Grab Financial Group launches new brand GrabFin, a new brand for its digital payments, insurance, lending and wealth management offerings, and Earn+, an investment product for Singapore-based Grab users.

- Launch of GrabFin reinforces Grab’s mission to deliver simple, accessible and flexible financial services tailored to users on its superapp platform

- Earn+ is a flexible investment product that helps Grab users work their idle cash harder by offering potential, non-guaranteed returns of 2% to 2.5%[1] per annum

SINGAPORE, 23 May 2022 – Grab Financial Group (GFG), a leading Southeast Asian fintech platform, announced today that it will be launching GrabFin, a new brand for its digital payments, insurance, lending and wealth management offerings, and Earn+, an investment product for Singapore-based Grab users.

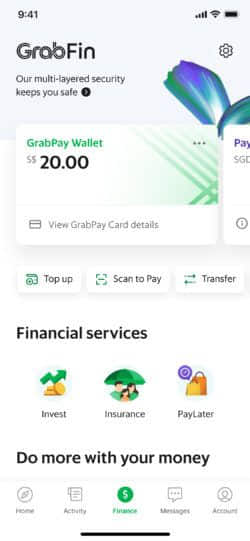

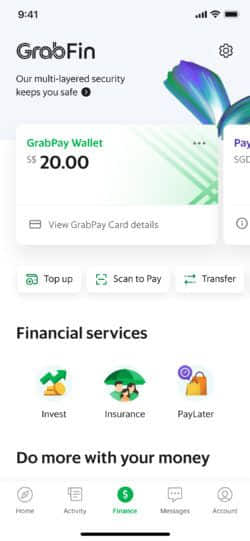

GrabFin offers Grab users a single entry point to payment, investment and insurance services on the Grab app. It addresses a consumer preference indicated in a recent Nielsen survey where three in five consumers prefer to access all their digital financial services on one integrated platform[2].

GrabFin also represents Grab’s commitment to empower Southeast Asia with greater financial access. The brand will offer everyday financial services that are simple to activate with just a few clicks in-app; fractionalised so that more people can access them; and flexible to enable consumers to choose how they use the products with no lock-in period.

“Grab’s superapp platform, deep tech expertise and data-driven insights position us uniquely to drive financial inclusion across Southeast Asia. The GrabFin brand reinforces our promise to empower the six in 10 financially underserved in the region, by providing simple, accessible and flexible financial services in a single platform that they are familiar with and already access daily,” said Kell Jay Lim, Head of GrabFin. “With GrabFin, access to financial services will be as simple as ordering a ride on the Grab app. Our customised products offer consumers flexibility and GrabPay’s multi-layered security features let them transact with peace of mind.”

Following its launch in Singapore and Malaysia, the GrabFin brand will be progressively rolled out in other Southeast Asian markets in the coming months.

GrabFin introduces Earn+ to allow consumers to put their idle cash to work

In line with its promise to provide consumers with simple, flexible and accessible financial products, GrabFin is introducing Earn+ for Singapore-based Grab users.

Earn+ is a a low-risk investment product with a projected yield of 2%-2.5% per annum[3] with better potential returns than most savings accounts when held over the short-to-medium term. Earn+ users can start with a minimum investment of $1, with no maximum investment limit or lock-in period. Users can also withdraw funds to their GrabPay wallets instantly, or transfer the funds to their bank accounts[4] at any time, without incurring any penalties or early withdrawal charges.

“Earn+ provides our users with access to low-risk, investment-grade bond portfolios, which were previously only available to institutional investors. In today’s volatile environment, it can be a good complement to our users’ investment portfolio as a low-risk investment option. With Earn+, Grab users can put their idle cash to work, and ideally stay invested for the short-to-medium term to ride out volatility and cushion the impact of inflation,” said Wenbin Wong, Head of GrabFin, Singapore.

Earn+ invests in low-risk and well-diversified mutual funds managed by Fullerton Fund Management and UOB Asset Management Ltd, and is available to all users over 18. Grab users can access Earn+ by tapping on the “Invest” icon on the Grab app home page, selecting “Earn+” and selecting “Explore more” to learn more about the investment product. Earn+ will be rolled out to all users in Singapore by the end of the week.

[1] Earn+ is an investment product that is not capital guaranteed. Estimated returns are not guaranteed or protected.

[2] This Nielsen survey was commissioned by Grab and comprised 4,800 consumers, gig workers and merchants from Singapore, Malaysia, Indonesia, Thailand, the Philippines and Vietnam.

[3] See footnote 1.

[4] Withdrawals to bank accounts will take 4-5 business days.