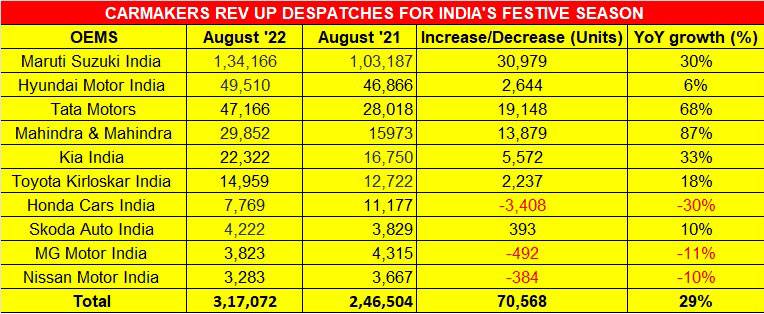

As expected, August 2022 has turned out to be quite an august month for the passenger vehicle industry in India. As per the wholesale numbers announced by 10 of the 16 PV manufacturers in the fray, a total of 317,072 units constitutes 29% year-on-year growth (August 2021: 246,504). Of these 10, three OEMs – Honda Cars India, MG Motor India and Nissan India – have reported YoY declines.

What has helped OEMs rev up the despatches to dealers across the country is the easing of the vexing semiconductor supply chain issue as well as the opening of the festive season in India, which is when consumers prefer to make a new vehicle purchase and OEMs typically keep their showrooms well stocked. The other growth driver, of course, remains the continued surge in demand for SUVs, which now account for nearly 50% of the overall PV market. Here’s looking at how the leading OEMs fared in August 2022.

Maruti Suzuki India: 134,166 units / 30%

India’s passenger vehicle market leader despatched 134,166 units, up 30% YoY (August 2021: 103,187 units) and its five-month tally of 646,170 units in April-August 2022 is a good 22% improvement too (April-August 2022: 529,981).

The company is seeing growth for all its vehicle categories other than the premium Ciaz sedan. Importantly, demand is returning to its entry-level models. The Alto and S-Presso together account for 22,162 units, up 8.31% YoY. Its six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R contributed 71,557 units, which constitutes a 70% YoY increase (August 2021: 45,577). The UVs – new Brezza, Ertiga, S-Cross and XL6 – added another 26,932 units, up 11% YoY.

Maruti Suzuki India currently has a ‘problem’ of plenty. It has new vehicle bookings of 387,000 units. This number was around 280,000 units in Q1 FY2023, but strong customer demand for the new Brezza compact SUV and the midsized Maruti Grand Vitara has increased the backlog by another 100,000-odd units. And the order backlog includes CNG variants which account for 33% or around 126,000 units.

Clearly, Maruti has to get all its plants running at full capacity but that’s easier said than done. At this stage in the fiscal, Maruti Suzuki is well placed to accelerate growth on the back of its new SUVs, huge order backlog as well as the general improved market sentiment. It’s only the inadequate chip supplies which are playing spoilsport.

Hyundai Motor India: 49,510 units / 5.6%

Hyundai Motor India, the No. 2 PV player, reported despatches of 49,510 units, up 6% on the year-ago tally of 46,866 units. The Creta continues to be the mainstay for the Korean manufacturer, even as the Venue compact SUV delivers the goods. For Hyundai, which is currently the fourth-placed utility vehicle OEM in India, ramping up production to meet demand is critical.

Tarun Garg, Director (Sales, Marketing & Service), Hyundai Motor India, said: “With the continuously improving semi- conductor situation, supplies continue to go up.”

Tata Motors: 47,166 units / 68%

Tata Motors is on a roll and reported wholesales of 47,166 PVs, which translates into 68% year-on-year growth (August 2021: 28,018 units) and just 339 units shy of the carmaker’s best monthly sales figure: 47,505 units in July 2022. In August 2022, it is just 2,344 units behind Hyundai.

Sales of 43,321 ICE PVs (Altroz, Tiago, Tigor, Nexon, Punch, Harrier and Safari) were a 60% YoY increase (August 2021: 26,996) and 3,845 EVs a 276% YoY growth (August 2021: 1,022).

The company has recently entered the CNG market with its Tiago i-CNG and Tigor i-CNG but where it has a huge advantage over the PV competition is with its EV portfolio. At present, it has three models – the Nexon EV, Tigor EV and the fleet-only XPres-T EV – but is looking to aggressively expand its EV portfolio. It is understood that there are 10 new EVs to be added in the next few years as the company looks to increase its EV presence and also keep new competition at bay. As is known, Mahindra & Mahindra will be revealing its all-electric XUV400 on September 8. At 3,845 units last month, EVs account for 8% of Tata’s overall PV sales, establishing the importance of the first-mover advantage.

As is known, Tata has targeted production and sale of over 500,000 PVs this fiscal. In the first five months of FY2023, it has averaged monthly sales of 44,959 units. If it maintains this growth trajectory, there is no reason why the half-a-million target should not be achieved.

Mahindra & Mahindra: 29,852 units / 87%

Mahindra & Mahindra, like Tata Motors, has recorded strong YoY growth last month. The company, which is riding the surging wave of demand for SUVs with a number of its products, reported wholesales of 29,852 units, up 87% YoY (August 2021: 15,973 units). Ninety-eight percent of these – 29,516 units – comprised SUVs.

According to Veejay Nakra, President, Automotive Division, M&M< “August was a very exciting month across many segments for us. Demand across our portfoio remains strong and is enhanced with launches of the Scorpio N, Scorpio Classic and new Bolero Maxx Pik-up. The supply chain situation continues to remain dynamic for select product lines and we are taking appropriate actions to minimise impact.”

Kia India: 22,232 units / 33%

Kia India clocked 22,322 units of wholesales in August 2022, a YoY growth of 33.27%. The Seltos, Kia’s first product in India launched in August 2019, remains its best-seller – with 8,652 units, the Seltos accounted for 39% of overall sales last month. The Sonet (7,838 units / 35% share), Carens (5,558 units / 25% share) and the Carnival MPV (274 units / 1.23% share).

On August 2, Kia launched the Seltos with six airbags, making it the first SUV in its segment to get six airbags as standard, with the carmaker also increasing prices by up to Rs 30,000 across trim levels. The SUV now comes priced between Rs 10.49 and Rs 18.75 lakh, ex-showroom, with the additional safety kit making it ready to comply to the upcoming six airbag mandate for cars from October 2022.

Commenting on the August 2022 sales, Hardeep Singh Brar, VP and Head of Sales & Marketing, Kia India said, “We have been observing upward sales momentum since the beginning of this year, and it is a good sign for the Indian automotive market. Comparing the quarters, our monthly average so far for Q3 of 2022 stands at 7.8% over Q2 and 10.9% over Q1 of this year, indicating gradual improvement in supply chain constraints and healthy consumer sentiment. With the demand and supply curve staying positive, we are optimistic that an excellent festive season in terms of sales is ahead of us.”

Toyota Kirloskar Motor: 14,959 units / 17%

Toyota Kirloskar Motor reported wholesales of 14,959 units in August 2022, which marks 17% YoY growth (August 2021: 12,722 units). The company’s cumulative wholesales in the first five months of FY2023 are 76,073 units, which is a YoY increase of 68% (April-August 2021: 44,998 units).

Atul Sood, Associate VP, Sales and Strategic Marketing, TKM said, “Last month, our segment-leading models like the Innova Crysta, Fortuner and the Legender witnessed unprecedented customer orders. The new Glanza and the Urban Cruiser continue to garner customer interest as well as orders. The Vellfire MPV has performed exceptionally well, registering a growth of close to 120%. Similarly, the Camry Hybrid has garnered very encouraging customer orders.”

Sood added that the initial response for the soon-to-be-launched self-charging hybrid Urban Cruiser Hyryder electric SUV “has been phenomenal”. Meanwhile, the company is working on launch plans for the upcoming Limited Edition Crysta Gasoline.

On August 30, TKM issued an official release saying it is to “temporarily stop taking orders for the diesel variant” of the Innova Crysta MPV. The statement did not clarify as to when the diesel variant, which is the best-seller for TKM, will be back on sale. According to dealers, bookings for the Innova Crysta diesel have been halted due to the semiconductor shortage. It is understood that the company will fulfill all bookings it received until early August 2022 for the diesel variant as per the stipulated time, but future bookings are likely to be delayed by a few months. Considering the diesel-engined Innova Crysta is one of TKM’s high sellers, TKM’s growth trajectory this fiscal could be impacted.

Growth outlook: Over to the buyer now

At an estimated 330,000 units last month, August 2022 will be the best month for wholesales in the ongoing fiscal. As per SIAM industry data, April 2022 wholesales were 251,581 units, May 2022was 251,052 units, June 2022 was 275,788 units and July 2022 was 293,865 units.

India’s festive season has begun with Ganesh Chaturthi on August 31 and it continues right till Diwali which is at the end of October. Onam, the popular 10-day harvest festival began on August 30 and the nine-day Navratri festival begins on September 26 and ends on October 4. These are two months which will see plenty of new vehicle purchases, particularly with the improved market sentiment.

This is just what carmakers as well as two-wheeler manufacturers are banking on, and the robust August 2022 vehicle despatches to dealers and showrooms depict just that. Maruti Suzuki and Mahindra & Mahindra are among the carmakers with sizeable order backlogs and, like other OEMs, they will be doing their best to keep their manufacturing plants buzzing to meet demand. What is important though is the real-world market scenario – the retail sales count for August, which we will know later this month.

/analysis-sales/it’s-an-august-month-as-carmakers-rev-up-despatches-for-festive-season-92683 It’s an August month as carmakers rev up despatches for festive season Improved supplies of chips and in turn higher production, a flurry of new SUV models and opening of two months of festivals in India see OEMs pack a punch in August 2022. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/e4b481ec-2ea3-4503-8279-6c64f14c9ce0.jpg