Amsterdam, the Netherlands, 14 April 2022, 7:00 AM CEST

TomTom has a solid start to the year, in line with expectations

TOMTOM’S CHIEF EXECUTIVE OFFICER, HAROLD GODDIJN

“We had a solid start to the year with all our businesses performing in line with our expectations. Deal activity continues to be strong, with several high-quality deals on the table. Furthermore, we secured important partnerships that help enrich our services.

We are reiterating our revenue and FCF guidance. However, we should recognize the uncertainties that emerged over the past months, such as the war in Ukraine and increasing inflation. These could impact supply chains, cost levels, and general economic activity. We closely monitor the situation to ensure we can react swiftly and decisively. We believe in the strength of our business, financial position, and strategy, and are proceeding with investments as planned.”

OPERATIONAL SUMMARY

- We have partnered with the Foxconn-initiated MIH Consortium to develop the next generation of smart electric vehicles

- We teamed up with Webfleet Solutions to combine our maps, traffic, and navigation with a range of workforce management features in a single mobile offering for fleet managers and drivers

- Our technology supports the Nissan Ariya, the brand’s latest flagship electric crossover that is set to be launched with advanced infotainment and driver assistance features

FINANCIAL SUMMARY FIRST QUARTER 2022

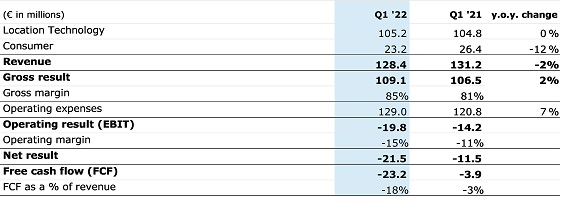

- Group revenue decreased by 2% to €128 million (Q1 ’21: €131 million)

- Location Technology revenue of €105 million equal to last year (Q1 ’21: €105 million)

- Automotive operational revenue decreased by 8% to €68 million (Q1 ’21: €74 million)

- Free cash flow is an outflow of €23 million (Q1 ’21: outflow of €4 million)

- Net cash of €331 million (Q4 ’21: €356 million)

KEY FIGURES

TOMTOM’S CHIEF FINANCIAL OFFICER, TACO TITULAER

“Location Technology revenue was roughly flat year on year. Enterprise revenues exhibited growth, while Automotive revenues decreased slightly. Automotive operational revenue showed a year-on-year decline, in line with declining car production volumes in our core markets.

Our operating result decreased versus the same quarter last year, gross margin improvements were offset by a year-on-year increase in operating expenses. These higher expenses combined with a lower trade receivable starting position compared with the same quarter last year, resulted in a decrease in our free cash flow year on year.

We do expect that our increased expenses, which center around investments in our application layer and the further automation of our mapmaking platform, will lead to lower spend levels from 2023 onwards.”

View the full TomTom first quarter 2022 results press release on our quarterly results website.