New Delhi: Electric vehicle (EV) sales volumes would steadily increase in the next three years. But the growth rate would be lower than anticipated. However, the growth rate of the CNG or LPG-based PVs and passenger carriers will continue to be high over the next five years.

A recent report by CareEdge, a Mumbai-based research firm, says that factors like the sharp increase in the prices of key raw materials, including nickel, lithium and cobalt, will keep battery prices firm and dampen EV demand and sales growth. The mining capacity increase in these products would take at last three more years to realise.

Based on market data, CareEdge report says, “The cost of manufacturing cathode contributes to a little over 50% of the overall battery manufacturing cost. The sudden increase in demand for these metals in the past five years has led to a demand-supply mismatch with mining capacity having to ramp up significantly to match demand.”

The CareEdge report finds that among the ICE auto categories, the CNG or LPG-based PVs and passenger carriers (whether buses or three-wheelers) will continue to display the highest growth rate over the next five years. Driving this demand is the lower cost of ownership of CNG or LPG vehicles, in turn, linked to the price differential between petrol/diesel and gas prices.

“The shift in buyer preferences towards CNG or LPG vehicles is clearly reflected not only in the 25.8% CAGR growth that market leader Maruti Suzuki India Ltd (MSIL) has displayed during FY17-FY22 (with 49% CAGR in the last three years), but also in the increasing proportion of CNG vehicles in MSIL’s sales (16.8% in FY22 compared with 5.1% in FY17),” the report said.

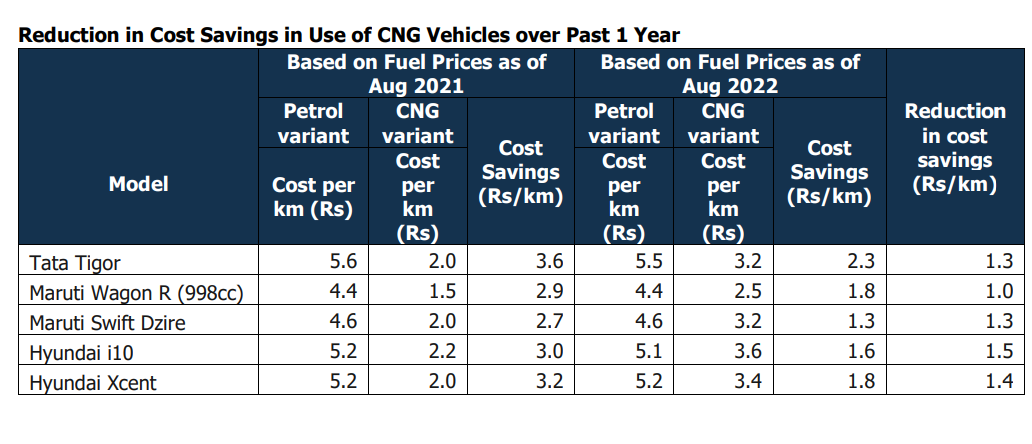

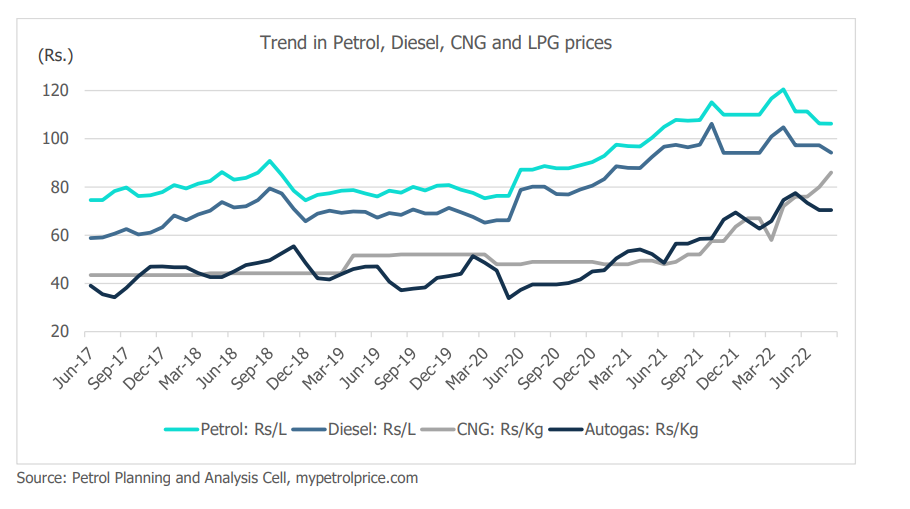

The price differential has reduced in recent months due to the reduction in excise duty on petrol and diesel and the rise in CNG and LPG price which is linked to higher import costs. “Demand would be tempered to some extent by the reduced price differential between traditional fuels and CNG/LPG, however, this category of ICE vehicles will continue to enjoy higher demand given the cost savings they will still continue to offer,” CareEdge notes.

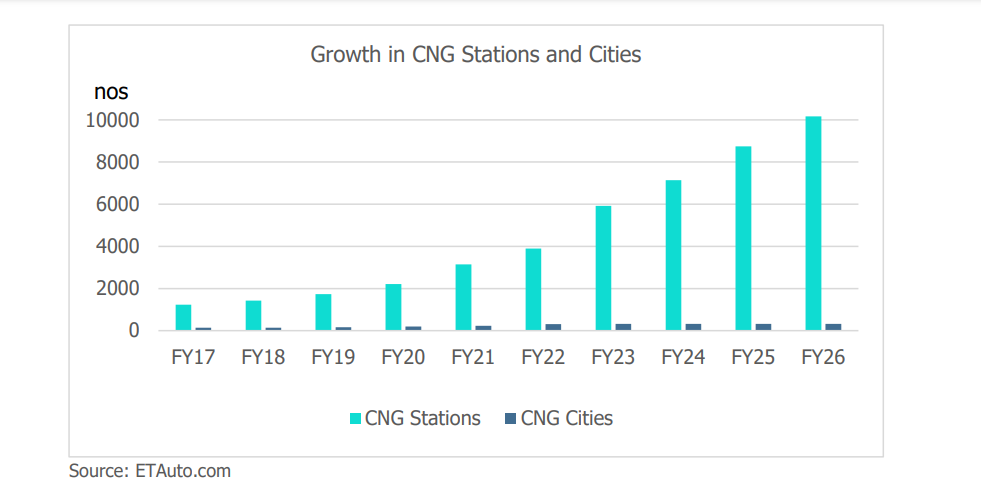

As per CareEdge, another factor driving the demand for CNG or LPG vehicles is the pace at which additional fuel stations are being set up. From around 3900 fuel stations for CNG across 236 cities in FY22, the number is expected to swell to 10,164 across 327 cities by FY26. Unlike for EVs where support infrastructure in terms of charging stations will take a long time to ramp up leading to continued ‘range anxiety’ among potential buyers, CNG or LPG vehicles are not expected to face much difficulty in access to fuel.

The report also stated that the large-scale transition to EVs, which was earlier expected to happen post 2023, is likely to be delayed by at least three years, with two-wheeler EVs continuing to account for over 90% of demand in the interim. “The switchover to EV in the car segment will continue to be hampered by relatively much higher car prices (as against comparable prices of EV and ICE vehicles in the two-wheeler segment), as well as the lack of charging infrastructure which is yet to be ramped up on a pan-India basis,” it added.

Furthermore, in the ICE segment, three and four-wheelers with CNG or LPG variants would continue to sell faster than conventional petrol or diesel engine vehicles given the lower running costs. However, as the price of CNG and Autogas has increased significantly in the past year the demand over the next three years in this case also would be lower than previous estimates. “Adequate fuel infrastructure in this case will help drive volumes of three and four-wheeler CNG or LPG vehicles,” CareEdge concludes.