This map demonstrates the correlation between the market uptake of electrically-chargeable vehicles (ECVs) and the availability of purchase incentives to stimulate ECV sales (in 2020) for each of the 27 member states of the European Union and the United Kingdom. Key observations Purchase incentives for electrically-chargeable vehicles (ECVs), and especially their monetary value, still differ… Continue reading Statistics – Interactive map: Electric vehicle purchase incentives per country in Europe (2020 update)

Category: Trade Body Site

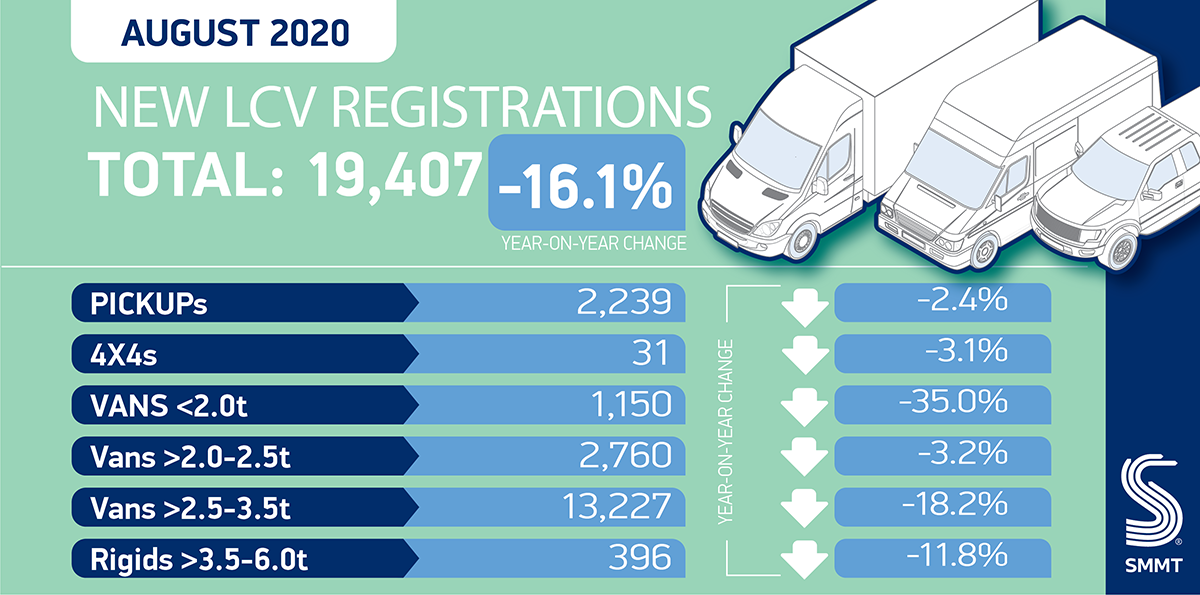

LCV market drops by -16.1% as businesses wait for plate change

04 September 2020 #LCVs #Registrations #SMMT News UK light commercial vehicle (LCV) registrations decline by -16.1% during the traditional ‘quiet’ month for registrations 19,407 vans registered as businesses await plate change month and clarity over economic outlook YTD sales down -36.4%, equivalent to almost 90,000 units. SEE LCV REGISTRATIONS BY BRAND DOWNLOAD PRESS RELEASE AND… Continue reading LCV market drops by -16.1% as businesses wait for plate change

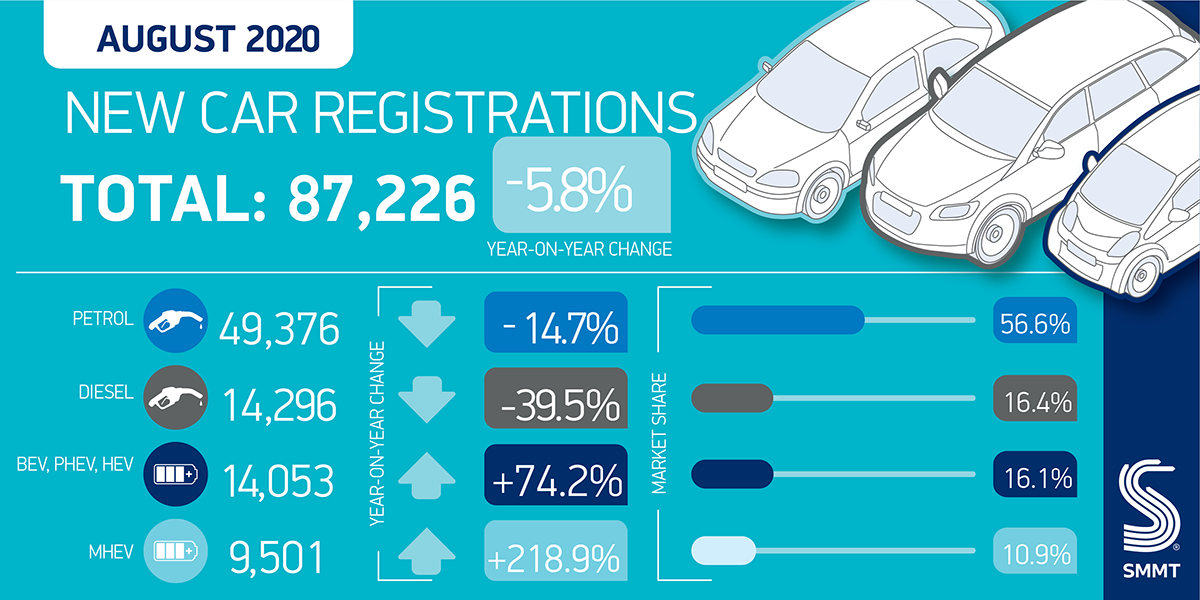

New car registrations down -5.8% despite new model boost to electric vehicle demand

New car registrations decline -5.8% during traditionally quiet pre-plate change month. Private car demand remains relatively steady, down -1.7%, with 699 fewer registrations, but fleet and business purchases drop by more substantial -5.5% and -57.9% respectively. Sales of zero emission-capable cars rise by 110% as new models hit the market, but still accounted for less… Continue reading New car registrations down -5.8% despite new model boost to electric vehicle demand

Billions invested in electric vehicle range but nearly half of UK buyers still think 2035 too soon to switch

Huge investment in electric vehicle choice is driving demand, but nearly half of motorists still not ready for a 2035 switch, with higher purchase prices and charging concerns holding buyers back. SMMT calls for zero tax on zero emission-capable cars, including plug-in hybrids, alongside long-term commitment to the Plug-in Grant to drive as many as… Continue reading Billions invested in electric vehicle range but nearly half of UK buyers still think 2035 too soon to switch

ACI: positive balance also in August for the used car market, the number of cars in circulation still growing

ACI: positive balance also in August for the used car market, the number of cars in circulation still growing 03.09.2020 The positive trend of the second-hand market was confirmed in August. The effect of the incentives for the purchase of new vehicles did not slow down the transfer of ownership, which, net of mini-transfers (temporary… Continue reading ACI: positive balance also in August for the used car market, the number of cars in circulation still growing

Press Releases – Fuel types of new cars: petrol 51.9%, diesel 29.4%, electric 7.2% market share second quarter 2020

Brussels, 3 September 2020 – In the second quarter of 2020, the market share of electrically-chargeable vehicles increased to 7.2% of total EU car sales, compared to a 2.4% share during the same period last year. The overall decline in passenger car registrations as a result of the COVID-19 pandemic affected the diesel and petrol… Continue reading Press Releases – Fuel types of new cars: petrol 51.9%, diesel 29.4%, electric 7.2% market share second quarter 2020

July 2020 new car pre-registration figures

01 September 2020 #Pre-Registration SMMT released figures for July pre-registrations in the UK new car market. The data shows the number of cars disposed of by vehicle manufacturers in July 2020 that were defined as pre-registrations. Download the July 2020 release Go to Source

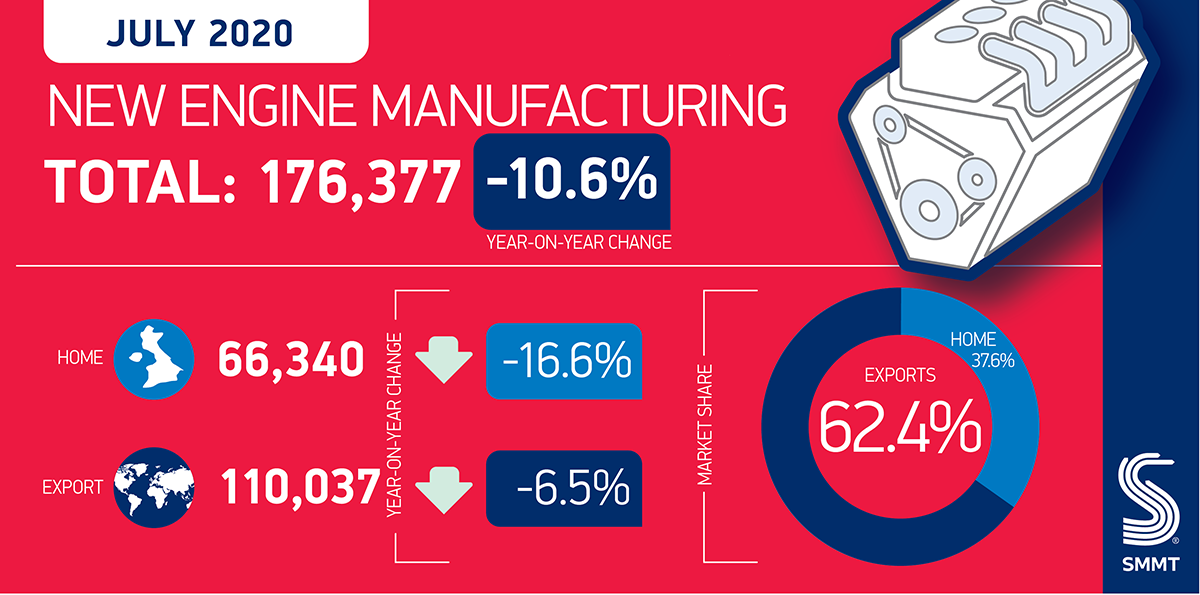

British engine manufacturing falls -10.6% in July

27 August 2020 #SMMT News #UK Manufacturing UK engine production declines -10.6% in July to 176,377 units. Demand from home and international markets falls -16.6% and -6.5% respectively. Year to date output down -35.2% with 537,712 units lost in first seven months. Mike Hawes, SMMT Chief Executive, said, July’s engine production figures, while an improvement… Continue reading British engine manufacturing falls -10.6% in July

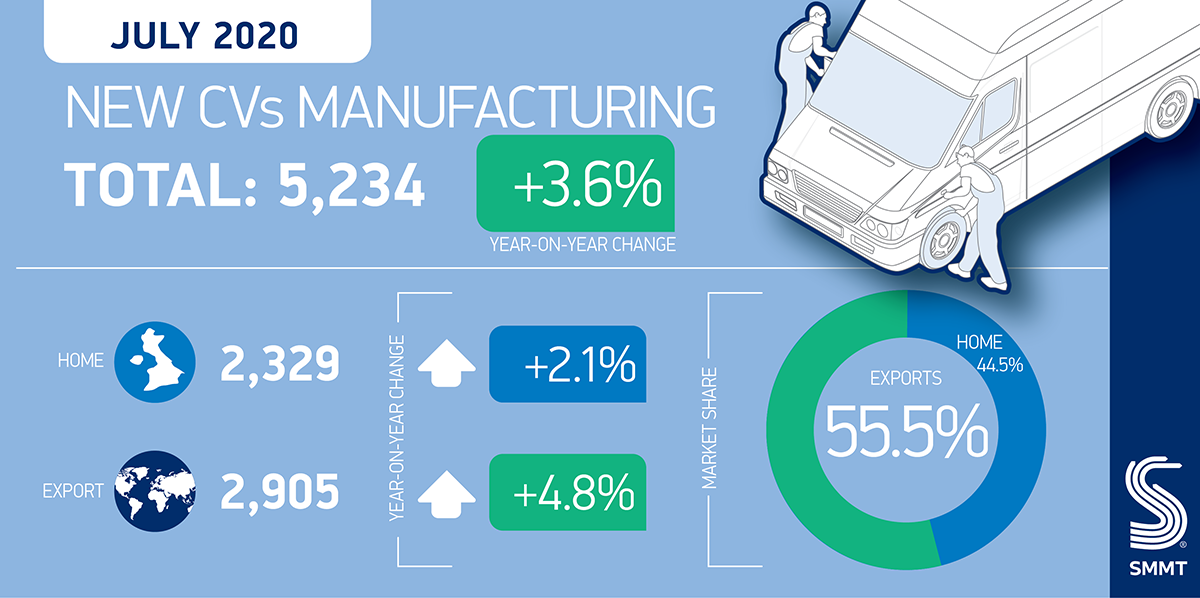

Commercial vehicle production rises 3.6% in July

27 August 2020 #SMMT News #UK Manufacturing July production up 3.6%, with 5,234 commercial vehicles manufactured. Glimmer of hope comes from uptick in orders from Europe, with 53.4% of all units produced in July destined for EU markets. Year-to-date output down -21.2%, with July growth failing to make up for 8,529-unit loss in first seven… Continue reading Commercial vehicle production rises 3.6% in July

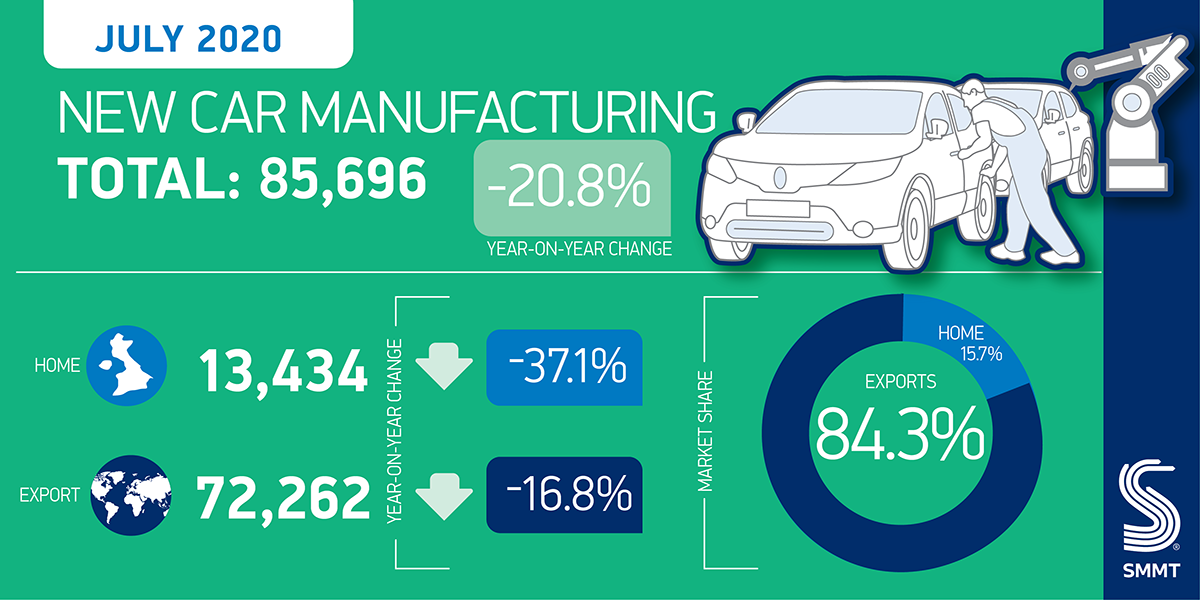

July UK car production down -20.8% as uncertainty reigns

UK car manufacturing falls -20.8% in July with 85,696 units made as factories struggle to ramp up output and global demand recovers slowly. Production for UK buyers down -37.1% as exports also decline, but by a less substantial -16.8%. 307,707 units lost in year to date, down -39.7%, as coronavirus crisis forced markets and plants… Continue reading July UK car production down -20.8% as uncertainty reigns