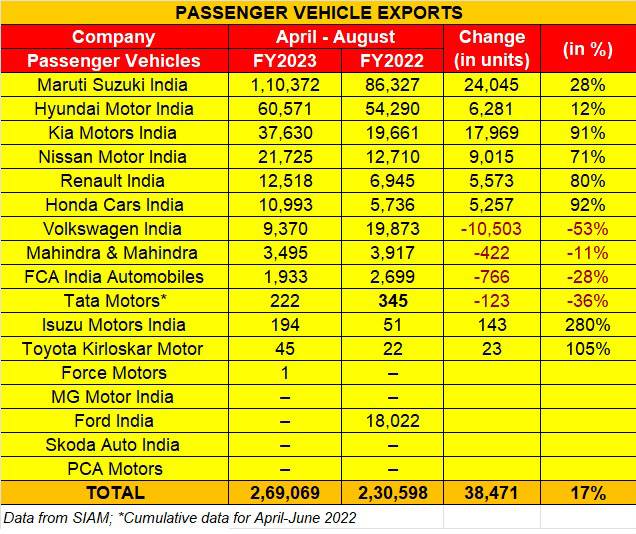

Passenger vehicle market leader Maruti Suzuki India, which wrested the made-in-India PV export crown from Hyundai Motor India in FY2022 with shipments of 235,670 units, has taken a strong lead in the first five months of FY2023.

The company, which currently has a strong order book in India and a backlog of 417,000 units, has shipped 110,372 units in the April-August 2022 period, registering 28% year-on-year growth. With seven months still to go in FY2023, at this stage the carmaker has clocked 47% of its FY2022’s exports of 235,670 units which were its best ever.

Maruti Suzuki continues to sees its best export gains from the premium Baleno hatchback which, along with the Celerio, has chalked up cumulative numbers of 57,250 units (up 23%). The SUV duo of the Jimny and Brezza SUVs with 24,493 units (up 56%) is best in terms of percentage growth. The entry level Alto and S-Presso saw YoY growth of 15% with 21,729 units, while the Ciaz with 3,803 units (up 56%) and Ertiga/ S-Cross with 2,913 (up 17%) also made gains. Export demand for the Eeco van though dropped 66% to 158 units.

Hyundai ships fewer Cretas and Venues than it did a year ago

Hyundai Motor India, which was the No. 1 exporter in FY2020 when it took the crown from Ford India, and also in FY2021, when it pipped a hard-charging Maruti Suzuki by just 9,404 units, will have to do a fair bit of catching up if it is to beat Maruti in the export game this fiscal. Between April-August 2022, Hyundai has exported 60,571 units, up 12% YoY.

While the trio of the Aura, i1o and the i10 saw exports of 28,931 units (up 6%), the Verna was the strong growth driver with 15,491 units (up 47%). The premium Alcazar SUV has 3,052 units to its export tally (up 1140% on a low year-ago base of 246 units). However, the Creta and Venue exports have seen a decline: The Creta with 11,141 units is down 13% YoY, and the Venue with 1,956 units is down a sharp 42%.

Seltos powers Kia India’s overseas shipments

At No. 3 position is Kia India with 37,630 units, up 91% (August 2021: 19,661). The midsized Seltos SUV, Kia’s longstanding best-seller in India, is also its most popular export model with 20,539 units (up 71%), followed by the Sonet compact SUV with 14,701 units (up 92%).

Meanwhile, Nissan Motor India exported a total of 21,275 units between April and August, with the Sunny sedan contributing 18,982 units (up 101%) or 91% of total exports. The company also shipped 2,743 Magnite SUVs (up 18%). Nissan India’s export performance is better than its domestic market sales: 14,706 units in April-August 2022. In end-July, the company recorded a key export milestone: shipment of its millionth vehicle manufactured at the Renault-Nissan Automotive India plant in Chennai. The export journey to the million-units milestone has taken a little less than 12 years.

Renault Motor India, at fifth place in the export rankings with 12,518 units and 80% YoY growth, saw demand for its Kiger/Triber SUVs grow 100% YoY to 7,892 units while the Kwid hatchback with 4,626 units was up 55 percent YoY.

The City sedan continues to power Honda Cars India’s exports: of the total 10,993 units shipped, the City accounts for 94% (10,345 units / up 107%)

FY2023 set to be a good export year

Maruti Suzuki’s sterling export performance could be attributed to the fact that the company is being able to procure more number of semiconductor chips which are specific to its export models, than the ones powering its domestic cars on sale in India. Most of these chips are related to electronic components such as the vehicle’s ECU.

Cumulative exports from 16 carmakers, as reported by industry body SIAM for the April-August 2022 period are 269,069 units, up 17% YoY (April-August 2021: 230,598). Given that the domestic PV market is firing on all cylinders, most OEMs are putting their shoulder to the wheel of their manufacturing to produce all they can. If some of them are getting their export act right, then that’s all the more creditable given that the margins on export products are handsome, if not lucrative.

Ample proof of this is the production figures: these 16 OEMs between them produced a total of 1,755,071 units, up 00% over the 1,400,776 units in April-August 2021. Maruti Suzuki rolled out a total of 790,174 units, up 23% (April-August 2021: 640,443) while Hyundai produced 296,100, up 14% YoY and Kia manufactured 146,188 units at its Anantapur plant, up 57% YoY.

/analysis-sales/export-leader-maruti-suzuki-takes-huge-lead-in-first-five-months-of-fy2023-92781 Export leader Maruti Suzuki takes huge lead in first five months of FY2023 Having shipped a total of 110,372 units in April-August 2022, Maruti Suzuki is 49,801 units ahead of its closest rival, Hyundai Motor India. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/5f05aaf5-9216-42f3-b0a5-4d9da85d29e2.jpg