India is likely to post double-digit economic growth for the April to June quarter, banking on favorable base effect and consumption boost following easing of Covid-led restrictions.

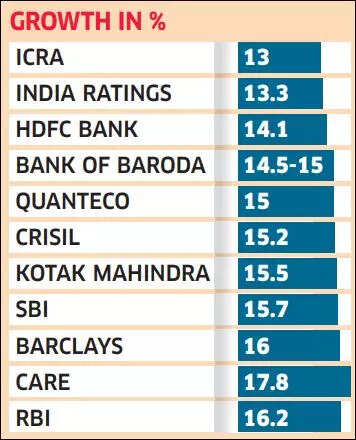

India’s gross domestic product output is expected to have expanded by an annual 15.7%, with a large possibility of an upward bias because several indicators have shown good progress in the Indian economy, as per the latest SBI Ecowrap report.

The progress in the economy is seen despite global spillovers, elevated inflation and some slackening of external demand as geopolitical developments take their toll on world trade.

Ritika Chhabra, economist and quant analyst at Prabhudas Lilladher, expects India’s GDP to grow by 14.0%-14.5% on year in the fiscal first quarter ending June 30 backed by a low base and strong domestic demand.

“A broad-based pickup was observed across consumption, services industry and investment. We expect the private final consumption expenditure, a measure of demand and gross fixed capital formation, a measure of investment, to grow by 16% and 14%, respectively. However, net exports will be a drag due to high average crude prices during Q1,” she said.

A rebound in private consumption – one of the key factors affecting GDP number – and growth in contact-intensive sectors like travel, tourism and hospitality amid declining Covid-19 fears during the first quarter of FY23 might push the number in an upward direction.

India faced a severe Delta wave of coronavirus in the comparable period last year, in turn affecting growth consumption demand slackened.

A Reuters poll of 51 economists expect a 15.2% surge in economic output, faster than 4.1% growth rate in the preceding quarter. If realised, this will also be the fastest pace of growth in a year. The data is due for release post market hours tomorrow.

ICRA also suggested that India’s GDP growth in the first quarter of the current fiscal may have grown in double digits at 13% owing to a low base and robust recovery in the contact-intensive sectors following the widening vaccination coverage.

Morgan Stanley wrote in a recent report, “a recovery in private capex is underway” as investments in infrastructure, manufacturing and technology services have picked up.

The Reserve Bank of India (RBI) has forecast 16.2% GDP growth for the first quarter and 7.2% for the fiscal year.

The rationale behind the growth

- Low-base effect: A favourable and low base might aid the GDP growth. A low base means the base year or month with which the current figure is being compared. GDP for Q1 FY22 stood at 20.1%, but the reading was magnified again by contraction of 23.8% during Q1FY21.

- Pent-up consumer demand: Easing of Covid-19 restrictions led to increased consumer demand which, in turn, might have given a boost to the private consumption sector constituting 57% of GDP. Contact-intensive sectors like restaurants and hotels, travel and tourism, etc have seen a growth in the past few months.

- Higher vaccination rate: There is no doubt that India has emerged as one of the countries with highest vaccination rates which stands close to 68%. With the government announcing vaccines for children and free booster doses for adults, the population of fully vaccinated people is expected to increase further.

- Excise duty cuts on fuel: In one of the most significant moves by the Modi-government, excise duty on petrol and diesel was reduced by Rs 8 a litre and Rs 6 a litre, respectively. Import duty on coal was lifted from the previous 2.5%. Slashing of crude and edible oil prices pushed consumption demand.

- Investment growth recovery: Businesses ramped up capacity as domestic demand recovered, which indicated a nascent recovery in the economy. Most likely, the turnaround in investment from the pre-pandemic levels is going to support the growth.

Likely growth impediments

- Intense heatwave: Excessive and early heat waves resulted in destruction of crops impacting the agricultural sector which is the backbone of the Indian economy. This led to an increase in prices of commodities causing heatflation in the country.

- Ban on exports/imports: United Arab Emirates (UAE) had in June ordered a four-month suspension in exports and re-exports of wheat and wheat flour originating from India. In addition to this, India had banned wheat exports in a surprise move on May 14 this year. The sudden ban on wheat exports resulted in complete collapse of the export pipeline which ultimately affected growth. Ban on palm oil exports by Indonesia added to the woes.

- Rupee hitting all-time low: While rising inflation, tightening monetary policy, and climbing crude oil prices have made the current fiscal a difficult one for the INR, the Russia-Ukraine war sparked a near-freefall, with the Rupee having lost nearly 7% in value since Russia’s invasion on February 24.

- Geopolitical tensions: The rising geopolitical tensions amid war between Russia and Ukraine impacted the economy severely. The war caused supply-chain disruptions creating a blockage in the manufacturing industry. Ukraine is a supplier of about 30% of the grains in the world. The worries of Chip shortage contributed to the worries of increasing inflation.

- Inflation: Retail Inflation in the first quarter of FY23 remained over 7% crossing the upper limit of RBI’s tolerance band. June was the sixth consecutive month when the headline CPI inflation remained at or above the upper tolerance level of 6%.

The Reserve Bank of India in its August bulletin noted that inflation in July 2022 eased by 30 basis points from June 2022 and 60 basis points from the average of 7.3% for Q1 FY23, thereby validating its hypothesis that the retail inflation peaked in April in India.

Go to Source