While the passenger vehicle market continues to fire on cylinders since the past year, thanks to the surging demand for SUVs, the uptick in the Indian economy and the increased government spend in infrastructure development is driving much-needed growth into the commercial vehicle industry.

Commercial vehicle wholesales numbers in the first quarter (April-July 2022) indicate that momentum is back and here to stay for the rest of the fiscal and beyond. As per apex industry body SIAM, wholesale numbers of 224,512 units (112%) in Q1 FY2023 and the strong performance of both the M&HCV segment (75,685 units / 159%) and LCV segment (148,827 units / 94%) reveal that CV customers are back into purchase mode as they go about replacing older vehicles and also invest in future business operations.

Combined goods carrier sales (M&HCV: 67,978 units & LCV: 137,237 units) of 205,215 units in Q1 FY2023 constitute 91% of total CV sales of224,512, the balance 9% being the 19,297 buses across both M&HCV and LCV segments.

FY2023 volumes could close in on 900,000 units

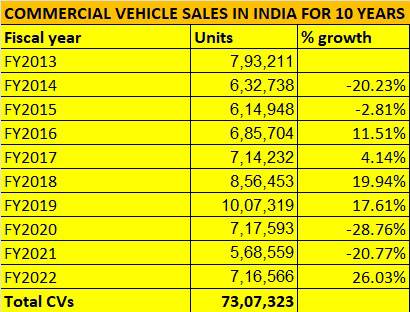

A quick analysis of the past 10 years’ CV industry sales in India reveals that the market revival, cyclical at that, has begun. Given FY2022’s sales of 716,566 units constituted a 26% YoY growth over a lower-base of 568,559 units in the pandemic-impacted FY2021 and the strong momentum in Q1 FY2023, it is estimated that demand for the sector could cross the 850,000-unit mark or even hit 900,000 units in FY2023. This would translate into 18-25% YoY growth and taking it to FY2018 levels of 856,453 units. FY2019’s million CV sales have been the best yet for the industry.

ICRA Research has forecast volume growth of 12-15% in FY2023, based on the fact that the industry has registered YoY growth of 112% in Q1 FY2023 (albeit on a low base) and is expected to continue its growth trajectory, given the improvement in the macroeconomic environment, replacement cycle and healthy demand from the end-user industries. Further, growth trends have continued into the current quarter also, with combined CV volumes of OEMs growing by around 87% in the first four months of FY2023, compared to the year-ago period.

Challenges to growth though could come through headwinds such as hardening of interest rates, elevated fuel prices, increasing vehicle prices to pass on the increase in commodity prices and geo-political issues.

Goods carriers delivering the goods for CV OEMs

According to Ms. Kinjal Shah, VP and Co-Group Head, ICRA Ratings, “The growth trends in the CV industry have been largely secular in nature, but more pronounced in the goods carrier sub-segment. Within goods carriers, growth in the medium and HCVs sub-segment has been spurred by demand from the steel, cement and mining industries and a pick-up in economic activity. This is expected to continue over the medium term, and ICRA expects volume growth of 15-20% for M&HCV (trucks) in FY2023. Within M&HCV (trucks), demand for tippers would continue to be supported by the pick-up in construction activity, while that for haulage trucks would be dependent on the general macroeconomic activity.”

The wholesale numbers in the first quarter (April-June 2022) of 224,512 units (112%) and the strong performance of both the M&HCV segment (75,685 units / 159%) and LCV segment (148,827 units / 94%) reveal that CV customers are back into purchase mode as they go about replacing older vehicles and also invest in future business operations.

Combined goods carrier sales (M&HCV: 67,978 units & LCV: 137,237 units) of 205,215 units in Q1 FY2023 constitute 91% of total CV sales of224,512, the balance 9% being the 19,297 buses across both M&HCV and LCV segments.

All M&HCV OEMs are benefitting from the growth percolating into the industry. Q1 FY2023 wholesales data reveals all six players have registered strong YoY growth, albeit on a low year-ago base.

The light commercial vehicles (LCV) segment started recovering earlier than the M&HCV segment, supported by healthy demand from e-commerce as well as from agricultural and allied sectors. However, the segment witnessed an 8% sequential dip in volumes in Q1 FY2023 as the pent-up demand tapered off and the base effect caught up.

Ms. Sruthi Thomas, Assistant Vice President & Sector Head, ICRA Ratings, added, “The upswing in the e-commerce sector since the pandemic, and the resultant change in purchasing habits resulted in increased last-mile transport requirements, thus spurring demand for smaller trucks. Accordingly, the segment’s quarterly volumes averaged at more than 125,000 units over Q3-Q4 FY2022, higher than the FY2018 levels and trending towards the industry highs reported in FY2019. The growth drivers for the segment remain largely favourable, especially the increased requirement for last-mile transportation from the e-commerce segment, while demand from the agricultural and allied sectors would remain dependent on stability of rural cash flows. Accordingly, ICRA expects the segment volumes to grow by 8-10% in FY2023.”

Buses back in action

Recovery in the bus segment has set in from Q4 FY2022 onwards. In Q1 FY2023, the segment reported healthy volume growth of 258% on a YoY basis to 19,297 units, supported by the re-opening of schools and offices and the gradual return to normalcy after the pandemic. ICRA expects a growth of 60-65% in the segment in FY2023, albeit on a low base.

As per the ICRA research report on the commercial vehicle industry published in July 2022, ICRA expects the CV book of financiers to grow by 7-9% in FY2023. The overall financing environment would remain a key monitorable going forward, especially the trends in the asset quality of CV financiers, which would remain dependent on the ability of the borrowers to pass through the fuel cost and interest cost escalations adequately in the near term.

ALSO READ

M&HCV & LCV goods carriers deliver the goods in strong Q1 FY2023

/analysis-sales/domestic-cv-volumes-in-fy2023-likely-to-cross-fy2018’s-850-000-sales-92558 Domestic CV volumes in FY2023 likely to cross FY2018’s 850,000 sales Macroeconomic improvements driving demand for M&HCV goods carriers while e-commerce is fueling a new growth charge for light and small commercial vehicles. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/1f55e661-d01b-4340-bf6a-3f569486b050.jpg