Electric vehicles (EVs) in India have seen a growth of CAGR of 205% and 149% domestic sales volumes in two-wheelers and four-wheelers respectively during FY20-FY22, but persistent concerns around raw material availability are set to dampen the demand scenario in the coming years.

The growth seen in the last few years can be attributed to a low base, increasing demand and steps taken by the governments to spur the said demand. While the cost of manufacturing Lithium-Ion batteries has reduced over the past few years, their production costs are not likely to reduce from current levels for the next three years, thereby dampening demand for EVs to some extent, CareEdge said in its report.

The three key raw materials need to manufacture cathodes are lithium, cobalt and nickel. There has been an increased demand for these metals over the last five years which has led to a demand-supply mismatch, the report notes.

Australia, Chile and China are the largest suppliers of lithium in the world while the Democratic Republic of Congo (DRC), Russia and Australia are the top three cobalt producers. When it comes to nickel, Indonesia, the Philippines and Russia are the top producers.

The prices of these key metals have been volatile over the past few months owing to multiple reasons like the Russia-Ukraine war, and activism against the adverse environmental impact of mining of these metals.

“Based on market data, we believe that increasing mining capacity for lithium, cobalt and nickel would take at least three years and during the interim, battery prices would remain firm at around present levels,” CareEdge said.

Demand for EVs across various categories was therefore expected to rise steeply from 2023 onward. However, as per research conducted by Bloomberg NEF, the volume weighted per kwh production cost in CY2022 is likely to rise marginally to around USD135 after displaying a sharp reduction in the past decade from over USD1000 to USD132 in 2021.

The problem for India

The research firm has argued that the large-scale transition to EVs in India, which was forecast to happen post 2023, will be delayed by at least three years. The lack of charging infrastructure continues to be an issue.

“The switchover to EV in the car segment will continue to be hampered by relatively much higher car prices (as against comparable prices of EV and ICE vehicles in the two-wheeler segment), as well as the lack of charging infrastructure which is yet to be ramped up on a pan-India basis,” the report said.

India’s imports of lithium-ion batteries jumped 54% from a year earlier to $1.83 billion in the year ended March, trade ministry data show. Almost 87% of the purchases came from China and Hong Kong, despite India’s efforts to shun imports from its northern neighbour.

To deal with concerns around import and promote self-sustainability, the government is reportedly seeking to change laws to allow private miners to extract lithium.

The Indian government is planning to add local manufacturing of a swathe of zero-emissions technologies as it chases a target of becoming carbon neutral by 2070 and to capture opportunities from the global transition to cleaner energy.

India has also pledged to build 500 gigawatts of clean power capacity by 2030, and the deployment of huge volumes of battery storage is seen as vital to enable the round-the-clock use of renewables.

Besides the effort to boost local output, India is also scouting for lithium and cobalt assets overseas. A joint venture has been formed with three state companies — National Aluminium Co., Hindustan Copper Ltd. and Mineral Exploration Corp. — to acquire mines overseas.

CNG remains the optimal choice in India

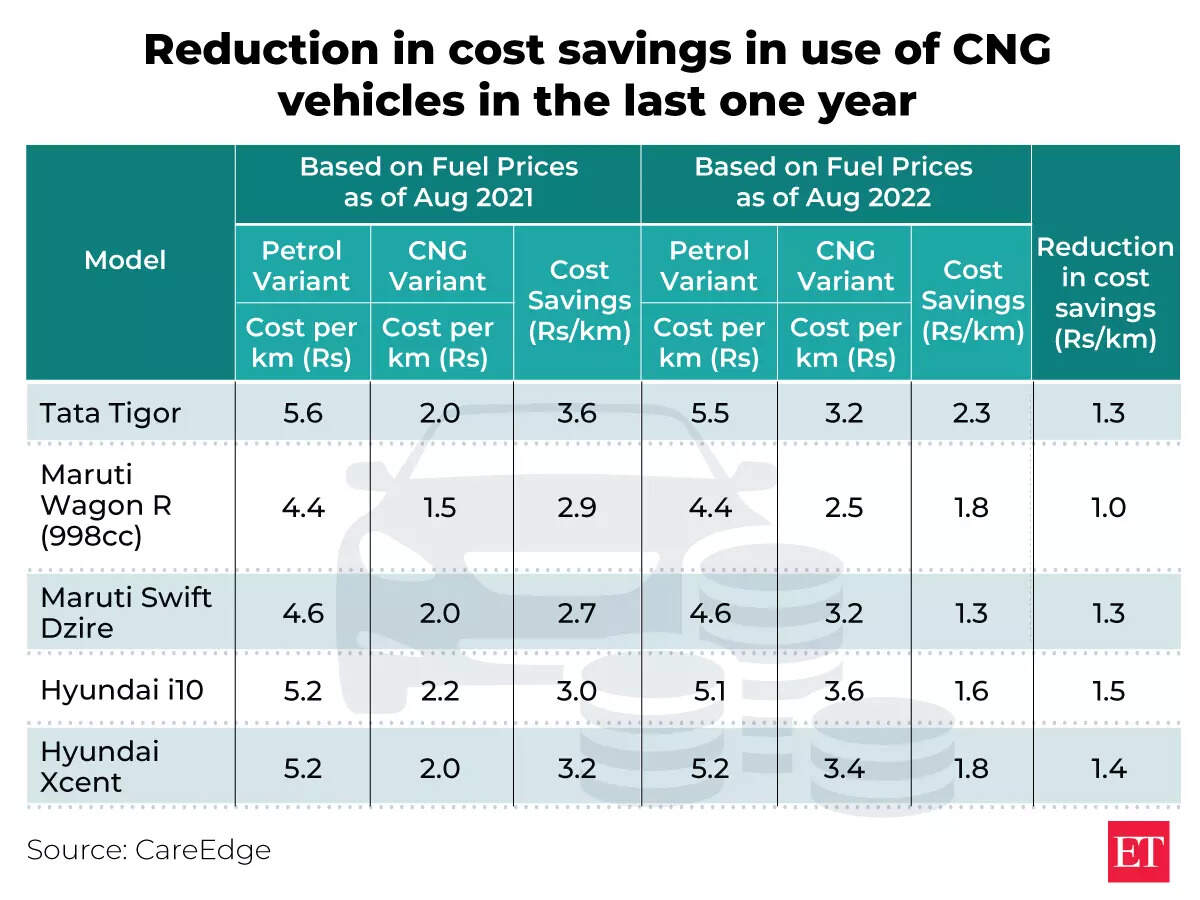

CareEdge in its report said that it expects CNG/LPG-based passenger vehicles to display the highest growth rate in the next five years on the back of lower cost of ownership and the price differential between petrol/diesel and gas prices.

The price differential has come down in the last few months as the government slashed excise duty on fuel even as CNG and LPG prices continued to climb on higher import costs. The research firm has opined that even though the demand will be tempered to some extent owing to this, it will continue to enjoy higher demand given the cost savings they will still continue to offer.