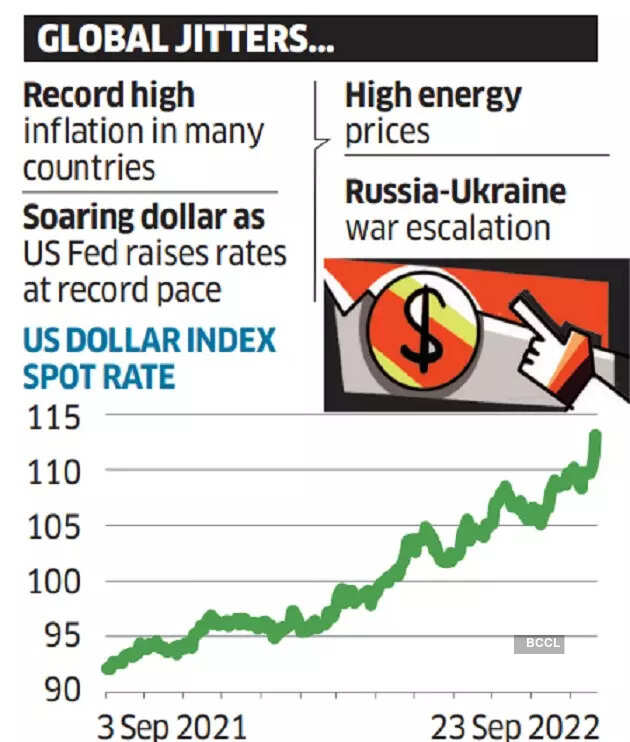

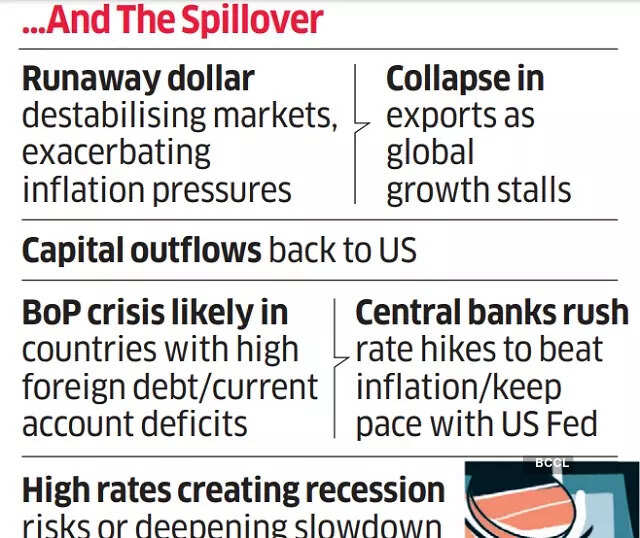

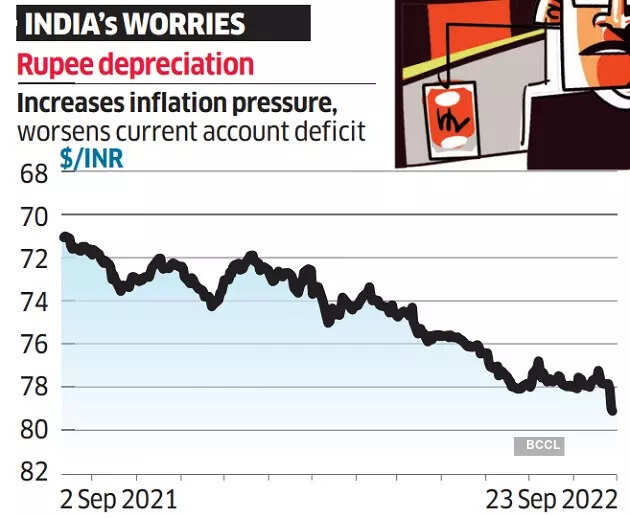

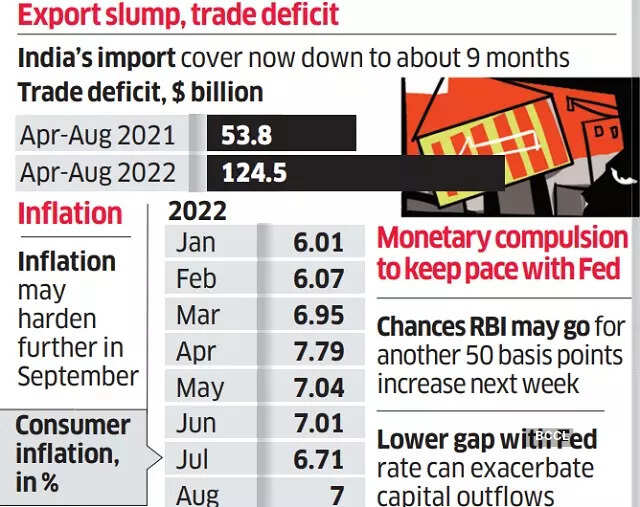

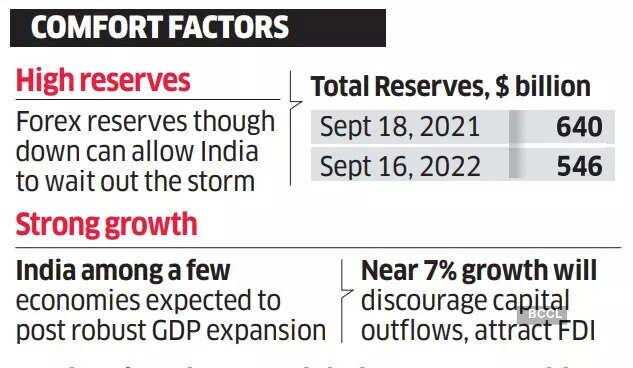

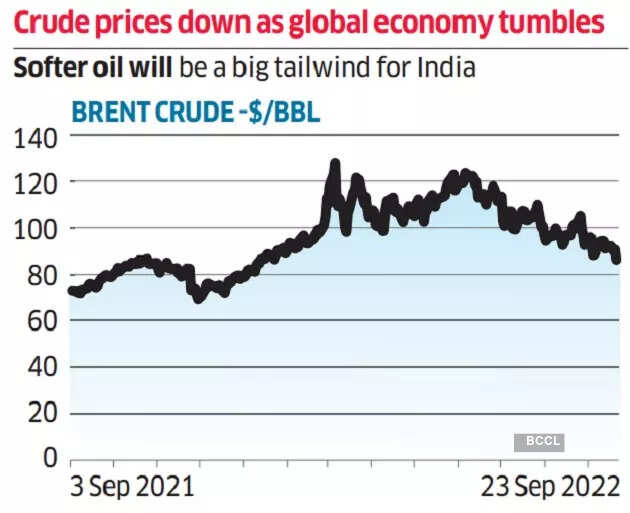

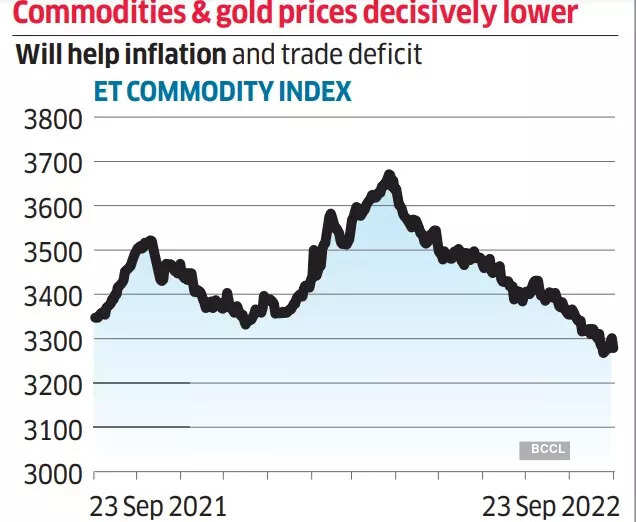

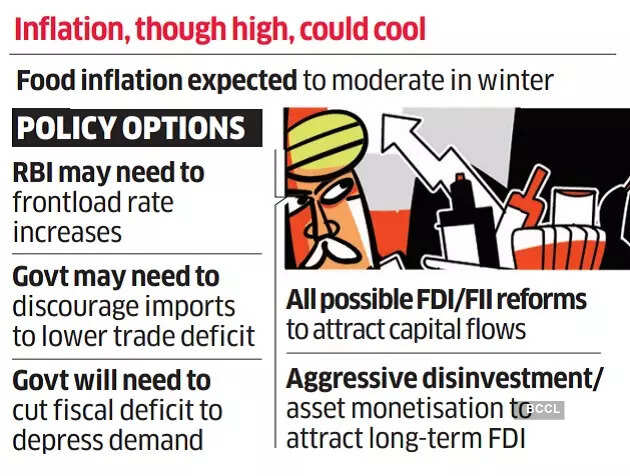

Markets are in turmoil after the US Federal Reserve raised rates, singeing equity markets amid signs the global economy is stumbling. The dollar’s surge, stoked by rising bond yields, saw currencies plummet — the pound is at its weakest in 37 years, the euro hasn’t been this worse off in two decades and the Japanese central bank bought yen in a support move for the first time in 24 years. Central banks rushed monetary measures to stem capital flows and combat inflation that no longer looks temporary. The rupee also hit a new low, sending stocks crashing. Can the Indian economy hold steady and what will help?

Read More: