In a sign that the market for logistics and transportation tech isn’t cooling (economic downturn be damned), HyperTrack, a startup offering APIs for freight order planning, assignment and tracking, today closed a $25 million Series A funding round. Led by Westbridge Capital with participation from Nexus Venture Partners, the round will be put toward expanding HyperTrack’s engineering team and “doubling down” on broader growth, CEO Kashyap Deorah told TechCrunch in an interview this month.

As supply chain challenges endure, VCs view logistics startups — including HyperTrack — as a safe bet in choppy market waters. While investment slowed in early 2022 compared to 2021, startups developing transportation and logistics technologies still collected $14 billion in Q1 alone, according to PitchBook.

“The pandemic significantly accelerated on-demand delivery, the growth of the gig economy and software automation. All three factors have served as tailwinds for HyperTrack’s growth,” Deorah told TechCrunch via email. “Two of the toughest challenges for technology leaders are hiring talent and optimizing cloud bills. Business demands speed-to-market while development roadmaps continue becoming delayed. APIs help technology teams to build their apps their own way with predictable time and cost.”

Prior to launching HyperTrack, Deorah co-founded blogging platform RightHalf.com and restaurant payments app Chalo (among other startups), which were acquired by Stratify and OpenTable, respectively. After spending a little over a year at OpenTable as GM of payments after the Chalo acquisition, Deorah says he was inspired to found HyperTrack due to the growing demand in the “on-demand” economy (e.g., food and goods delivery services) for location and mapping tech.

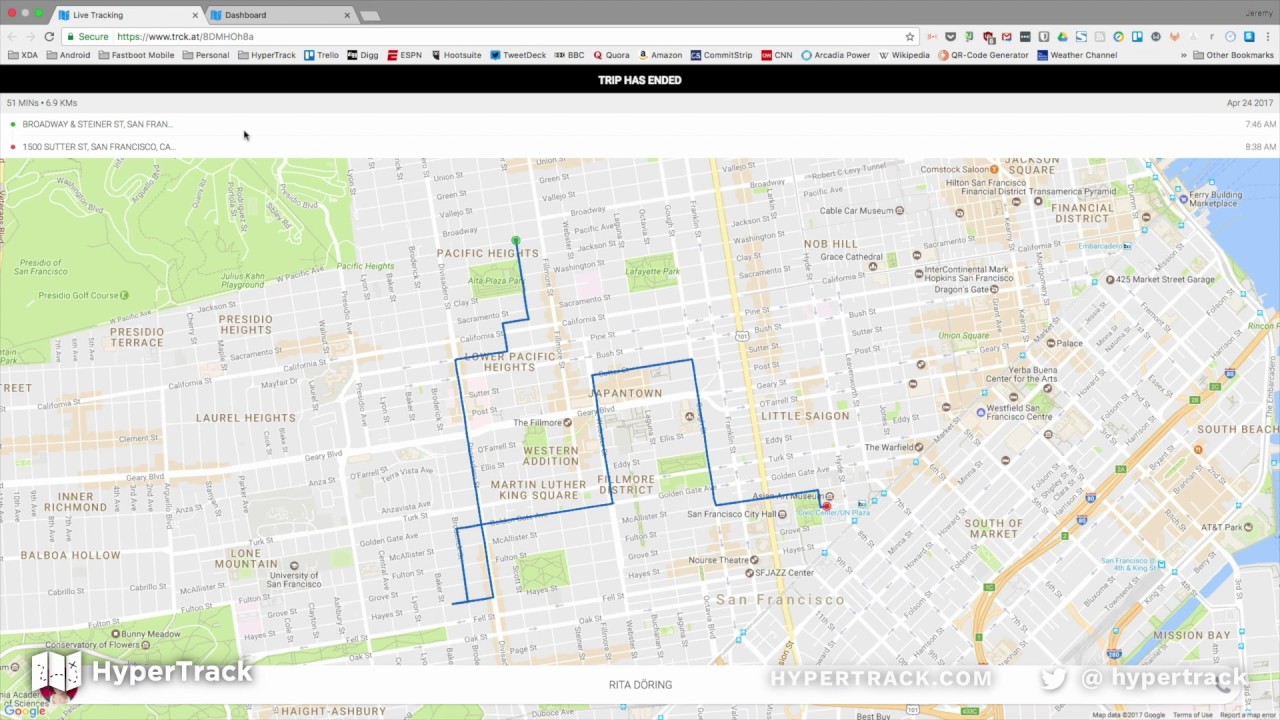

Image Credits: HyperTrack

“In the early days of DoorDash, Instacart and Postmates, then called ‘Uber-for-X,’ I recognized the on-demand economy as the convergence of physical and digital commerce across multiple industries and regions,” Deorah said. “HyperTrack has witnessed too many enterprises building their own logistics tech solutions, especially for on-demand fulfillment by gig workers. Our APIs deliver a better solution, support and price predictability than hyperscalers.”

As Deorah explains, traditionally, companies making on-demand deliveries have taken a “linear approach” to geocoding customers’ addresses. (“Geocoding” refers to transforming a description of a location, like an address or place name, to geographic coordinates.) But the addresses aren’t always accurate. A recent study found that the coordinates vary widely across commercial vendors, with one vendor accurately mapping addresses only 30% of the time.

HyperTrack, by contrast, claims to use “ground truth” delivery data — data from orders fulfilled and routes taken to destinations, for example — to compute address accuracy in addition to metrics like service time, route deviations and live driver locations. The platform loops this data back into AI systems to “continuously” improve delivery order planning and assignment, Deorah says — ideally preventing delayed orders, lowballed payments to drivers and wrong ETAs.

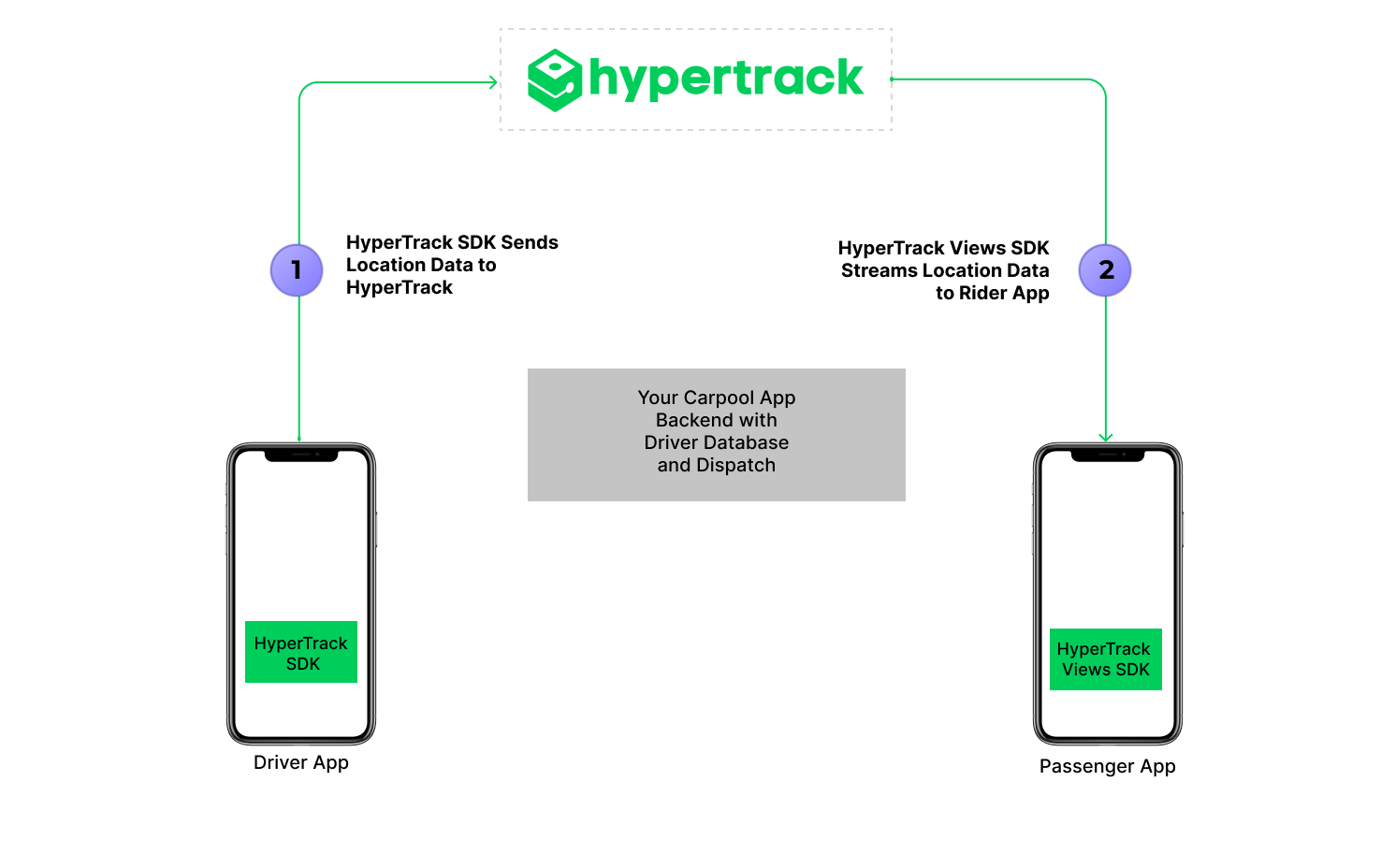

To customers, HyperTrack offers software development kits and APIs specifically for logistics around the last mile, or the last leg of an order’s journey. The toolkit allows companies to build workflows that help predict things like capacity utilization and per-order costs, plus capabilities like nearby search, geotags, geofences and “flex routes” in consumer and delivery driver apps.

HyperTrack tackles a logistics roadblock that other vendors, including Google and Amazon, have long aimed to address, too, with their own solutions. For example, AWS’ Amazon Location Service lets developers add location functionality like maps, routing and tracking to their apps, while Google’s Last Mile Fleet Solution ships with APIs, SDKs and a backend service for mapping and routing functionality.

But Deorah asserts that HyperTrack is one of the few offerings on the market that bridges mobile, cloud and maps for a per-order price. He takes aim at startups like Onfleet, Bringg (which became a unicorn last June) and Locus as well, which he says only provide proprietary packaged apps as opposed to unbundled APIs and development kits.

Cost is indeed a major challenge for logistics providers in last-mile delivery. According to Statista, more than half cite increasing delivery costs as their main challenge, followed by reliable order fulfillment and a lack of workers. Eighty-two percent of brands feel they need to improve their customers’ last-mile experiences, a separate survey showed — in part by increasing delivery options and promoting sustainability.

The stakes can be high. In 2021, a Florida trucking contractor contended that the U.S. Postal Service’s reliance on dynamic route optimization software shorted it $110 million, forcing it to slash hundreds of jobs and opening it up to lawsuits. Amazon’s cost-saving routing algorithm reportedly had drivers walking into traffic.

Image Credits: HyperTrack

“Builders of logistics technology can often become confused by the various route solvers, mapping platforms, cloud technologies and smartphone APIs they need to stitch together to build simple use cases — not to mention inflexible fleet management applications that confuse developers with their APIs,” Deorah said. “[Using HyperTrack,] logistics tech builders no longer need to develop for months with a team of engineers to build out the consumer and driver apps for mobile, live location tracking, operations dashboard and cloud infrastructure.”

Up against the formidable competition, HyperTrack appears to have fared well, with 3,000 apps using the platform, including technician firm Jobox and home services company Spiritzone. Deorah — who declined to reveal revenue numbers — claims that the platform is now coordinating 10 million orders per month across a fleet of 150,000 drivers.

“In 2022 alone, HyperTrack has grown from 15 to 30 employees and we plan to grow to 40 within the next few months.” Deorah said. “[HyperTrack] has been a complex product to build, yet here we are with a great product and many production users, and it is time to now double down on growth.”

The Series A tranche brings HyperTrack’s total raised capital to $32 million.