figures an alarm call. The sector, and the millions of people who depend on it for essential mobility, is at a critical juncture, as Covid-19 has led to declining ridership which, in turn, has damaged demand for new fleet investments. We need the Bus Back Better programme to release funds to support the sector and for that investment to be made urgently. If we are to improve air quality and reduce carbon emissions whilst keeping society and the economy moving, operator confidence and fleet renewal are essential.

Notes to Editors

1. 2021 was the weakest performing year since records began in 1996

2. Ridership declined 17.0% between September 2020 and September 2021 – https://www.gov.uk/government/statistics/transport-use-during-the-coronavirus-covid-19-pandemic#full-publication-update-history

3. Single-deck buses declined -58.7% in 2020

4. Bus Recovery Grant was introduced in 2021 and provided operators and local authorities with £255.5m funding to protect services

5. https://www.gov.uk/government/news/government-unveils-levelling-up-plan-that-will-transform-uk