In the accumulated of the year, sales of passenger cars and SUVs accumulate a drop of 11%

Registrations of light commercial vehicles fall 18% compared to the same month of the previous year, with 11,279 units

Industrial vehicles, buses, coaches and minibuses increase their sales by 19% in July

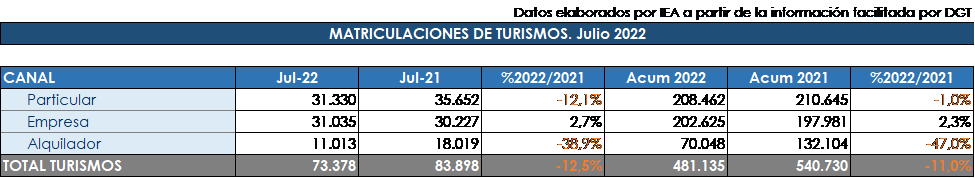

Madrid, August 1, 2022. The month of July registered a 12.5% drop in car and SUV registrations compared to the same month of the previous year, with a total of 73,378 units. During the last month, the market has once again been conditioned by economic uncertainty, derived from the increase in inflation and prices, and by the shortage of semiconductors that continue to hamper the arrival of vehicles at dealerships. Until the month of July, sales of passenger cars and SUVs accumulated a fall of 11% compared to the same period of the previous year, with a total of 481,135 units.

The average CO2 emissions of cars sold in July are 122.4 grams of CO2 per kilometer traveled, 2.7% lower than the average emissions of new cars sold in July 2021.

In the last month, only sales to companies have managed to obtain a positive result, with growth of 2.7% and 31,035 units sold. For its part, the individual channel once again suffered a decline of 12.1% to 31,330 sales. As for the purchases made by renters, they maintain the annual trend of sharp decline, accumulating 11,013 units in the seventh month, 38.9% less than in the same month of the previous year. This channel is the one that suffers the most from the lack of semiconductors.

LIGHT COMMERCIAL VEHICLES

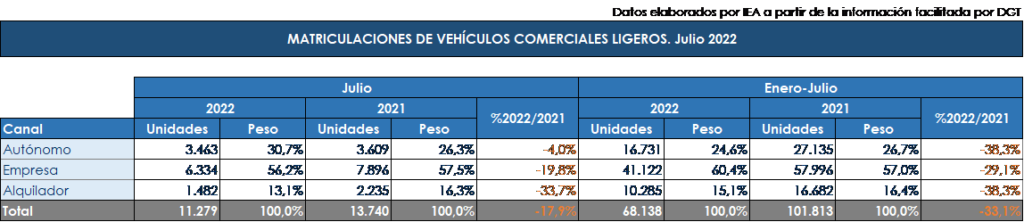

In July, the registrations of light commercial vehicles registered a sharp drop again, with a reduction of 17.9% and a total of 11,279 units. In the accumulated of the year, a total of 68,138 units is added, which represents a decrease of 33.1%. As for the channels, they all maintain the downward trend, with the rental channel, with a drop of 33.7%, suffering the greatest decline.

INDUSTRIAL AND BUSES

The registrations of industrial vehicles, buses, coaches and microbuses maintained the increase in their sales in July with a growth of 18.8% and 1,842 units sold. For the total of the year, 14,393 units are accumulated, 9.3% more compared to the same period of the previous year. With regard to industrial vehicles, with the exception of light industrial vehicles, the rest of the segments achieved notable increases in the seventh month. For their part, buses decreased this month by 24.2%, to 116 units.

DECLARATIONS

Félix García, director of communication and marketing at ANFAC, explained that “the car and SUV market has not yet reached positive figures. A month like July, which historically used to show good behavior, has closed with a significant drop. The poor economic situation, which was already assuming an important conditioning factor for users’ decision to purchase, has been aggravated by the sharp rise in inflation and energy prices, as well as consumer uncertainty in the face of some messages against the use of vehicles. private. To which we must add that, despite the slight recovery in vehicle production, the shortage of microchips is still causing delays in the deliveries of vehicles already ordered at dealerships. These factors are causing users to delay their acquisition or opt for a used vehicle. The latter is especially significant since, up to July, almost the same number of passenger cars over 15 years old as new vehicles have been sold. A situation that neither entails a benefit for Road Safety, nor does it contribute to the necessary decarbonisation process of the old-fashioned Spanish car fleet”.

Raúl Morales, communication director of FACONAUTO, indicated that “traditionally, July was one of the best months of the year for the automobile because families scheduled the purchase of their new car before the holidays and vehicle rental companies reinforced their fleets of ahead of the summer campaign. These situations have not occurred this year, and hence the drop not only in registrations but also in orders. In this way, the market remains depressed, more than 30% below the figures for 2019, and with the same ailments as in recent months, mainly the lack of stock and above all the uncertainty felt by buyers, who are also they have to face a clear increase in the cost of vehicles, 6% on average so far this year, and now a rise in the price of money, which distances the average Spanish family from the possibility of acquiring a New car”.

According to the communication director of GANVAM, Tania Puche, she highlighted “we have to go back to 2012 to see a month of July with a lower volume of registrations, which brings us back to figures from the economic crisis at that time. Although July was traditionally one of the best months of the year in sales because the buyer took the opportunity to drive the car on vacation, we now find that purchases by individuals deepen their fall in a context in which, due to the lack of vehicles in points of sale due to the chip crisis, added to it is unbridled inflation that increasingly reduces the purchasing power of families and that will weigh down the pace of market recovery in the coming months”.