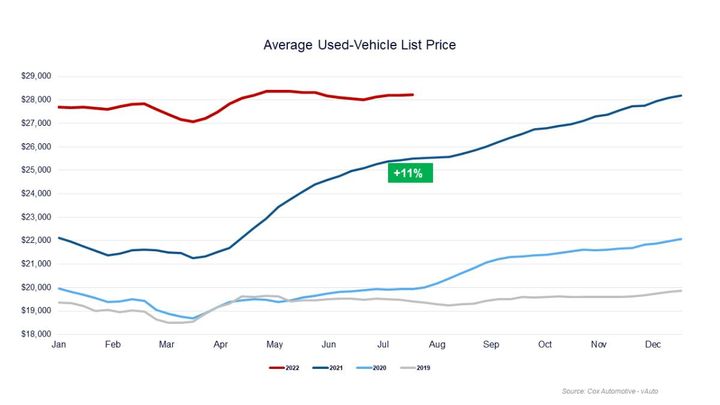

The average used-vehicle listing price surpassed $28,000 in mid-April and rose to a record high of $28,375 in early May. The average listing price then edged downward throughout June but turned upward during July, closing at $28,219, an increase from the revised $28,004 at the end of June.

Source: Cox Automotive

Used-vehicle inventory held steady from June to July, while sales – and prices – registered an uptick by month’s end, according to the Cox Automotive analysis of vAuto Available Inventory data released Aug. 12.

The total supply of unsold used vehicles on dealer lots, both franchised dealers and independents, across the U.S. stood at 2.46 million units at the close of July, about the same as the revised number at the end of June.

As used-vehicle sales picked up, total days’ supply at the end of July dropped to 49, compared with the revised 52 days’ supply at the end of June. Days’ supply in July was 24% above year-ago levels, when inventory volume was slightly lower, and sales were stronger.

“Inventory volume at the end of July was 5% above year-ago levels, so we’re holding our ground. In fact, we’re tracking at a fairly normal pace for supply. Sales have slowed compared to the strong pace we saw in the summer of 2021, but are still relatively healthy,” said Chris Frey, Cox Automotive’s senior manager for Industry Insights, in a news release.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, in this case, ended July 25. Sales were 1.51 million, the highest for any 30-day period since May.

“While used-vehicle sales in total so far this year are down 15% from the strong pace in the first half of 2021, the year is tracking in a normal trend line,” Frey said. “The latest uptick in July suggests resilience in the used market.”

By brand, Toyota and Honda had the lowest used-vehicle inventory, with days’ supply at 37 and 39, respectively. They were the only major brands to be under a 40 days’ supply. They are near the bottom for supply of new vehicles as well.

Other Asian automakers with low used supply as well as skimpy new-vehicle inventory are Subaru and Hyundai, with used days’ supply of 43, and Kia with only 44. Mazda has above-average new-vehicle inventory but is on the low side at 43 days’ supply of used-vehicle inventory.

By price category, the lower the price, the lower the supply. The under $10,000 segment has the lowest available supply and lowest days’ supply of 33, about the same as a month ago. The $10,000 to $15,000 segments had days’ supply dip to 38 from the 40s a month earlier. Price categories between $15,000 and $30,000, representing the bulk of available inventory, had 42 to 50 days’ supply. Above $30,000 categories had 54 to 62 days’ supply.

Used-Vehicle Prices Remain Elevated

The average used-vehicle listing price surpassed $28,000 in mid-April and rose to a record high of $28,375 in early May. The average listing price then edged downward throughout June but turned upward during July, closing at $28,219, an increase from the revised $28,004 at the end of June. Price growth versus the year earlier was 28% in mid-April but has been falling every week since. Average listing price now stands 11% higher than a year ago.

“The average list price for used vehicles continues to trend at just over $28,000, but the price growth has definitely come down since we passed the anniversary of last year’s big run-up,” Frey said. “Still, prices remain above 2021 levels and will stay there as demand remains strong and until new-vehicle inventory builds.”

In terms of wholesale prices, the Manheim Index shows prices had been moving generally downward for most of the year. Over the last six weeks, the divergence between wholesale and retail prices has widened. “It is unclear if the retail index will follow the wholesale index through the depreciation cycle over the next 20 weeks,” Frey said. “Regardless, wholesale has returned to depreciating after the spring.”

Originally posted on Vehicle Remarketing