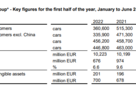

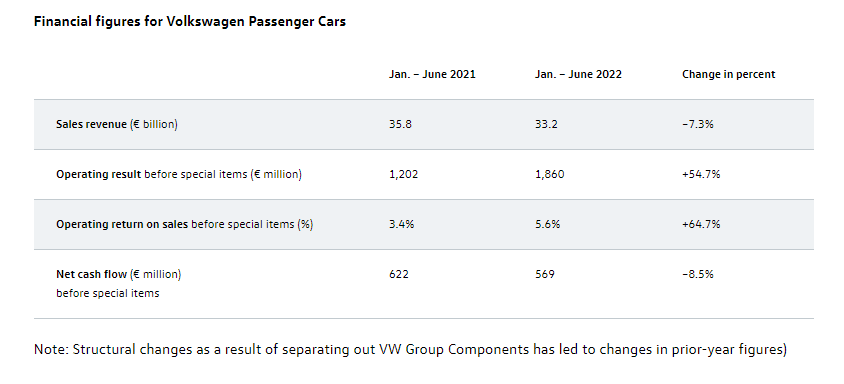

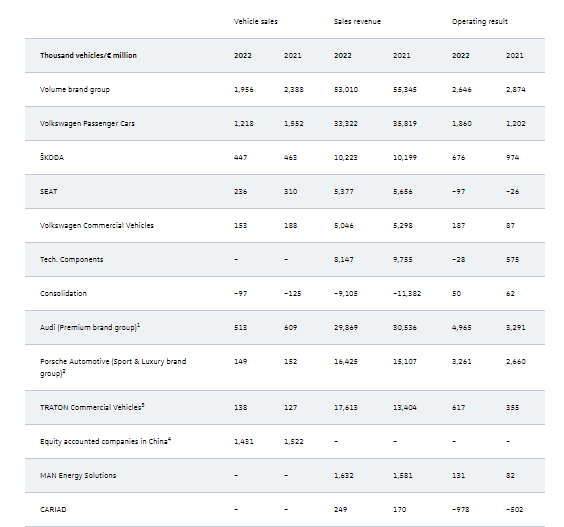

New Delhi: The Volkswagen brand recently reported an operating result before special items of EUR 1.9 billion (first half of 2021: EUR 1.2 billion). The operating return on sales before special items rose to 5.6% (first half of 2021: 3.4%).

According to the Group, the half-year result benefited in particular from a strong second quarter. This is also the main reason that the net operating cash flow reached EUR 569 million in the first six months.

“The upward trend continued in the second quarter,” Alexander Seitz, CFO, Volkswagen, said.

As a result of the optimized model and price policy, the company generated sales revenue of just under EUR 33 billion (first half of 2021: 36 billion euros) – despite a significant year-on-year decline in vehicle deliveries.

Thomas Schäfer, CEO, Volkswagen, said, “The aim is to increase efficiency by 20% for the entire Volume brand group in the medium term. For the second half of the year, we are cautiously optimistic that the supply situation will ease.”

The Volume brand group, which comprises Volkswagen Passenger Cars, Seat and Cupra, Škoda as well as Volkswagen Commercial Vehicles, is under the responsibility of Thomas Schäfer in the Group Board of Management.

Global deliveries amounted to 2.08 million vehicles (down 23.2%). The number of electric vehicles delivered meanwhile continues to grow. The delivery of 116,000 units means that 25% more all-electric cars were delivered than in the same period of the previous year. The clear front runner was the ID.4 – at around 63,000 deliveries – making every second BEV an ID.4.

Overall, demand remains high for both ICE and electric vehicles. The backlog of orders across all drive types stands at 728,000 vehicles for Europe alone, including around 139,000 all-electric IDs.

“For full-year 2022, we are now aiming for an operating return on sales before special items of 4 to 5%,” added Alexander Seitz. The full-year outlook was previously at up to 4%.

BEV demand continued to grow rapidly in Q2, with the order intake in Western Europe for H1 2022 at 40% above the previous year’s level.

The Group continued to prioritize investment in future BEV technology and software. R&D expenditure increased to EUR 4.9 billion in Q2 accelerating Volkswagen’s progress towards becoming a software-driven mobility provider.

Despite global headwinds and supply chain issues, the Group demonstrated financial resilience in Q2. Sales revenue for the quarter stood at EUR 69.5 billion (a 3.3% increase over 2021). Operating profit before special items in Q2 came in at EUR 4.7 billion and included roughly EUR 2.4 billion of negative fair value effects from derivatives outside hedge accounting (mainly from raw material hedging), a reverse effect compared to Q1.

The Group expects the product mix to normalize in H2 as the semiconductor situation improves in combination with a strong order book. A noticeable recovery of the monthly sales towards the end of Q2 additionally bodes well for H2 sales.

“Despite all the caution in the face of the volatile market environment and geopolitical risks, we are confident that we can further accelerate the transformation of the Group,” Antlitz said.

Also Read: