StoreDot to manufacture extreme fast-charging EV batteries in the US, Europe and Asia StoreDot, which has developed an extreme fast charging (XFC) high energy battery solution for electric vehicles, has announced its global manufacturing strategy in three continents to best serve its global automotive customers. The company’s manufacturing strategy is focused on localising its supply chain… Continue reading StoreDot to manufacture extreme fast-charging EV batteries in the US, Europe and Asia

Category: US Motoring Press

StoreDot to manufacture extreme fast-charging EV batteries in the US, Europe and Asia

StoreDot to manufacture extreme fast-charging EV batteries in the US, Europe and Asia StoreDot, which has developed an extreme fast charging (XFC) high energy battery solution for electric vehicles, has announced its global manufacturing strategy in three continents to best serve its global automotive customers. The company’s manufacturing strategy is focused on localising its supply chain… Continue reading StoreDot to manufacture extreme fast-charging EV batteries in the US, Europe and Asia

Volvo Group partners with Narayana Health, launches advanced medical services mobile clinic

Volvo Group partners with Narayana Health, launches advanced medical services mobile clinic The Volvo Group, in association with Narayana Health, has built an advanced mobile community clinic called ‘Wellness on Wheels’ to provide free community screening and medical services in rural parts of Karnataka as well as in other states of the country. ‘Wellness on… Continue reading Volvo Group partners with Narayana Health, launches advanced medical services mobile clinic

Mercedes-Benz Trucks begins eActros roadshow through five European countries

Mercedes-Benz Trucks started its eActros sales tour through five European countries on May 2. The route of the three electric trucks for distribution haulage will initially run from the Mercedes-Benz Worth plant via Austria to Italy. After a subsequent loop through Germany, the eActros will continue on to the Netherlands and Belgium. Several stopovers will… Continue reading Mercedes-Benz Trucks begins eActros roadshow through five European countries

Mercedes-Benz Trucks begins eActros roadshow through five European countries

Mercedes-Benz Trucks started its eActros sales tour through five European countries on May 2. The route of the three electric trucks for distribution haulage will initially run from the Mercedes-Benz Worth plant via Austria to Italy. After a subsequent loop through Germany, the eActros will continue on to the Netherlands and Belgium. Several stopovers will… Continue reading Mercedes-Benz Trucks begins eActros roadshow through five European countries

Magna wins new high-voltage eDrive business with European premium carmaker

Magna International has announced it has been awarded a high-volume contract with a Europe-based global premium OEM to supply its new eDrive system (eDS Mid). The eDrive is planned for 2027 model SUVs / sedans, with production expected to begin in 2026. “The electrified powertrain technologies of the future are being developed today. We are… Continue reading Magna wins new high-voltage eDrive business with European premium carmaker

Magna wins new high-voltage eDrive business with European premium carmaker

Magna International has announced it has been awarded a high-volume contract with a Europe-based global premium OEM to supply its new eDrive system (eDS Mid). The eDrive is planned for 2027 model SUVs / sedans, with production expected to begin in 2026. “The electrified powertrain technologies of the future are being developed today. We are… Continue reading Magna wins new high-voltage eDrive business with European premium carmaker

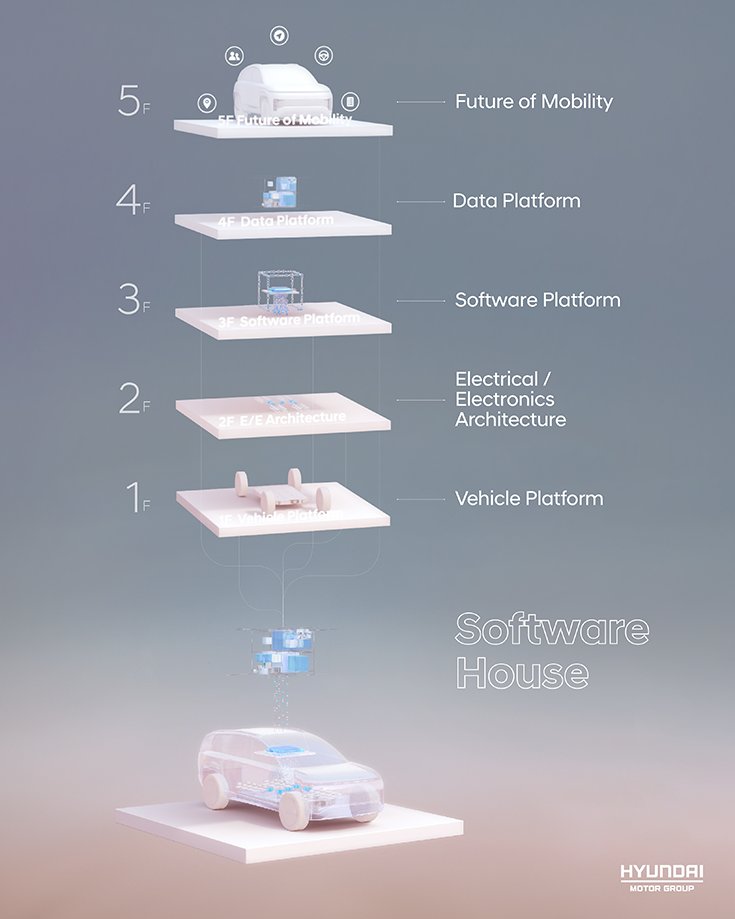

Kia bets big on software-defined vehicle tech with flagship EV9 SUV

Kia today introduced its Software Defined Vehicle (SDV) technology through its EV9 SUV’s on-demand features and over-the-air (OTA) software updates, allowing customers to remotely purchase and install new software functions based on their needs. Kia, which is affiliated with the Hyundai Motor Group, has recently launched its flagship electric SUV, the EV9. Notably, it is… Continue reading Kia bets big on software-defined vehicle tech with flagship EV9 SUV

AA, RAC slam forecourts for ongoing fuel price ‘scandal’

The pump price of diesel should be 16p per litre cheaper than it currently is and fuel retailers are keeping the cost high despite a marked fall in wholesale prices, two of the UK’s biggest insurance firms have told Autocar. According to data from RAC Fuel Watch, diesel is now 6p per litre cheaper than… Continue reading AA, RAC slam forecourts for ongoing fuel price ‘scandal’

E-fuels exemption could spark “chaos” in EV push – Stellantis boss

“I’m fine to go full speed on EVs, and demonstrate to the world that I am the best EV maker. I’m playing that game, full power in a regulatory framing that is given to me. Then the question: is this regulatory framing the best for the societies? Is that the best for the planet? And… Continue reading E-fuels exemption could spark “chaos” in EV push – Stellantis boss