Engineering giant Larsen & Toubro (L&T) is selling its eight operational road assets that the company built and operated to Edelweiss Infrastructure Yield Plus, an infrastructure fund managed by Edelweiss Alternative Asset Advisors, for an enterprise valuation of Rs 7,000 crore, said people aware of the matter. The transaction, yet to be made public, was signed earlier this month and is awaiting regulatory approvals from the National Highways Authority of India (NHAI) and the Securities and Exchange Board of India (Sebi), they added. The transaction also includes one power transmission asset.

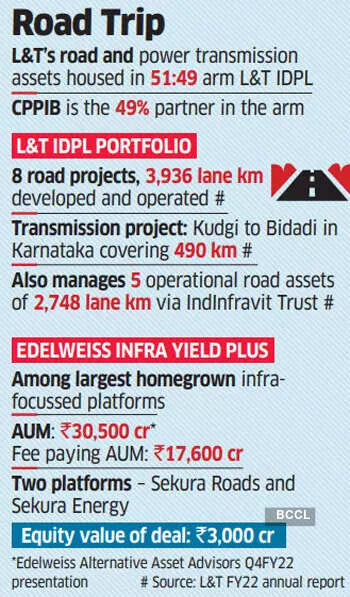

The divestment is part of L&T’s asset-light strategy, which has seen the company exit several non-core assets. The L&T Infrastructure Development Projects Ltd (L&T IDPL) concessions have also been part of that list. The Edelweiss infrastructure fund has two operating platforms — Sekura Roads and Sekura Energy. Both are being used as vehicles for this buyout. The equity value of the road concessions and power transmission project stands at Rs 3,000 crore.

L&T’s road and power transmission assets are housed in 51:49% subsidiary L&T IDPL. Canadian pension fund Canada Pension Plan Investment Board (CPPIB) is the 49% partner in the arm.

In 2018, L&T IDPL had floated an infrastructure investment trust (InvIT) — IndInfravit Trust — and roped in Allianz Capital Partners, Canada Pension Plan Investment Board and OMERS Infrastructure as key unit holders. IndInfravit currently holds a portfolio of 13 operational road concessions with about 5,000 lane km in five states.

Portfolio Sale?

In June, IndInfravit had acquired a portfolio of Indian road assets from Canadian asset manager Brookfield in a deal valued at Rs 9,300 crore ($1.2 billion). L&T senior management had told ET previously that the group will exit its 6% economic interest in the InvIT by 2023.

“The eight operating roads were not transferred to the trust. The trust has external shareholders and they decide independently which asset to buy, transfer or sell,” said an official involved in the ongoing negotiations.

Edelweiss, CPPIB didn’t respond to queries.

“The information about the sale referred to is speculative,” an L&T spokesperson told ET. “Our exit from the concession business will be done at platform level as and when it happens. We have no other confirmations to make now.”

According to an official, Sebi approval is required since IndInfravit Trust is a subsidiary of L&T IDPL. Since the assets are getting sold, under the guidelines, the trust manager needs to be hived off before the sale is officially “closed”.

The L&T IDPL assets sold include the L&T Chennai-Tada Tollway, a 43.34 km road that connects Chennai to Tada on NH5 in Andhra Pradesh; the L&T Rajkot-Vadinar Tollway, a 131.75 km stretch of State Highway 25 in Gujarat; the Vadodara-Bharuch Tollway, an 83.17 km stretch on NH8 between Vadodara and Bharuch; the Panipat Elevated Corridor, a 10 km expressway on NH1 between Delhi and Chandigarh; the L&T Samakhiali Gandhidham Tollway, a six-lane stretch on NH8A; the L&T Ahmedabad-Maliya Tollway, a 180 km stretch connecting Ahmedabad-Viramgam-Halvad-Maliya; the L&T Sambalpur Rourkela Tollway, four-laning the Sambalpur-Rourkela section of of SH10 in Odisha; the L&T Deccan Tollway, a 145 km road connecting Sangareddy to Karnataka; and Maharashtra and Kudgi Transmission Ltd, which owns the Kudgi Thermal Power plant located in Karnataka.

Sekura Roads owns Dhola Infra Projects (Assam) and Dibang Infra Projects (Arunachal Pradesh), acquired from Navayuga Group for $150 million in 2020. Sekura Roads has also won the 10th toll-operate-transfer (TOT) bundle in the recent NHAI auction. TOT 10 offers the 125 km section of Gwalior-Shivpuri (NH3) in Madhya Pradesh. It is not clear if L&T’s roads will get merged into the existing Sekura platform or be kept separate.

Edelweiss Infrastructure Yield Plus last year acquired a 74% stake in French utility major Engie Group’s solar energy assets in India in 2019. This transaction gave Sekura Energy a portfolio of 11 solar assets. Sekura Energy had also acquired two operating power transmission assets from Essel Infraprojects—Darbhanga-Motihari Transmission and NRSS XXXI (B) Transmission in 2018.

L&T IDPL had become a zero-debt company, L&T said in its FY22 annual report.

Betting on Yields

Edelweiss Infrastructure Yield Plus is the largest yield-focused infrastructure alternative investment fund (AIF) in India with capital commitments from both domestic and global investors. Edelweiss’ alternative assets under management–including its AIF and offshore funds–add up to about Rs 30,500 crore, as per the company’s latest presentation.

L&T made a deliberate decision not to bid for public private partnership (PPP) projects and focus on its traditional engineering businesses. The company is keen to divest its other developmental assets such as the Hyderabad Metro project and the Nabha Power plant. It recently sold a 99 MW hydropower unit to ReNew Power for Rs 985 crore.

“We have already identified our non-core assets in Nabha Power, a 2×700 MW supercritical thermal power plant at Rajpura, Punjab, L&T Infrastructure Development Projects Ltd (L&T IDPL), our subsidiary primarily engaged in road projects and power transmission lines and Hyderabad Metro, the largest Public-Private Partnership (PPP) project in the Metro rail sector for divestment. We will work out the divestment process of all these assets over a period of time,” DK Sen, whole-time director and senior executive vice president (development projects), L&T, said in the statement, last August.

ET had reported on August 25, 2021, that discussions had been ongoing with National Investment and Infrastructure Fund (NIIF) for the Hyderabad Metro project. NIIF is likely to form a consortium as part of the plan, ET reported.