The market grew 9.1% in August compared to the same month in 2021. However, it fell 30.3% compared to August 2019.

Registrations of light commercial vehicles rose 9% compared to the same month of the previous year, with 9,039 units.

Industrial vehicles, buses, coaches and minibuses increased their sales by 32.8% in August to 1,418 units.

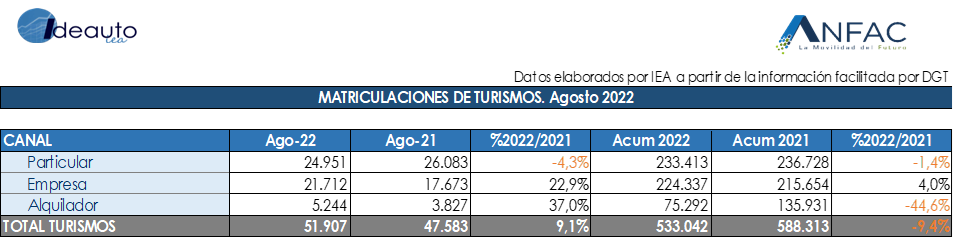

Madrid, September 1, 2022. The month of August registered a 9.1% increase in car and SUV registrations compared to the same month of the previous year, with a total of 51,907 units. During the last month, the market grew, but a change in trend is not expected, given the current economic context with inflation at 10.4% and geopolitical tensions. In fact, the data for the last month is 30.3% lower than the 74,490 passenger cars sold in August 2019, when a serious pandemic was not expected. As for the accumulated figure for the year up to August, sales of passenger cars and SUVs totaled a drop of 9.4% compared to the same period of the previous year, with 533,042 units.

The average CO2 emissions of passenger cars sold in the month of August remain at 122 grams of CO2 per kilometer traveled, 1.3% lower than the average emissions of new passenger cars sold in August 2021. Until the month of August emissions have been reduced by 3.8% compared to the same accumulated period of the previous year.

In the last month, sales to companies grew by 23% with 21,712 deliveries. In the accumulated figure for the year, this channel is the only one showing an upward trend with 224,337 units and an increase of 4%. Last month the rental channel also closed positive with a rise of 37% to 5,244 units. However, this channel fell 44.6% so far this year to 75,292 registrations, being the one that suffers the most from the shortage of semiconductors.

For its part, the individual channel closed again with a drop in August of 4.3% to 24,951 sales. So far this year, families have bought 1.4% fewer cars than in the same period last year with a total of 233,413 deliveries. The economic uncertainty with a scenario of rising interest rates and inflation growing at a double-digit rate, plus some messages against the private vehicle, including the new and electrified one, delays the purchase decision of families. This aggravates the decarbonization problem, by penalizing the renovation of the park.

LIGHT COMMERCIAL VEHICLES

In August, registrations of light commercial vehicles registered a rise of 8.8% and a total of 9,039 units. In the accumulated of the year, 77,184 units have been sold, which represents a decrease of 29.9%. As for the channels, that of renters fell 32.2% in August; while the self-employed and companies rose 5.8% and 27.8% last month.

INDUSTRIAL AND BUSES

The registrations of industrial vehicles, buses, coaches and microbuses maintained the increase in their sales in August with growth of 32.8% and 1,418 units sold. For the total of the year, 15,819 units are accumulated, 11.1% more compared to the same period of the previous year. As for industrial vehicles, heavy vehicles of less than 16 tons are the ones that pulled the market in August with a rise of 35.5% and a volume of 1,110 units. For their part, the buses with 107 units almost triple the sales of August 2021.

DECLARATIONS

Félix García, director of communication and marketing at ANFAC, explained that “the car and SUV market achieved a slight increase in the month of August. But this data can be misleading since in relation to 2019, in a pre-pandemic context, sales fall above 30% and in the accumulated the contraction of the market with respect to that year is 40%. The sector continues to suffer from the microchip crisis aggravated by the complicated international geopolitical scenario that generates uncertainty in the economic situation with high inflation and rising money prices. At this juncture, in addition, some messages against the use of the private car do not help in the purchase decision for users, even if this is a new and electrified vehicle.

Raúl Morales, communication director of FACONAUTO, indicated that “despite the slight improvement in the market in August, the very low number of vehicles sold continues to tell us of a rickety and depressed market that, impacted by a totally unfavorable context (increase in prices, high cost of fuel or distrust of families when it comes to consumption) is not being able to change its dynamics to approach more reasonable figures. The crisis that the automotive industry is experiencing in our country is unprecedented and its consequences for employment and competitiveness are unpredictable, which is why the inaction and unwillingness of the Government to meet with the sector is not understood, as we have already requested from Faconauto or from the UGT itself, to find measures that promote the viability of such a strategic activity for the economy and consumption”.

According to the communication director of GANVAM, Tania Puche, she highlighted “the market closed in positive after five consecutive months of declines. However, we cannot launch the bells on the fly because the volume is still more than 30% below pre-pandemic figures. In addition, sales to individuals, which are what mark the health of the market, completed a quarter in August due, to a large extent, to the fact that the current climate of economic uncertainty does not invite buying. In fact, this weakness in demand is evidenced by the fact that, in a context of lack of supply derived from the supply crisis, the remaining vehicles have not gone to the private channel – which is the one that is prioritized for being the one that contributes the most profitability- but to that of rental companies that, although they have not been able to have a fleet in time to face the summer campaign, have thus been able to overcome nine consecutive months of double-digit falls”.