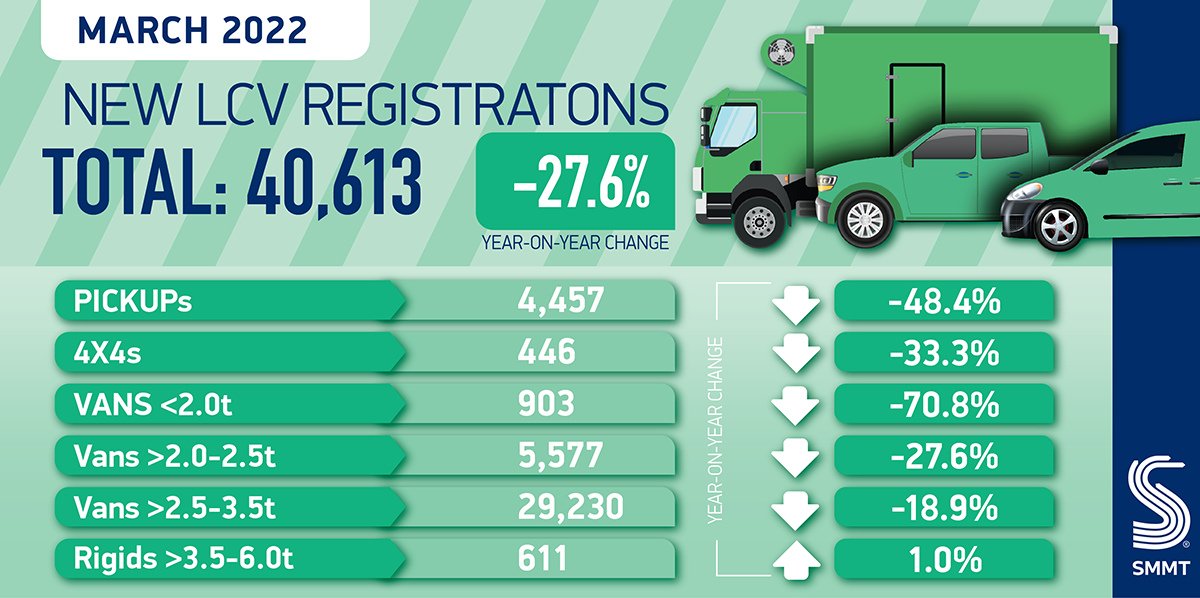

- New light commercial vehicle (LCV) registrations fall by -27.6% in March to 40,613 units.

- Registrations of large vans down -18.9%, while demand for medium-sized vans, the second biggest segment by volume, falls -27.6%.

- Market ends first quarter of 2022 at -27.6% below pre-pandemic levels, as global shortage of semiconductors continues to affect supply.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK light commercial vehicle (LCV) market declined in March by -27.6% to 40,613 units according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). The scale of the fall is amplified by comparison with March last year, when pent-up demand contributed to the largest increase in LCV registrations since 1999.1

March is conventionally a bumper period due to the introduction of the new bi-annual number plate, with more LCVs registered last month than January and February combined. However, supply and delivery issues continue to hamper the sector, including the global shortage of semiconductors and those affecting construction, logistics and shipping, with the March market -38.6% down on pre-pandemic 2019.2 Meanwhile, the cyclical process of LCV fleet renewal has contributed naturally to a slower first quarter this year, following a period of robust post-pandemic recovery in 2021.

Newly registered large vans, which represent more than two thirds of the LCV market, totalled 29,230 units, -18.9% on March last year, while medium-sized vehicles weighing greater than 2.0 tonnes to 2.5 tonnes declined by -27.6%. Small vans, meanwhile, decreased by -70.8% and pickups by -48.4%. Recent high year-on-year demand for 4x4s also slowed, decreasing by -33.3%.

Battery electric vans (BEV) continue to attract interest as businesses renewing their fleets look to meet tighter air quality regulations in urban areas, with registrations rising by 17.7% year-on-year to 1,909 units. Compared with Q1 last year, electric van uptake increased by 68.9% to a market share of 5.8%, more than double a year ago but still some distance behind fully electric passenger cars.3 Further investment is needed in the right types of chargepoint infrastructure in all regions of the UK so that more fleet and self-employed van operators can be confident to make the switch.

At the end of the first quarter this year, LCV registrations are down by -23.6% after three months of consecutive decline compared with a strong start in 2021, when the construction and home delivery sectors were significant drivers of demand, while Q1 in 2022 represents a 27.6% fall on pre-pandemic 2019.4

Mike Hawes, SMMT Chief Executive, said,

The light commercial vehicle market has made a slower start to 2022 compared with the first quarter of last year, reflecting the cyclical nature of fleet operator investment, amid global supply shortages and increasing economic pressures. Targeted support from government is needed to encourage fleet renewal and a full zero emission van market. The expansion of the Plug-in Van Grant will be a positive for the sector, but equally there needs to be a greater roll-out of suitable chargepoints to ensure fleet and self-employed van operators in all regions can make the transition.

Notes to editors

1. March 2019: 66,123 units

2. Q1 2022: 74,344; Q1 2021: 97,356; Q1

2019: 102,743

3. Q1 BEV car market share: 15.4%

4. Q1 2022: 74,344; Q1 2021: 97,356; Q1 2019: 102,743