Foreign banks and rating agencies are increasingly growing bullish on India’s growth potential and as a key investment destination, while the global economy keeps brooding over deep pains brought about by the biggest economies be it in the form of frontloading of Federal Reserve rate hikes or China’s worsening construction bubble.

Moody’s yesterday affirmed a stable outlook on India, saying its credit profile reflects key strengths, including its large and diversified economy with high growth potential, a relatively strong external position, and a stable domestic financing base for government debt.

In fact, McKinsey & Co’s chief executive said it’s not India’s decade, but it’s India’s century. A large working population, multinational companies reimagining global supply chains, and a country leapfrogging at digital scale-to achieve something special not just for the Indian economy but potentially for the world are the key elements in place to drive Asia’s third largest economy.

“India is the future talent factory for the world. By 2047, India would have 20% of the world’s working population. And with supply chains being reimagined, it has massive potential for India across all aspects of manufacturing. The third is digitisation. India has leapfrogged on the digital scale. All those are the raw materials to do something special for not only the Indian economy but potentially for the world,” McKinsey’s Bob Sternfels told ET.

India’s finance minister today highlighted that emerging economies like that of India are showing full potential to lead the global economy for the next 50-60 years. “They (emerging economies) are the ones which are robust and are coming out in a very comprehensive way out of the economy. They are the ones who have solutions for many of the issues, whether it is based on food security or commodity prices. These are the markets which will give you both the supply and the supply and demand side answers in the next 25-40 years,” she added.

India’s Rebound Story

India’s rebound story is also getting too common for the markets, economy and its financial instruments.

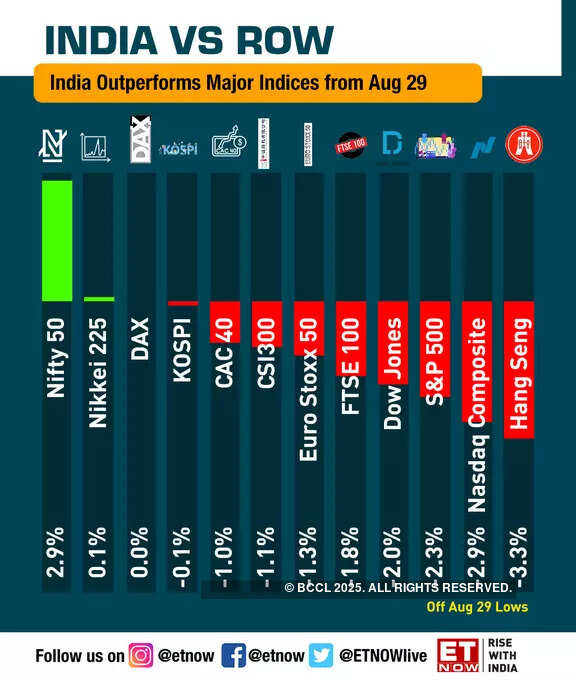

On August 29, Sensex jumped a whopping 1,564 points to record its second best single-day gain of the year, while the local currency too logged its biggest one-day gain in a year against a wobbly dollar. The Nifty 50 rose 2.9% between Aug 29 and yesterday, outperforming the US and Chinese markets. In contrast, the Dow fell 2% and Hang Seng dropped 3.3% over the same period.

Foreign Investors Return To India

Moreover, foreign investors, who had earlier shunned India as an investment destination, are returning to Asia’s third largest economy and have pumped in about $7.6 billion in one month. August marked the first month this year when overseas investors turned net buyers of India’s government debt. In August, FIIs bought equities worth Rs 51,000 crore, a sharp rebound from Rs 5,000 crore of net investment by FPIs in July, when they turned net buyers for the first time after nine months.

Between October last year and June 2022, the overseas investors had sold a massive Rs. 2.46 lakh crore of Indian equities.

When the FII selling was at its peak and many global markets were caught in a bear grip, the downside in Nifty was relatively less because of heavy participation from domestic investors. With FII support, Nifty is now 950 points away from racing past all-time highs.

India is now reaping the benefits of stronger corporate earnings, despite higher crude oil prices and fears of global recession.

“For India, the FPI movement has been similar to that of other major EMs like China, Korea, Taiwan, etc. A stabilized inflation scenario compared to other countries and sustainable growth in earnings from Indian companies have also helped in a big way,” Jisang Yoo, CEO, Mirae Asset Capital Markets, had told ETMarkets.

The central bank too has helped attract the flows as they took a slew of measures in recent months.

Growing Confidence of New Delhi, Mint Street

Another revival story is also entrenched in the government’s and the central bank’s conviction in the inflation trajectory and the economic growth.

Sitharaman had categorically refused to associate terms like- stagflation and recession with the current state of the Indian economy. “India’s general debt is also in a good position compared to many other countries,” she said.

Noel Quinn, Group Chief Executive at HSBC, the world’s local bank, told ET that inflationary pressures in India are not as great as that prevalent elsewhere in the world. “I think India in particular, has a very strong, bright future ahead of it. It’s quite a stable economy, with manageable inflation, very strong growth prospects, and a stable political environment within India. And I think that fosters a very strong growth environment,” he said.

Quinn said the Indian economy is progressively getting unlocked because of digitisation and simpler tax structure and is poised to reap the benefits of “re-globalisation” that is underway as companies alter supply lines to face the new geopolitical realities

Mint street on its part has in recent weeks repeatedly said that India’s inflation has peaked. Reserve Bank of India Governor Shaktikanta Das had referred to the country’s economy as an island of stability despite two Black Swan events and multiple shocks.

Black Swan events refer to unpredictable incidents that lead to negative consequences.

While Das did not list the Black Swan events, the global economy in recent times was ravaged by the coronavirus-induced crisis, which did not spare India as well and Asia’s third largest economy suffered one of its worst contractions in fiscal 2021. Soon after, Russia’s invasion of Ukraine destabilised the global food and oil supply chain, triggering multi-year high inflation readings. India’s retail inflation print surged to about eight-year high in April.

But as mentioned, the revival story is intact, and it is coming at a time when investors across the globe are jittery.

India To Benefit From China’s Miseries

China had by a whisker avoided posting a contraction in the second quarter as pandemic-led lockdowns and the plunging construction sector wrecked consumer and business confidence.

The property sector crisis inflicted serious wounds to China’s largest lenders, as real estate bad debt surged in the first six months of the year.

Home sales in China have fallen for 11 straight months, the longest such streak since the world’s second biggest economy created a private property market in the late 1990s.

“The future outlook of the construction sector in China over the long run structural factors such as demographic ageing and rebalancing of the economy will eventually remove a substantial portion of demand,” State Bank of India said in a research report. However, while the China story may now be facing clear headwinds, India is likely to benefit from such stark realities over the longer term, it added.

“India is likely to be the beneficiary as China slows down in terms of new investment intentions.”

Also Read: