Asian non-luxury brands and European luxury brands had the lowest inventories. Non-luxury brands with the lowest inventories were Kia, Toyota, Subaru, Honda and Hyundai. Luxury brands with the lowest inventories were Land Rover, Lexus, Acura, Porsche and BMW.

Graphic: Cox Automotive

New-vehicle inventory closed August higher than it did a year ago, when the global computer chip shortage began hurting production, but supply remains low compared with pre-pandemic times, according to Cox Automotive’s analysis of vAuto Available Inventory data released Sept. 15.

After bumping around through the month, the average listing price closed August about where it was at the end of July.

The total U.S. supply of available unsold new vehicles stood at 1.23 million units at the end of August, up 31%, or about 287,000 units, from the year before. Days’ supply was 40. At the end of August 2021, the supply was 930,000 vehicles for a days’ supply of 27. As anticipated, the percentage and the raw volume difference in supply between this year turned positive.

“Available supply is at its highest level in our data since June 2021,” said Charlie Chesbrough, Cox Automotive senior economist, in a news release. “Still, it is far below historical levels. Production just cannot catch up to demand yet.”

The end-of-August available supply is up a bit from the revised end-of-July available supply of 1.09 million. Inventory has hovered in that range since the start of the year, although supply is still far below levels of the past. In 2020, new-vehicle inventory at the end of August was 2.48 million units for a days’ supply of 57. At the same time in pre-pandemic 2019, it was 3.45 million for a days’ supply of 80. Days’ supply for 2022 has been in the mid-30s range since mid-January.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, in this case, which ended Aug. 29 for about 911,567 vehicles sold. For the calendar month of August, sales totaled 1.128 million, down 16% compared to August a year ago. This August’s seasonally adjusted annual rate (SAAR) was 13.2 million, up slightly from last year’s 13.1 million but down a bit from July’s 13.3 million.

Non-luxury inventory totaled 1.02 million units entering September with a 40 days’ supply. Luxury supply stood at 124,819 units for a 44-day supply at the start of September.

Asking Prices Climb Again

The average listing price – or the asking price – has been creeping up since December of 2021. The average listing price was $46,624 at the end of August, above the revised $46,426 at the end of July. The listing price is running 11% above August a year ago.

Prices are expected to remain elevated due to continued high demand, low inventory and record low incentives. In addition, luxury vehicles are accounting for a larger – record – percentage of share of new vehicle sales at 18%. Automakers still are prioritizing available computer chips to high-end, high-margin models instead of entry-level vehicles.

The average transaction price (ATP) – the price people paid – set another record in August, increasing to $48,301 after surpassing $48,000 for the first time in July, according to Kelley Blue Book, a Cox Automotive company. The August ATP rose .5%, or $222, from July and up 10.8% or $4,712 from August 2021.

Incentives decreased slightly in August versus July but remain low, at only 2.3% of the average transaction price. A year ago, incentives averaged 5.5% of ATP. Full-size cars and luxury cars had the highest incentives in August, while high-performance cars, vans, and electric vehicles had the lowest incentives.

Asian Brands Have Lowest Supply

Asian non-luxury brands and European luxury brands had the lowest inventories. Non-luxury brands with the lowest inventories were Kia, Toyota, Subaru, Honda and Hyundai. Luxury brands with the lowest inventories were Land Rover, Lexus, Acura, Porsche and BMW.

Once again, Stellantis brands – Dodge, Ram and Jeep – had the highest inventories. Luxury brands with high inventories were Volvo, Lincoln and Jaguar.

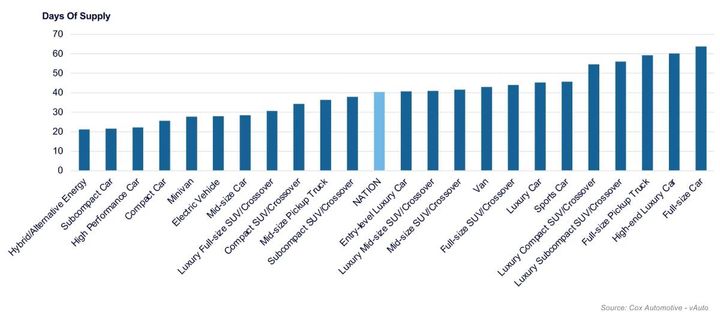

Hybrids had the lowest inventory among segments at the end of August. They were followed by subcompact and compact cars as well as minivans. Large and luxury cars had the highest supply, along with full-size pickup trucks.

Of the 30 highest-selling models in the 30 days ended August 29, Toyota, Kia and Hyundai models dominated the low end of inventories. The lowest were Kia Telluride, Kia Sportage, Kia Forte, Hyundai Tucson, Toyota RAV4, Toyota Camry and Toyota 4Runner. Of the 30 top-selling models, domestic trucks and SUVs had the most inventory. The Ram 1500 had a hefty 88 days’ supply. Chevy Silverado had 77 days of supply. Ford Escape, Ford F-150, and GMC Sierra followed with high inventory.

In terms of price categories, the lower the price, generally, the lower the supply. Price categories under $40,000 had a supply of fewer than 40 days. The $40,000 to $50,000 category had a 40-day supply. Higher price segments had a wide range from 40 to 56 days’ supply.

Originally posted on Vehicle Remarketing