Denim, the fintech platform for freight and logistics formerly known as Axle Payments, today announced that it raised $126 million in a Series B funding round led by Pelion Venture Partners with participation from Crosslink Capital, Anthemis, Trucks VC, FJ Labs, Tribeca Early Stage Partners and Refashiond Ventures at a “nine-figure” valuation. CEO and co-founder Bharath Krishnamoorthy tells TechCrunch that the new cash, a combination of equity ($26 million) and debt ($100 million), will be put toward scaling the business and providing Denim’s customers with working capital.

Krishnamoorthy and Denim’s other co-founder, Shawn Vo, had been friends for 16 years before they launched the company. Vo was in the credit risk department at Barclays and a full-stack developer at Fintria, a fintech company, while Krishnamoorthy was an associate at several law firms including Gibson, Dunn & Crutcher.

“We witnessed a significant gap in the freight broker market, where legacy systems — i.e., paper checks, physical filing — were still in place, and developed an intuitive payments technology to help streamline broker operations and attract the best carrier relationships through the platform,” Krishnamoorthy told TechCrunch via email.

To that end, Denim provides financial products, operations tools, and automated workflows for freight brokers — the middlemen between shippers and carriers. The company handles broker invoicing, collections, and payments and in addition provides access to debt financing.

“The industry has shown reluctance to abandon its legacy processes — many shippers still pay freight brokers on 30-60 day terms despite carriers expecting near-instantaneous payments. These longer time frames can create cash flow problems,” Krishnamoorthy added.

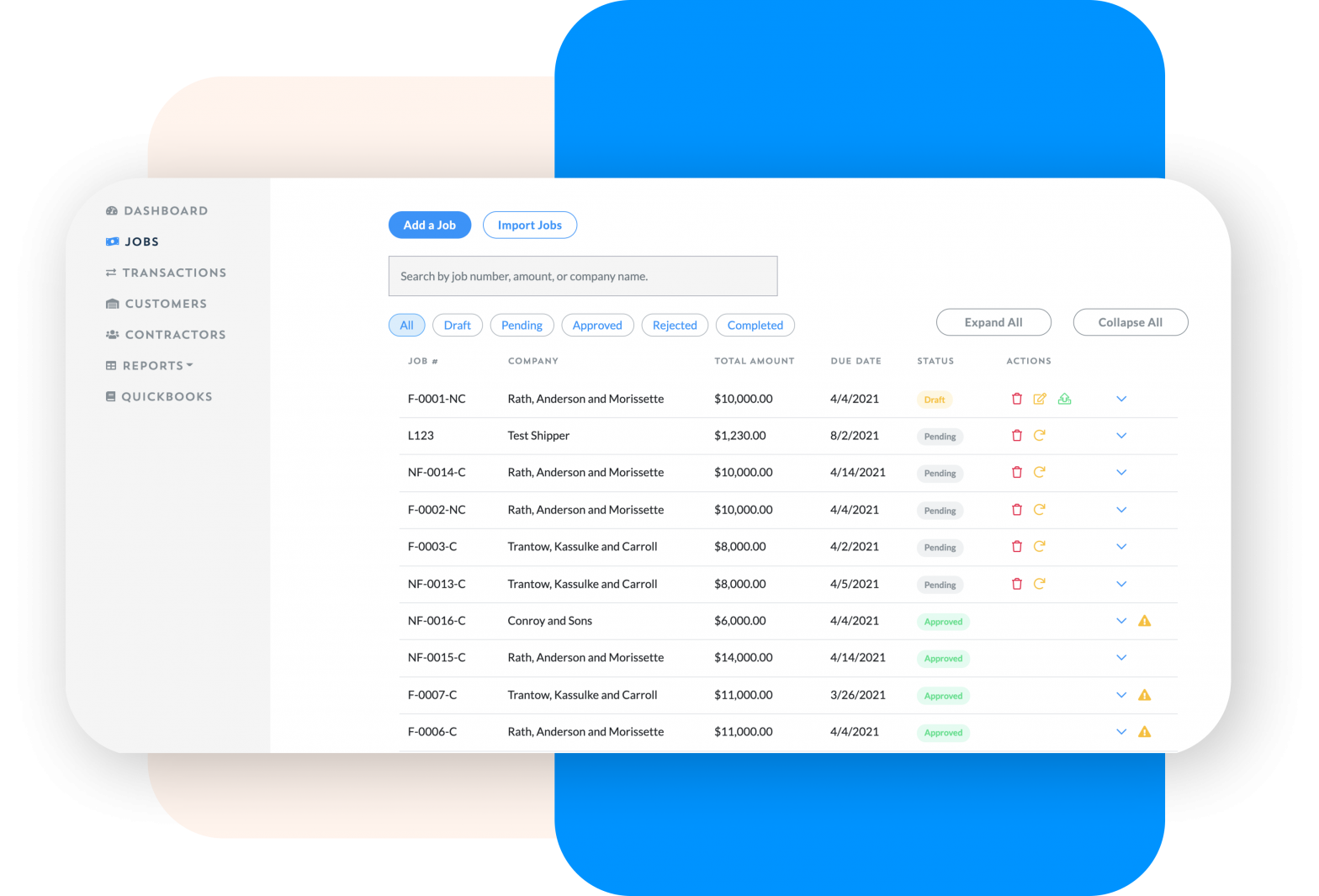

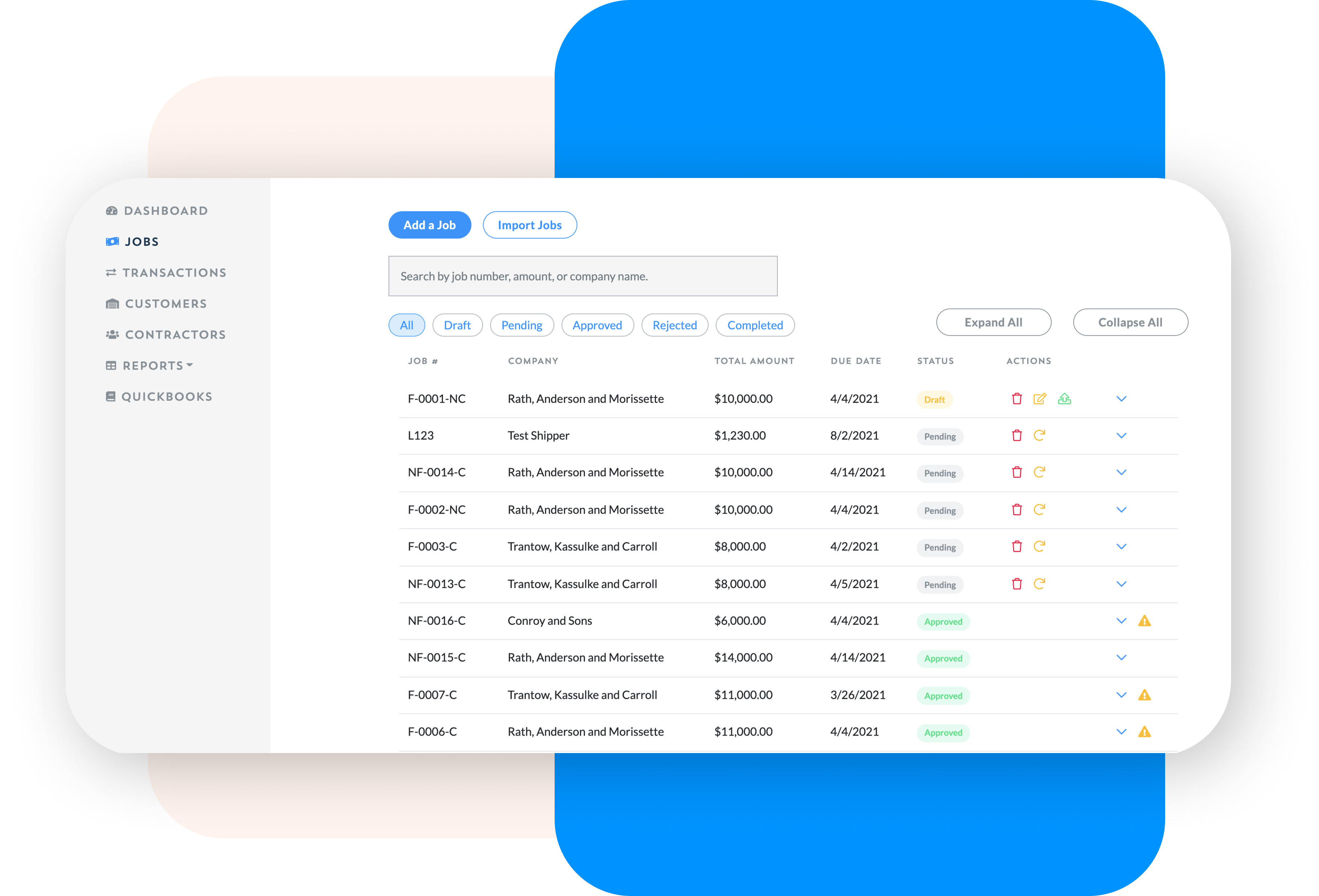

Managing jobs in Denim.

Denim uses algorithms to reduce the amount of time its operations team spends evaluating the risk of invoices it purchases from brokers. For each shipment, these algorithms review 20 different data points and either approve the purchase or flag that a manual review is required.

Beyond this, the Denim platform integrates with accounting software like QuickBooks to allow brokers to share data between various existing systems. From a dashboard, users can see metrics like pending or completed jobs, total factored amounts, the most frequently used carriers and the fastest-paying customers.

“This combination of automation, financial stability and accurate reporting enables freight brokers and their partners to navigate volatile shifts in the economy. And most importantly, it ensures the entire supply chain continues moving in the right direction,” Krishnamoorthy continued. “In our current economic environment, companies can’t afford to ignore back-end risks and slow processes.”

Denim competes with other fintech firms in the space, including TriumphPay, HaulPay and OTR Capital. Curiously, Krishnamoorthy declined to say how many customers the company currently has or where its revenue stands. But he did volunteer that Denim has connected over 7,000 freight brokers, shippers and carriers since its launch three years ago.

“Despite the slowdown, Denim is uniquely positioned to continue scaling its platform and workforce. We’ve established a financial model based on healthy unit economics,” Krishnamoorthy said. “We’re bringing new solutions to market to give freight brokers the ability to seamlessly operate at full capacity and adapt to changes in the supply chain. And we’re hiring talent that not only aligns with our business goals but with our core values.”

Denim has 100 full-time employees and plans to reach 120 by the end of the year, funded in part by the new equity. To date, the startup has raised a total of $165 million.