- New analysis reveals manufacturers have committed £10.8 billion in UK EV and battery R&D and production since 2011.

- More than 150 models of plug-in cars and vans now on sale, while British factories have produced a quarter of a million electric cars, vans, buses and trucks in the last decade.

- In new blueprint for electric transition, industry calls for all stakeholders to match its commitment and ‘plug the gap’ between ambition and delivery, to make Britain a world leader in zero emission mobility.

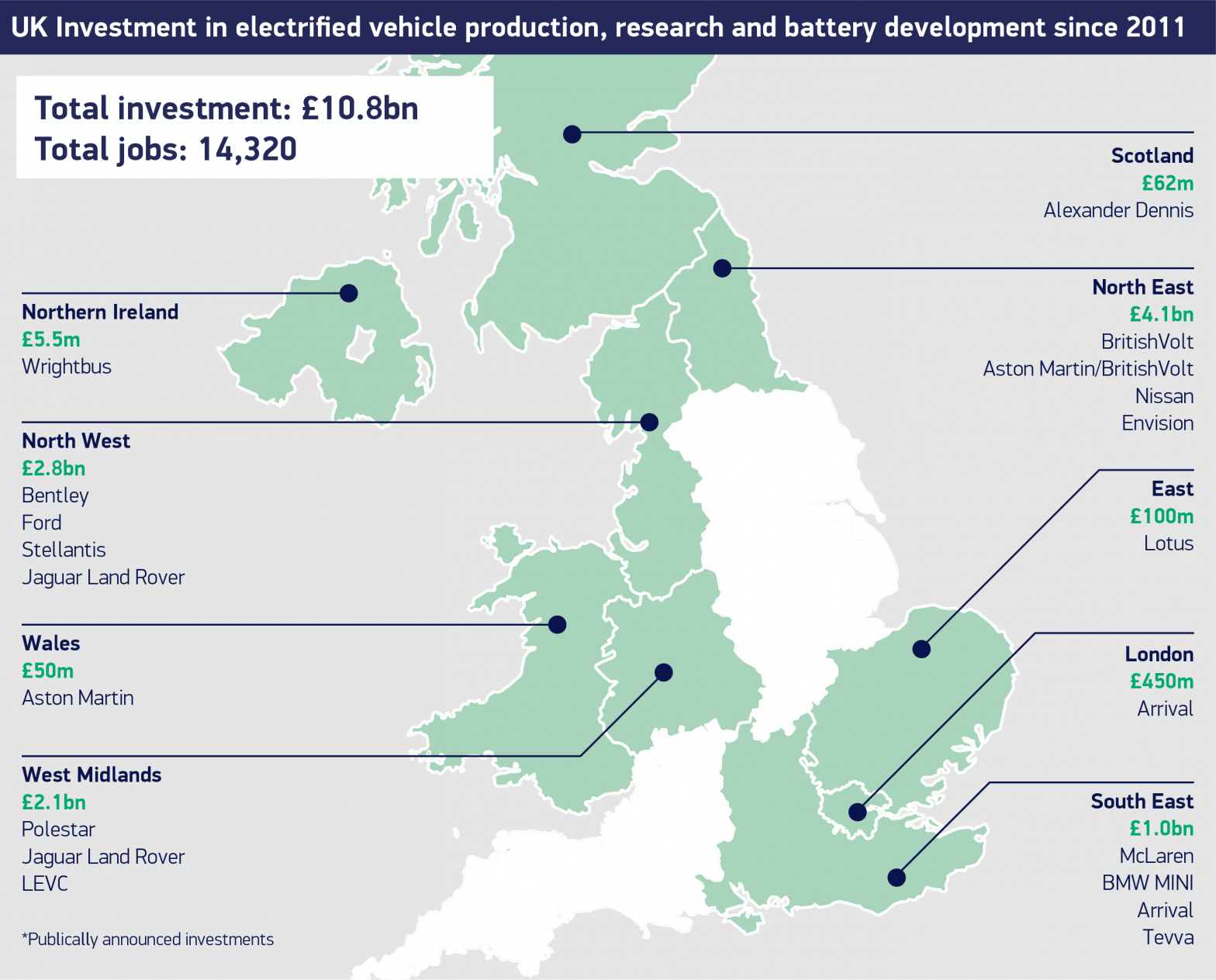

The automotive industry has called for all stakeholders to match its commitment to deliver zero emission mobility, as new analysis by the Society of Motor Manufacturers and Traders (SMMT) reveals some £10.8 billion has been dedicated to UK electric vehicle production and gigafactories since 2011, with billions more invested globally to bring new technology to market.1 Given the figure accounts purely for public announcements by vehicle and battery manufacturers, and does not include wider supply chain investment, the overall UK automotive commitment to electrification will be even higher.

In Britain’s first ‘electric decade’, kicked off by a £420 million investment in Sunderland for the UK’s first mass-produced battery electric car, more than 10 vehicle manufacturers have invested in communities across the country to create jobs and to design, engineer and build the cleanest, greenest vehicles for domestic and export markets. Alongside cars, the UK also produces electric vans, buses and trucks, as established manufacturers and new entrants have invested in production.

The UK electric vehicle market has followed suit, growing rapidly. Ten years ago, six models of electric car were available, accounting for just one in 1,000 new car registrations. There are now more than 140 models on the market, with electric vehicles comprising more than one in six new cars and one in 28 vans registered. Just one in 80 cars on the road, however, runs on electricity, with the UK aiming for one in three by 2030 if net zero ambitions are to be met. The challenges are examined in Plugging the Gap, SMMT’s updated blueprint for delivering the zero-emission transition.

Private motorists accounted for just a third of new plug-in registrations in 2021, with uptake far higher among businesses and fleets, which benefit from generous fiscal incentives.2 Conversely, purchase incentives have been rolled back dramatically over the past year, with the UK’s EV adoption now falling behind some European markets which offer more attractive incentive packages.

Further growth in this market, however, depends as much on charge point provision as affordability. Research by SMMT reveals that the ratio of public standard chargers to electric vehicles has rapidly deteriorated, with just one charger for every 32 plug-ins across the UK compared with one for every 16 just 12 months ago and significant regional variations. The industry is calling on all parties integral to the drive to zero, including chargepoint operators and government, to help ‘plug the gap’ between infrastructure rollout and uptake.

SMMT has advocated a nationally co-ordinated, locally delivered infrastructure plan, with binding targets for chargepoints that match those imposed on vehicle manufacturers. Overseen by a regulator, such a plan would put consumers at the heart of the transition, accelerating chargepoint provision and addressing charging anxiety among drivers and businesses. It would also help the one in three households that do not have off-street parking and would therefore be reliant on public charging, to make the switch.3

Furthermore, a vibrant, well-supported market would help attract greater industrial investment, creating jobs and supporting economic growth. Gigafactory investment is essential if the UK is to achieve the 60GWh capacity it needs by 2030, a capability that would support the production of around one million electric vehicles a year.

This, in turn, would enable the industry to exploit the benefits of the UK’s ambitious trade agenda, maximising locally originating content to achieve tariff-free exports to key growth markets worldwide, and help Britain to realise a zero-emission future with greater resilience and self-sufficiency in battery production and the wider electrified supply chain.

While overall UK gigafactory capacity is currently just 2GWh, the £10.8 billion figure includes major battery production commitments that will come online in the coming years, estimated to take UK capability to around 41GWh by 2027. The EU, meanwhile, is forecast to have a capacity of up to 1.5TWh by 2040, with more than 25 gigafactories either under construction or in development.

For the UK to become a location of choice for potential investors, therefore, government must create the right conditions, with a streamlined process for obtaining the necessary permits and licences, easy access to skilled and productive labour, and competitively priced clean energy.

Mike Hawes, SMMT Chief Executive, said,

The UK automotive industry has set out its intent – to meet the challenge of net zero – and has backed that ambition with cash, investing massively during Britain’s first electric decade. As we enter the second, the stakes are higher, with some of the world’s toughest regulation coming, regulation that will seek to determine the pace of change in a market constantly buffeted by headwinds. But mandates on manufacturers alone will not drive the market. Delivering net zero needs a competitive industry and a competitive market. We need a holistic strategy with binding targets on chargepoint provision, attractive fiscal and purchase incentives, and a reliable, accessible and affordable user experience. We need a universal right to charge electric vehicles, for all drivers, wherever they live, wherever they travel and whatever their needs.

Plugging the Gap is available by clicking here

Notes to editors

1. Based on analysis of publicly announced investments delivered or secured by vehicle manufacturers and battery producers into UK R&D and production since 2011

2. Private BEV and PHEV registrations 2021: 102,913; Business and Fleet BEV and PHEV registrations 2021: 202,317

3. English Housing Survey 2019: 32.5% of households did not have offstreet parking or a garage: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1000181/DA2203_Parking_and_mains_gas_-_households.ods